Get the free Equal Credit Opportunity Act

Show details

This document outlines the Federal Equal Credit Opportunity Act and the Fair Lending Notice under the State of California, prohibiting discrimination in credit and lending based on various factors.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign equal credit opportunity act

Edit your equal credit opportunity act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your equal credit opportunity act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit equal credit opportunity act online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit equal credit opportunity act. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

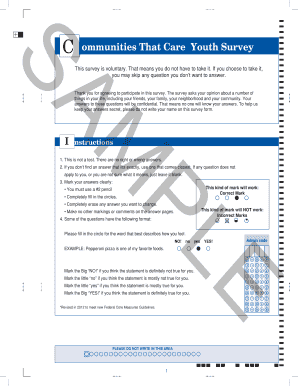

How to fill out equal credit opportunity act

How to fill out Equal Credit Opportunity Act

01

Obtain the Equal Credit Opportunity Act form from the relevant financial institution or the official website.

02

Read the instructions provided on the form carefully to understand the requirements.

03

Fill out your personal information in the designated sections, including your name, address, and contact details.

04

Provide details about your income, employment, and other relevant financial information as requested.

05

Indicate the type of credit you are applying for, whether it be a loan, credit card, or mortgage.

06

Review the form for accuracy and completeness before submitting.

07

Submit the completed form to the financial institution along with any required documentation.

Who needs Equal Credit Opportunity Act?

01

Individuals applying for credit, including loans and credit cards, who want to ensure they are not discriminated against based on race, color, religion, national origin, sex, marital status, or age.

02

Financial institutions that must comply with the Equal Credit Opportunity Act to ensure equitable access to credit for all applicants.

Fill

form

: Try Risk Free

People Also Ask about

What is an ECOA notice?

Two federal laws — the Equal Credit Opportunity Act (ECOA), as implemented by Regulation B, and the Fair Credit Reporting Act (FCRA) — reflect Congress's determination that consumers and businesses applying for credit should receive notice of the reasons a creditor took adverse action on the application or on an

What is the Equal Credit Opportunity Act?

The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided the applicant has the capacity to enter into a binding contract); because all or part of the applicant's income derives

What does ECOA stand for?

The Equal Credit Opportunity Act (ECOA) prohibits discrimination in any aspect of a credit transaction. It applies to any extension of credit, including extensions of credit to small businesses, corporations, partnerships, and trusts. The ECOA prohibits discrimination based on.

What is a creditor under ECOA?

Definition of Creditor. The ECOA and Regulation B prohibit a creditor from discriminating against an applicant on a prohibited basis regarding any aspect of a credit transaction. The ECOA's definition of creditor includes anyone who “regularly extends” or “regularly arranges for” the extension of credit.

What is the ECOA code on a credit report?

This code indicates how account information is reported to the Credit Bureau in keeping with the Equal Credit Opportunity Act. It can be placed on a loan record when it is created in the Loan Request screen, or updated later using Account Information Update.

What does ECOA mean on a credit report?

What is the Equal Credit Opportunity Act? The Equal Credit Opportunity Act (ECOA), otherwise known as "Regulation B," was enacted in 1974 and falls under the larger Consumer Credit Protection Act. It exists to help individuals from being denied from accessing credit based on discriminatory factors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Equal Credit Opportunity Act?

The Equal Credit Opportunity Act (ECOA) is a United States law that ensures all consumers are given equal access to credit without discrimination based on race, color, religion, national origin, sex, marital status, or age.

Who is required to file Equal Credit Opportunity Act?

Lenders that provide credit to consumers, including banks, credit unions, and other financial institutions, are required to comply with the Equal Credit Opportunity Act.

How to fill out Equal Credit Opportunity Act?

The ECOA does not require a specific 'form' to fill out; rather, lenders must implement policies and practices to ensure compliance with the law, which includes maintaining proper documentation of credit applications and decisions.

What is the purpose of Equal Credit Opportunity Act?

The purpose of the Equal Credit Opportunity Act is to promote fairness in lending practices and eliminate discrimination in credit transactions, thus ensuring that all qualified applicants have an equal chance to obtain credit.

What information must be reported on Equal Credit Opportunity Act?

Lenders must report information related to credit applications, including the applicant's race, ethnicity, gender, and marital status, as well as the outcome of the credit application, to ensure compliance with the ECOA.

Fill out your equal credit opportunity act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Equal Credit Opportunity Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.