Get the free Purchase/Lease Back Agreement

Show details

This Purchase/Lease Back Agreement outlines the terms under which Lompoc Valley Medical Center will install and lease a fiber optic system to the City of Lompoc, including installation details, lease

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign purchaselease back agreement

Edit your purchaselease back agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your purchaselease back agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing purchaselease back agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit purchaselease back agreement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

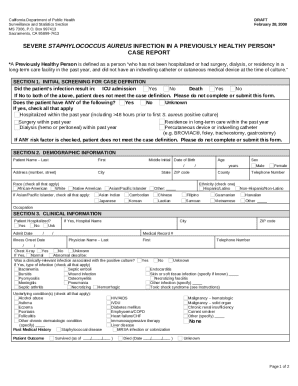

How to fill out purchaselease back agreement

How to fill out Purchase/Lease Back Agreement

01

Review the terms and conditions of the Purchase/Lease Back Agreement.

02

Fill in the names and contact information of both parties involved (buyer and seller).

03

Specify the property details, including its address and legal description.

04

Outline the purchase price agreed upon by both parties.

05

Determine the lease terms, including duration, monthly payment amount, and any renewal options.

06

Include provisions for maintenance responsibilities and any restrictions on property use.

07

Have both parties sign and date the agreement, and ensure that copies are distributed to each party.

Who needs Purchase/Lease Back Agreement?

01

Real estate investors looking to generate rental income from purchased properties.

02

Business owners who wish to sell their property for immediate cash while retaining use of the property through a leaseback agreement.

03

Individuals or entities wanting to retain occupancy of a property after selling it to free up capital for other investments.

Fill

form

: Try Risk Free

People Also Ask about

Is a sale/leaseback a good idea?

Sale leasebacks may be able to help your company: Increase working capital to deploy at a greater rate of return, if opportunities exist. Maintain control of the asset during the lease term. Avoid restrictive covenants associated with traditional financing.

What are the disadvantages of leaseback?

Disadvantages of leaseback A leaseback agreement can also be a disadvantage to a property owner because it can be difficult to find a tenant willing to agree to the lease terms. The owner may also be responsible for maintenance and repairs on the property, which can be expensive.

What is the purpose of a leaseback?

In a lease buyback, the dealer offers to buy your leased vehicle, even though your lease hasn't expired yet. Dealers might offer a buyback on desirable car models they'd like to add to their inventory.

How do lease buy backs work?

Disadvantages of using a sale leaseback Cause a lack of control of the asset at the end of the lease term. Require long-term financial commitments with fixed payments. Create loss of operational flexibility (e.g., ability to move from a leased facility in the future)

Is a lease back a good idea?

The bottom line: A rent-back agreement can benefit buyers and sellers. A rent-back agreement can make sense in certain situations – like when a buyer wants to strengthen their offer in a competitive market or when a seller needs a little extra time to get things in order after closing.

What is a purchase lease back?

A sale-leaseback transaction, simply put, occurs when the owner of property sells the property to a third-party buyer but retains the right to remain in possession and continue operating the property under a lease agreement executed upon closing — usually used as a financing mechanism by the owner-seller to access

How to write a lease purchase agreement?

How to structure a lease purchase agreement Set the lease period. The lease should outline how long the lease period will be and the monthly rent amount. Include special clauses. Allocate portion of rent to the down payment. Include a contract of sale. Have a professional review your contract.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Purchase/Lease Back Agreement?

A Purchase/Lease Back Agreement is a financial transaction where an asset is sold and then immediately leased back, allowing the seller to continue using the asset while providing liquidity.

Who is required to file Purchase/Lease Back Agreement?

Typically, businesses or individuals engaging in a purchase and subsequent lease back of an asset are required to file a Purchase/Lease Back Agreement.

How to fill out Purchase/Lease Back Agreement?

To fill out a Purchase/Lease Back Agreement, include details of the asset, purchase price, lease terms, parties involved, and any relevant provisions or conditions.

What is the purpose of Purchase/Lease Back Agreement?

The purpose of a Purchase/Lease Back Agreement is to free up capital for the seller while allowing them to retain use of the asset through leasing.

What information must be reported on Purchase/Lease Back Agreement?

The information that must be reported includes asset details, purchase price, lease duration, payment terms, and both parties' identification.

Fill out your purchaselease back agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Purchaselease Back Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.