Get the free BROWARD HEALTH 457(b) Deferred Compensation Plan - browardhealth

Show details

This document outlines the features and enrollment procedures for the 457(b) Deferred Compensation Plan available to employees of Broward Health.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign broward health 457b deferred

Edit your broward health 457b deferred form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your broward health 457b deferred form via URL. You can also download, print, or export forms to your preferred cloud storage service.

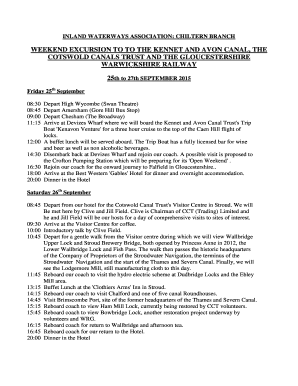

How to edit broward health 457b deferred online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit broward health 457b deferred. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out broward health 457b deferred

How to fill out BROWARD HEALTH 457(b) Deferred Compensation Plan

01

Obtain the BROWARD HEALTH 457(b) Deferred Compensation Plan enrollment form from the HR department or the company's benefits portal.

02

Carefully read the instructions and plan details provided in the form, including eligibility requirements and contribution limits.

03

Fill out your personal information, including your name, employee ID, and contact details.

04

Choose your contribution amount and frequency (e.g., percentage of salary or flat dollar amount).

05

Review the investment options available under the plan and select your preferred investments.

06

Indicate any beneficiary designations for your account.

07

Sign and date the form to certify your completion and understanding of the terms.

08

Submit the completed form to the HR department or through the specified submission method.

Who needs BROWARD HEALTH 457(b) Deferred Compensation Plan?

01

Employees of BROWARD HEALTH who are looking to save for retirement in a tax-advantaged way.

02

Individuals seeking to supplement their retirement income with additional savings beyond traditional pension plans.

03

Employees who want flexibility in their retirement savings and investment choices.

Fill

form

: Try Risk Free

People Also Ask about

How does a deferred compensation plan work?

They're more like an agreement between you and your employer to defer a portion of your annual income until a specific date in the future. Depending on the plan, that date could be in 5 years, 10 years, or in retirement.

What are the disadvantages of a 457 B plan?

Cons of 457(b) plans: Fewer investing options than 401(k)s (Not as common today) Only available to certain employees employed by state or local governments or qualifying nonprofits. Employer contributions count toward the annual limit. Non-governmental 457(b) plans are riskier.

Can I take money out of deferred compensation?

Unforeseeable emergency withdrawals: If you are experiencing severe financial hardship because of an unforeseeable emergency, you may be eligible to withdraw funds from your DCP account. IRS requirements restrict this type of withdrawal, and may limit the amount you can withdraw.

What are the withdrawal rules for a 457 plan?

Before Rollover: You can take penalty-free 457(b) withdrawals after leaving your job at any age. After Rollover to an IRA: The funds are now subject to IRA rules. Any withdrawal before age 59½ will be hit with the 10% tax penalty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BROWARD HEALTH 457(b) Deferred Compensation Plan?

The BROWARD HEALTH 457(b) Deferred Compensation Plan is a retirement savings plan that allows employees to save a portion of their income on a pre-tax basis, which can grow tax-deferred until withdrawal.

Who is required to file BROWARD HEALTH 457(b) Deferred Compensation Plan?

Employees of BROWARD HEALTH who participate in the 457(b) Deferred Compensation Plan are required to file the necessary documentation to enroll and contribute to the plan.

How to fill out BROWARD HEALTH 457(b) Deferred Compensation Plan?

To fill out the BROWARD HEALTH 457(b) Deferred Compensation Plan, employees must complete the enrollment form, indicating the amount they wish to contribute, and submit it to the HR or benefits department.

What is the purpose of BROWARD HEALTH 457(b) Deferred Compensation Plan?

The purpose of the BROWARD HEALTH 457(b) Deferred Compensation Plan is to provide employees with a tax-advantaged way to save for retirement and supplement their retirement income.

What information must be reported on BROWARD HEALTH 457(b) Deferred Compensation Plan?

Reporting for the BROWARD HEALTH 457(b) Deferred Compensation Plan typically includes contributions made by employees, investment earnings, and withdrawals, as well as compliance with IRS reporting requirements.

Fill out your broward health 457b deferred online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Broward Health 457b Deferred is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.