Get the free Schedule 3

Show details

Quarterly Report for St. Lucia Electricity Services Limited, detailing financial statements, management discussions, and operational highlights for the period ending September 30, 2007.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule 3

Edit your schedule 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule 3 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule 3. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

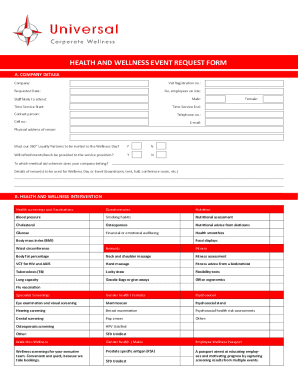

How to fill out schedule 3

How to fill out Schedule 3

01

Obtain Schedule 3 from the IRS website or your tax form package.

02

Fill in your name and Social Security number at the top of the form.

03

Complete Part I by reporting your total capital gains and losses, listing each transaction.

04

In Part II, calculate your net capital gain or loss and carry it over to your main tax return.

05

Review all entries for accuracy before submitting with your tax return.

Who needs Schedule 3?

01

Individuals who have to report capital gains and losses from the sale of assets.

02

Taxpayers who exceed the limits for simple reporting and need to provide detailed information.

Fill

form

: Try Risk Free

People Also Ask about

What is considered a schedule 3 drug?

Schedule III drugs, substances, or chemicals are defined as drugs with a moderate to low potential for physical and psychological dependence. Examples of Schedule III drugs are: products containing less than 90 milligrams of codeine per dosage unit (Tylenol with codeine), ketamine, anabolic steroids, testosterone.

What is a schedule 3 example?

Some examples of Schedule III drugs are: Products containing less than 90 milligrams of codeine per dosage unit (Tylenol with codeine) ketamine. anabolic steroids.

Is Adderall a schedule 2 or 3?

Adderall and Narcotics are Schedule II drugs under the Federal Drug Control Act. This is the same classification as , , or meth. This also means that possessing any of these medications without a prescription is a FELONY.

What is the Schedule 3?

Key Takeaways Part I of Form 1040 Schedule 3 is for nonrefundable credits, including the Foreign Tax Credit, Child and Dependent Care Credit, education credits, and more. Line 6 of Schedule 3 is for less common credits, including the Credit for the Elderly or Disabled, the adoption tax credit, and more.

What does Schedule 3 mean?

Schedule III drugs, substances, or chemicals are defined as drugs with a moderate to low potential for physical and psychological dependence. Schedule III drugs abuse potential is less than Schedule I and Schedule II drugs but more than Schedule IV.

Is a schedule 3 drug a felony?

Possession of a controlled substance classified in Schedule III of the Drug Control Act, upon conviction, exposes the violator to a misdemeanor conviction for which the punishment is confinement in jail for up to twelve months and a fine up to $2,500, either or both.

What is schedule a, b, d, e, f, or h?

Schedule A — Itemized Deductions. Schedule B — Interest and Ordinary Dividends. Schedule D — Capital Gains and Losses. Schedule E — Supplemental Income and Loss. Schedule F — Profit or Loss From Farming.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule 3?

Schedule 3 is a tax form used in the United States to report certain types of income that are not reported elsewhere on the tax return.

Who is required to file Schedule 3?

Taxpayers who have additional income or adjustments to report that are not included on the main tax form are required to file Schedule 3.

How to fill out Schedule 3?

To fill out Schedule 3, taxpayers need to provide detailed information about the specific types of income or adjustments they are reporting, following the instructions provided with the form.

What is the purpose of Schedule 3?

The purpose of Schedule 3 is to provide a detailed account of additional income or income adjustments that may affect a taxpayer's overall tax liability.

What information must be reported on Schedule 3?

Information that must be reported on Schedule 3 includes certain types of income like capital gains, foreign income, and non-taxable distributions, as well as adjustments to income.

Fill out your schedule 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule 3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.