Get the free Building Loan Contract

Show details

This document serves as a loan agreement between a borrower and lender for the purpose of financing the construction of a building, outlining the terms, conditions, and obligations of each party.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign building loan contract

Edit your building loan contract form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your building loan contract form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit building loan contract online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit building loan contract. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

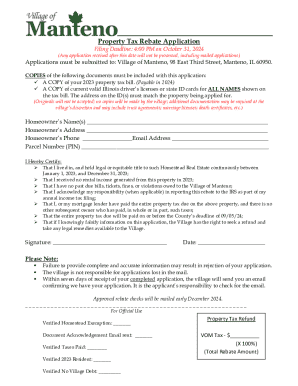

How to fill out building loan contract

How to fill out Building Loan Contract

01

Gather all necessary documents, including proof of income, credit history, and property details.

02

Fill in your personal information accurately at the top of the contract.

03

Outline the details of the loan amount required for the building project.

04

Specify the terms of the loan, including interest rates and repayment schedules.

05

Include any conditions or contingencies that apply to the contract.

06

Review the contract for any legal jargon, and seek clarification if needed.

07

Sign and date the document at the designated sections.

08

Provide copies of the signed contract to all involved parties.

Who needs Building Loan Contract?

01

Homebuyers looking to finance the construction of a new home.

02

Real estate investors planning to develop residential or commercial properties.

03

Individuals or businesses seeking to remodel or expand an existing structure.

04

Contractors in need of funding to complete building projects for clients.

Fill

form

: Try Risk Free

People Also Ask about

What is a loan agreement in English?

A Loan Agreement, also known as a term loan, demand loan, or loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the loan amount, any interest charges, the repayment plan, and payment dates.

What is the structure of a loan agreement?

A loan agreement is a formal contract between a borrower and a lender. These counterparties rely on the loan agreement to ensure legal recourse if commitments or obligations are not met. Sections in the contract include loan details, collateral, required reporting, covenants, and default clauses.

What is the difference between a loan and a contract?

The loan is an informal contract, because the lawmaker has not determined its form. The contract may be unaccounted for when the borrower can use it for any purpose and destined when the contract specifies in advance the purpose for which the borrower will use the asset or the borrowed money.

How to write a loan agreement contract?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

How to write a simple contract agreement?

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Describe how the contract will end. Say which laws apply and how disputes will be resolved. Include space for signatures.

What is the contract for a loan called?

A loan agreement (also known as a lending agreement) is a contract between a borrower and a lender which regulates the mutual promises made by each party. There are many types of loan agreements, including "facilities agreements", "revolvers", "term loans", "working capital loans".

How do I write a simple loan agreement?

What's in a Personal Loan Agreement? Identifications: The contract will need to list the names of all those involved and their addresses. Dates: There will need to be dates for when the contract goes into effect and any other important dates. Loan amount: This is the principal amount the borrower agrees to take out.

How do I write a simple loan agreement between friends?

Loan agreements between family members or friends should include: Details of who is lending the money and who is borrowing it. The exact amount of money being lent. The purpose of the loan. How and when the loan will be repaid. If interest will be charged on the loan, the interest rate, and how it will be calculated.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Building Loan Contract?

A Building Loan Contract is a legal agreement between a lender and a borrower that outlines the terms under which the borrower can obtain a loan for building or renovation of a property.

Who is required to file Building Loan Contract?

Typically, the borrower who is applying for the construction loan is required to file the Building Loan Contract.

How to fill out Building Loan Contract?

To fill out a Building Loan Contract, provide details on the property, loan amount, interest rate, repayment terms, borrower and lender information, along with any specific conditions or requirements agreed upon.

What is the purpose of Building Loan Contract?

The purpose of a Building Loan Contract is to ensure that both the lender and the borrower have a clear understanding of the terms of the loan, protect their rights, and provide a legal framework for the loan arrangement.

What information must be reported on Building Loan Contract?

The Building Loan Contract must include information such as the names of the parties involved, property details, loan amount, interest rates, repayment schedule, and any conditions or contingencies agreed upon.

Fill out your building loan contract online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Building Loan Contract is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.