Get the free Agricultural bBusinessb Personal Property bStatementb 82520A - www2 yavapai

Show details

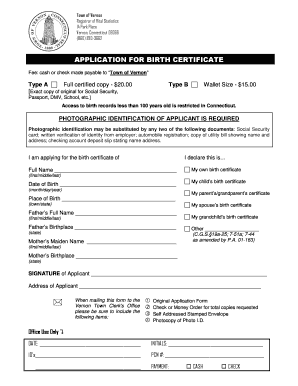

Print 2016 ARIZONA AGRICULTURAL BUSINESS PROPERTY STATEMENT RETURN TO: PAMELA J. PEARSALL YAVAPAI COUNTY ASSESSOR 1015 FAIR STREET PRESCOTT, AZ 86305 COMPLETE IN FULL AND RETURN TO ASSESSOR BY: THIS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign agricultural bbusinessb personal property

Edit your agricultural bbusinessb personal property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your agricultural bbusinessb personal property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing agricultural bbusinessb personal property online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit agricultural bbusinessb personal property. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out agricultural bbusinessb personal property

How to fill out agricultural business personal property:

01

Determine the scope of your agricultural business: Start by identifying the assets that fall under the category of agricultural personal property. This may include machinery, equipment, livestock, crops, and other related assets.

02

Gather necessary documentation: Collect all the required documents such as purchase receipts, invoices, lease agreements, and any other relevant paperwork related to your agricultural personal property.

03

Complete the personal property form: Obtain the agricultural business personal property form from your local tax authority or government agency. Fill out the form accurately and provide all the requested information.

04

Provide detailed asset information: In the form, provide the details of each asset, including description, make, model, year of purchase, purchase price, and any other relevant information. Include both owned and leased assets.

05

Assess the value of the property: Determine the current value of each asset. This can be done by considering factors such as depreciation, market value, and any improvements made to the assets.

06

Review and double-check: Review the filled-out form for any errors or omissions. Ensure that all the information provided is accurate and up to date. Double-check the form before submitting to avoid any potential issues.

07

Submit the form: Once you have completed the form and reviewed it, submit it to the appropriate tax authority or government agency as per their instructions. Keep a copy of the filled-out form for your records.

Who needs agricultural business personal property?

01

Farmers: Agricultural business personal property is necessary for farmers who own or lease agricultural assets such as tractors, trailers, livestock, and farm equipment. These assets are crucial for their day-to-day farming operations.

02

Ranchers: Ranchers also require agricultural business personal property as they own or lease livestock, machinery, and equipment for their livestock management and breeding operations.

03

Agricultural businesses: Any business involved in agricultural activities, such as crop production, plant nurseries, or agricultural research institutions, would need to declare and provide details of their agricultural personal property.

04

Vineyards and wineries: Vineyards and wineries require agricultural personal property to report their grapevines, harvesting machinery, wine-making equipment, and other assets critical to their operations.

05

Agricultural cooperatives: Cooperatives that support and provide services to farmers and agricultural businesses may also require agricultural business personal property forms to maintain accurate records and facilitate taxation processes.

It is important to consult your local tax authority or government agency to determine the specific requirements and regulations regarding agricultural business personal property in your region.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is agricultural business personal property?

Agricultural business personal property includes any equipment, machinery, or supplies used in farming operations.

Who is required to file agricultural business personal property?

Any individual or entity engaged in agricultural business activities is required to file agricultural business personal property.

How to fill out agricultural business personal property?

To fill out agricultural business personal property, one must provide details of all equipment, machinery, and supplies used in farming operations.

What is the purpose of agricultural business personal property?

The purpose of reporting agricultural business personal property is to assess property taxes for assets used in agricultural activities.

What information must be reported on agricultural business personal property?

Information such as the description, quantity, and value of all equipment, machinery, and supplies used in farming operations must be reported.

How do I complete agricultural bbusinessb personal property online?

pdfFiller makes it easy to finish and sign agricultural bbusinessb personal property online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I sign the agricultural bbusinessb personal property electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out agricultural bbusinessb personal property on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your agricultural bbusinessb personal property by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your agricultural bbusinessb personal property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Agricultural Bbusinessb Personal Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.