Get the free Income Tax Deduction for Timber Casualty Loss - state sc

Show details

This document provides guidance on claiming casualty loss deductions for timber damaged by natural disasters, detailing the calculation of losses, requirements for establishing timber basis, and tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income tax deduction for

Edit your income tax deduction for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income tax deduction for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

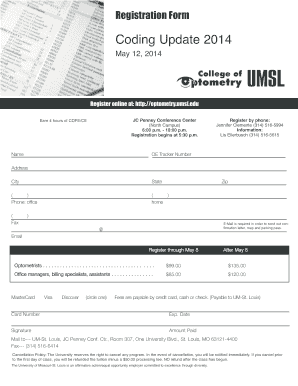

Editing income tax deduction for online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit income tax deduction for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income tax deduction for

How to fill out Income Tax Deduction for Timber Casualty Loss

01

Determine if your timber qualifies for casualty loss deductions.

02

Gather documentation of the timber's fair market value before the loss and the value after the loss.

03

Complete IRS Form 4684 for Casualties and Thefts, specifying the loss from timber.

04

Fill out the required sections of the form detailing the type and amount of timber lost.

05

Calculate your deductible loss based on the information provided in the form.

06

Transfer the calculated loss to Schedule A (if you are itemizing deductions) or the applicable section of your tax return.

07

Consult a tax professional if you have any uncertainties about the deductions.

Who needs Income Tax Deduction for Timber Casualty Loss?

01

Landowners who have experienced a loss of timber due to natural disasters such as storms, fires, or floods.

02

Individuals or businesses that manage timberlands and have suffered economic losses from timber damage.

03

Taxpayers looking to offset their income with casualty losses related to their timber assets.

Fill

form

: Try Risk Free

People Also Ask about

What expenses can you claim against tax?

Check what you can and can't claim for Working from home. Uniforms, work clothing and tools. Vehicles you use for work. Professional fees and subscriptions. Travel, subsistence, and overnight expenses. Buying other equipment.

Does timber qualify for a depletion deduction?

This depletion deduction is calculated in the same manner whether you report income under Section 631(a) or 631(b) of the IRS Code. The depletion deduction is a tax free return of how much the trees (timber), growing on your land, cost at the date you acquired the property.

Can you deduct a casualty loss on your taxes?

Casualty losses are deductible in the year you sustain the loss, which is generally in the year the casualty occurred. You have not sustained a loss if you have a reasonable prospect of recovery through a claim for reimbursement.

What is a qualified disaster?

When an event is declared a disaster by the president, the IRS will postpone some retirement plan and IRA deadlines for taxpayers in affected areas. These disasters are usually hurricanes, tornados, flooding, earthquakes, and wildfires.

How to report timber income on tax return?

The income qualifies as a long-term capital gain. Personal-use and investment owners use Form 8949 and Schedule D (Form 1040) to report a lump-sum timber sale. Use Form 4797 (Part I) and Schedule D (Form 1040) to report the sale if sold under a pay-as-cut contract.

What is the $6000 tax credit?

The deduction — up to $6,000 per eligible taxpayer — applies to taxpayers who are 65 or older with a modified adjusted gross income of less than $175,000 ($250,000 for married couples filing jointly). The deduction takes effect for the 2025 tax year and is set to expire after the 2028 tax year.

What is the most overlooked tax break?

The 10 Most Overlooked Tax Deductions State sales taxes. Reinvested dividends. Out-of-pocket charitable contributions. Student loan interest paid by you or someone else. Moving expenses. Child and Dependent Care Credit. Earned Income Tax Credit (EITC) State tax you paid last spring.

Can you claim damaged or downed trees as a tax deduction?

If timber that you own has been damaged or destroyed by a natural disaster, you may be entitled to a loss deduction on your federal income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Income Tax Deduction for Timber Casualty Loss?

The Income Tax Deduction for Timber Casualty Loss allows taxpayers to deduct losses incurred due to the destruction of timber caused by natural disasters, theft, or other casualty events. This deduction helps offset the financial impact of such losses on timberland owners.

Who is required to file Income Tax Deduction for Timber Casualty Loss?

Timberland owners who have suffered losses from casualties affecting their timber assets, such as natural disasters or theft, are required to file for this deduction. It is typically applicable to individuals, partnerships, and businesses that own timberland.

How to fill out Income Tax Deduction for Timber Casualty Loss?

To fill out the Income Tax Deduction for Timber Casualty Loss, taxpayers should complete IRS Form 4684, Report of Casualties and Thefts, specifically Section B for casualty losses. Proper documentation of the loss, including valuation of the timber before and after the casualty, is necessary.

What is the purpose of Income Tax Deduction for Timber Casualty Loss?

The purpose of the Income Tax Deduction for Timber Casualty Loss is to provide tax relief to timberland owners who have experienced significant economic losses due to unforeseen events. It aims to support the recovery efforts of these owners and promote the sustainability of timber resources.

What information must be reported on Income Tax Deduction for Timber Casualty Loss?

When reporting the Income Tax Deduction for Timber Casualty Loss, taxpayers must provide details such as the date of the casualty, the type of property lost, the fair market value before and after the loss, and any insurance reimbursements received. Accurate record-keeping of all relevant information is crucial.

Fill out your income tax deduction for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Tax Deduction For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.