Get the free INCENTIVE STATISTICAL REPORT - publicsafety utah

Show details

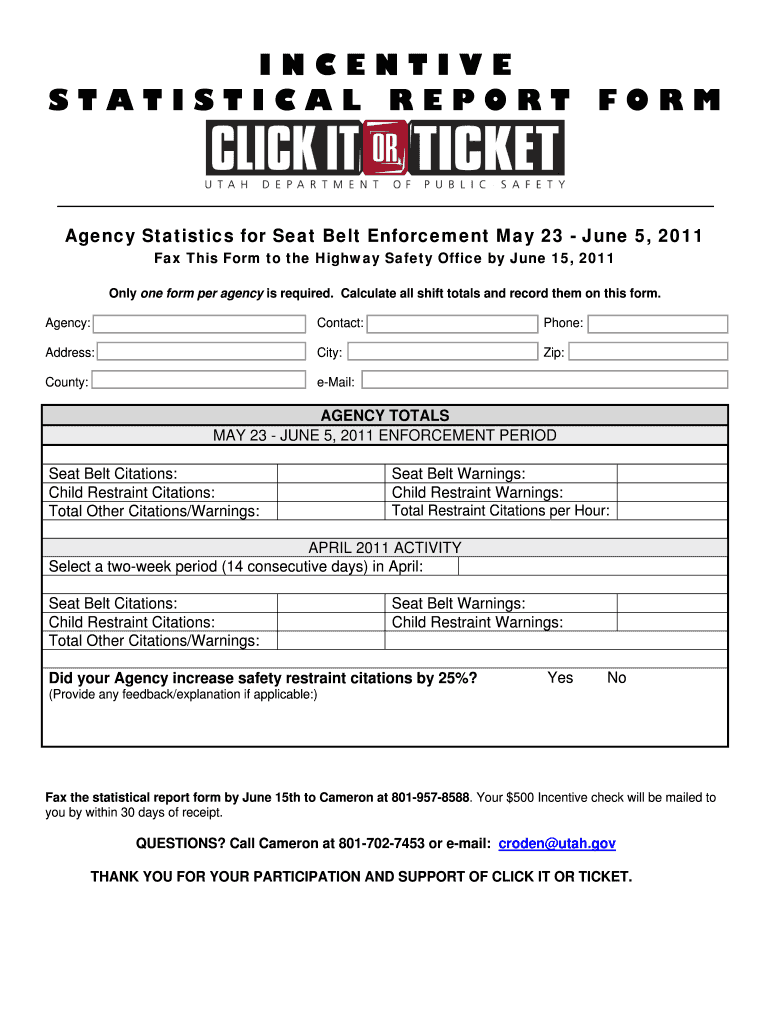

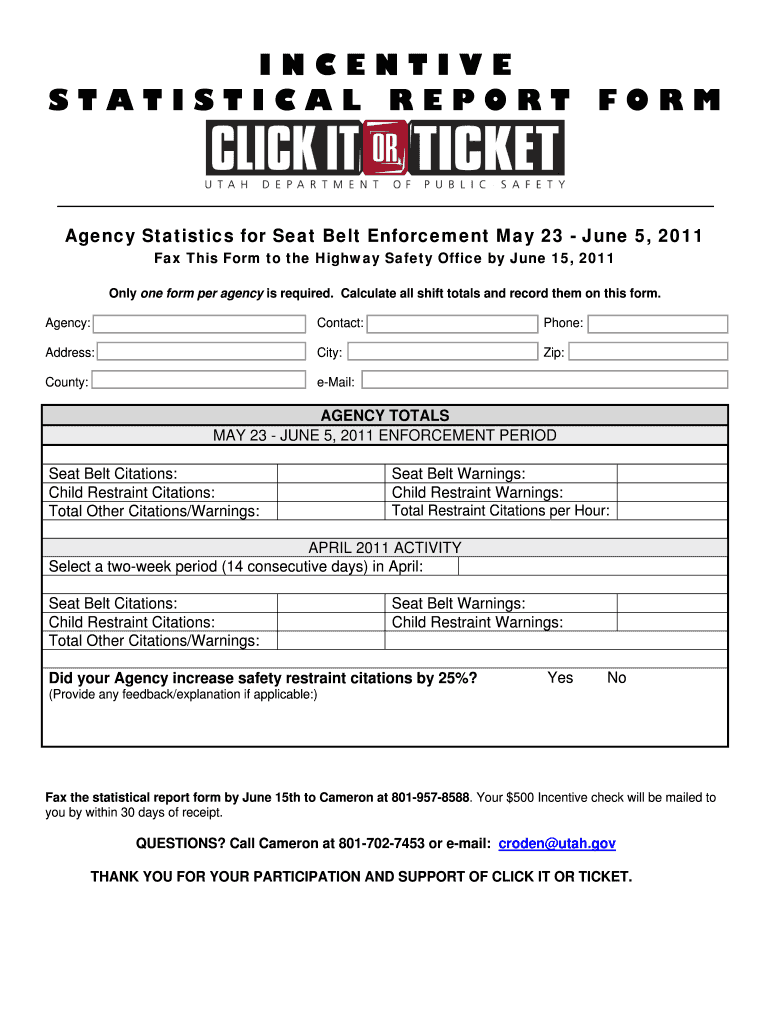

This document is a statistical report form for agencies to report their seat belt enforcement activities during a specified period.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign incentive statistical report

