Get the free Budgets & Financial Goals

Show details

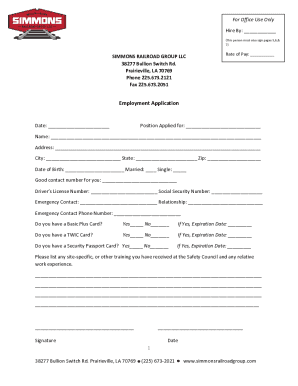

Budgets & Financial Goals Lesson 02 of the series, Happily Ever After? 1. We are only stewards of Gods things. The earth is the Lord's, and everything in it. The world and all its people belong to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign budgets amp financial goals

Edit your budgets amp financial goals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your budgets amp financial goals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit budgets amp financial goals online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit budgets amp financial goals. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out budgets amp financial goals

How to fill out budgets & financial goals:

01

Start by assessing your current financial situation. This includes gathering information about your income, expenses, debts, and savings. Take note of any financial obligations or goals you have in mind.

02

Set realistic and measurable financial goals. Determine what you want to achieve financially, whether it's saving for a down payment on a house, paying off debt, or building an emergency fund. Make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART goals).

03

Identify your fixed and variable expenses. Fixed expenses are recurring costs that remain relatively constant, such as rent, mortgage payments, or insurance premiums. Variable expenses are flexible and can change from month to month, such as groceries, entertainment, or dining out.

04

Track your expenses for a certain period, like a month. This will help you understand your spending habits and identify areas where you can cut back or save more. Use budgeting apps or software to make this task easier and more efficient.

05

Create a budget that aligns with your financial goals. Allocate your income towards your expenses, savings, and debt repayment. Ensure that your budget is balanced, meaning your income covers your expenses, savings, and debt obligations.

06

Regularly review and adjust your budget. Financial situations may change over time, so it's essential to review and update your budget as needed. Adjust your expenses and savings based on your income fluctuations or changes in financial goals.

Who needs budgets & financial goals?

01

Individuals or families looking to improve their financial stability and independence.

02

Students or young adults who want to manage their money effectively and develop good financial habits.

03

Individuals with financial goals, such as buying a house, starting a business, or retiring comfortably.

04

People struggling with debt and looking for a structured plan to pay it off.

05

Those who want to save for emergencies, education, or upcoming expenses.

06

Anyone who wants to avoid living paycheck to paycheck and create a long-term financial plan.

Remember, budgets and financial goals are valuable tools for managing your money effectively and achieving financial freedom.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in budgets amp financial goals without leaving Chrome?

budgets amp financial goals can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the budgets amp financial goals form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign budgets amp financial goals and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete budgets amp financial goals on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your budgets amp financial goals from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is budgets amp financial goals?

Budgets and financial goals refer to the planned allocation of funds and objectives set by an individual or organization to effectively manage their finances.

Who is required to file budgets amp financial goals?

Anyone who wants to effectively manage their finances or an organization that needs to track their financial performance is required to file budgets and financial goals.

How to fill out budgets amp financial goals?

Budgets and financial goals can be filled out by tracking expenses, setting specific financial objectives, and regularly reviewing and adjusting the budget as needed.

What is the purpose of budgets amp financial goals?

The purpose of budgets and financial goals is to help individuals and organizations track their spending, set achievable financial targets, and make informed decisions about their finances.

What information must be reported on budgets amp financial goals?

Budgets and financial goals must include details about income sources, expenses, savings goals, debt repayment plans, and any other financial objectives.

Fill out your budgets amp financial goals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Budgets Amp Financial Goals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.