Get the free G I AND COST Registration Form - schoenstattmncom

Show details

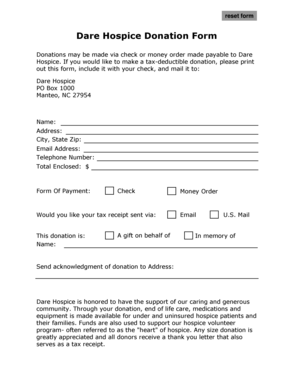

GENERAL INFORMATION AND COST Registration Form Please send along a ×5 check with registration to: Schoenstatt on the Lake 27762 County Road 27 Sleepy Eye, MN 56085 Name Who may come to Schoenstatt

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign g i and cost

Edit your g i and cost form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your g i and cost form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing g i and cost online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit g i and cost. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out g i and cost

How to fill out g i and cost:

01

Familiarize yourself with the purpose of g i and cost: Before filling out g i and cost, it is essential to understand the context in which they are being used. G i stands for the government identifier, which is a unique identification number assigned by the government for various purposes. Cost refers to the financial expenses or charges associated with a particular activity or item.

02

Determine the specific form or document: Different forms or documents may require the inclusion of g i and cost in different formats or sections. Identify the specific form or document you need to fill out in order to proceed accurately.

03

Locate the required fields: Once you have the relevant form or document, carefully go through it to identify the fields where g i and cost need to be provided. These fields may vary depending on the purpose of the form, so pay close attention to avoid any errors.

04

Enter the government identifier (g i): If you have been assigned a government identifier, enter it accurately into the designated field. Double-check the number to ensure accuracy and avoid any potential issues or delays.

05

Provide the relevant cost information: Determine the specific cost that needs to be recorded. It could be the total cost of a product or service, the cost of individual items, or any other relevant expenses. Enter this information accurately in the designated field, ensuring that all necessary details are included.

06

Review and submit: After filling out the g i and cost fields, it is crucial to review the entire form or document for any errors or omissions. Make sure that the information provided is complete and accurate. If you are satisfied, proceed to submit the form according to the specified instructions.

Who needs g i and cost:

01

Government agencies: Government agencies typically require individuals or entities to provide a government identifier (g i) for various purposes. This identifier helps them track and manage activities related to specific individuals or organizations. Additionally, g i may be necessary to qualify for certain government programs or benefits. Cost information is also relevant for government agencies to assess financial implications or obligations associated with certain activities.

02

Financial institutions: Banks, credit unions, and other financial institutions may request a government identifier (g i) and cost information to comply with regulatory requirements. G i helps these institutions verify the identity of individuals or entities and ensure compliance with anti-money laundering and know-your-customer regulations. Cost information may be necessary for assessing loan eligibility, creditworthiness, or any other financial transactions.

03

Businesses and organizations: Businesses and organizations may ask for g i and cost information for various purposes. For example, when engaging in government contracts, g i may be required to establish eligibility or track financial transactions. Cost information is relevant for budgeting, invoicing, or cost analysis purposes within organizations.

In summary, filling out g i and cost involves understanding the purpose, locating the fields, accurately providing the required information, and reviewing before submission. These details are needed by government agencies, financial institutions, and businesses/organizations for various regulatory, identification, or financial purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is g i and cost?

Gross income and cost refer to the total amount of income earned and expenses incurred.

Who is required to file g i and cost?

Any individual or business entity that earns income or incurs expenses must file gross income and cost.

How to fill out g i and cost?

Gross income and cost can be filled out by recording all sources of income and expenses in a financial statement.

What is the purpose of g i and cost?

The purpose of gross income and cost is to track the financial performance of an individual or business.

What information must be reported on g i and cost?

All sources of income and expenses must be reported on gross income and cost.

How do I edit g i and cost online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your g i and cost to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit g i and cost in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your g i and cost, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete g i and cost on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your g i and cost by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your g i and cost online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

G I And Cost is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.