Edit your incentive statistical report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your incentive statistical report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing incentive statistical report online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit incentive statistical report. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out incentive statistical report

How to fill out INCENTIVE STATISTICAL REPORT

01

Start with the report header: Include the title 'Incentive Statistical Report' and the reporting period.

02

Enter the employee details: Fill in the names, ID numbers, and positions of employees involved.

03

Record incentive categories: List all types of incentives applicable (e.g., bonuses, commissions).

04

Provide quantitative data: Enter the numerical values for each incentive earned by employees.

05

Include qualitative data: Add any notes or justifications for unusual results, if necessary.

06

Calculate totals: Sum up the total incentives for each category and for all employees.

07

Review for accuracy: Double-check all entries for errors or omissions.

08

Submit the report: Send the completed report to the appropriate department or management.

Who needs INCENTIVE STATISTICAL REPORT?

01

Human Resources personnel for tracking employee performance and compensation.

02

Financial departments for budgeting and financial forecasting.

03

Management for evaluating the effectiveness of incentive programs.

04

Auditors for compliance and verification of incentive distributions.

05

Employees themselves to understand their entitlement and incentives.

Fill

form

: Try Risk Free

People Also Ask about

What is the incentive grant for scientific research?

Incentive grant for scientific research - MIS Funding instrument to support young permanent researchers who seek to develop a scientific unit focusing on a future-oriented area within their university.

What is the tax incentive for scientific research and innovation?

Benefits of the Tax Incentive for Scientific Research and Innovation (IFICI) Special rate of 20% applicable to employment and self-employment income arising from the exercise of one of the eligible activities.

What are R&D tax incentives?

The federal research and development (R&D) tax credit results in a dollar for dollar reduction in a company's tax liability for certain domestic expenses. Qualifying expenditures generally include the design, development or improvement of products, processes, techniques, formulas or software.

What is a tax incentive?

Tax incentives refer to fiscal measures designed to encourage specific economic activities, which can include various forms such as rebates on energy taxes, reductions in VAT rates, and special tax exemptions for environmentally friendly initiatives.

What is the Pillar 2 tax incentive?

The aim of Pillar Two is to ensure a global minimum effective tax rate of 15 percent for MNEs (and – in some jurisdictions, including those in the EU, large-scale domestic groups) with at least EUR 750 million in consolidated revenues, by imposing an additional tax on the low-taxed income of Constituent Entities.

What are the tax incentives for R&D activities?

Typically, 6% to 8% of a company's annual qualifying R&D expenses can be applied, dollar for dollar, against its federal income tax liability. Various activities may qualify for the credit, including but not limited to: Developing processes, patents, formulas, techniques, prototypes or software.

What is the R&D tax credit for innovation?

R&D credits lower the cost of R&D and increase private R&D expenditure at the state level. R&D credits do not increase patenting or the scientific quality of patented innovation.

What is an R&D tax incentive?

The Research and Development Tax Incentive (R&D Tax Incentive or R&DTI) helps companies innovate and grow by offsetting some of the costs of eligible research and development (R&D).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is INCENTIVE STATISTICAL REPORT?

The INCENTIVE STATISTICAL REPORT is a document used to collect and report data regarding incentives, bonuses, and performance metrics within an organization.

Who is required to file INCENTIVE STATISTICAL REPORT?

Organizations that offer incentive programs, bonuses, or other performance-based remuneration to their employees are typically required to file the INCENTIVE STATISTICAL REPORT.

How to fill out INCENTIVE STATISTICAL REPORT?

To fill out the INCENTIVE STATISTICAL REPORT, the organization must gather data on employee incentives, complete the required sections detailing the types of incentives offered, amounts paid, and any relevant performance metrics, and submit the report by the designated deadline.

What is the purpose of INCENTIVE STATISTICAL REPORT?

The purpose of the INCENTIVE STATISTICAL REPORT is to provide a comprehensive overview of incentive distribution within an organization, aid in analysis, ensure compliance with regulations, and enhance performance management.

What information must be reported on INCENTIVE STATISTICAL REPORT?

The INCENTIVE STATISTICAL REPORT must include information such as the types of incentives provided, the total amount disbursed, employee performance data, eligibility criteria for incentives, and any relevant demographic information.

Fill out your incentive statistical report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Incentive Statistical Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.