Get the free Brokerage and Non-Brokerage Accounts

Show details

This document serves as an application for opening brokerage and non-brokerage accounts with Asset & Financial Planning, outlining required information and agreements concerning asset management.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign brokerage and non-brokerage accounts

Edit your brokerage and non-brokerage accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your brokerage and non-brokerage accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing brokerage and non-brokerage accounts online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit brokerage and non-brokerage accounts. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

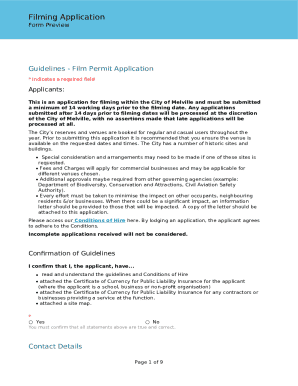

How to fill out brokerage and non-brokerage accounts

How to fill out Brokerage and Non-Brokerage Accounts

01

Determine the type of account you need: Brokerage (for trading stocks, bonds, and other securities) or Non-Brokerage (for other investment opportunities like savings accounts or CDs).

02

Gather necessary identification and personal information such as Social Security number, employment details, and financial status.

03

Choose a brokerage firm or financial institution that supports the type of account you wish to open.

04

Complete the application form provided by the brokerage or financial institution, ensuring all information is accurate.

05

Review and agree to the terms and conditions associated with the account.

06

Submit the application along with any required documents (such as ID proof and address verification).

07

Fund your account by transferring money from your bank account or by depositing checks, as instructed by the brokerage or financial institution.

Who needs Brokerage and Non-Brokerage Accounts?

01

Individuals seeking to invest in the stock market or other securities need a Brokerage Account.

02

Investors wanting to diversify their investment portfolio may require both Brokerage and Non-Brokerage Accounts.

03

People planning for retirement may need Non-Brokerage Accounts for savings and IRAs.

04

Individuals wanting to manage their finances and gain interest on deposits may benefit from Non-Brokerage Accounts.

Fill

form

: Try Risk Free

People Also Ask about

What are brokerage accounts?

Non-Brokerage Account means an account that is exempted from the definition of Account in this Code, such as the employee's NorthStar 401(k), a retirement plan sponsored by a previous employer, a Family Member's employer sponsored retirement plan, accounts held directly at a mutual fund company, 529 or other college

What are the two types of brokers?

Discount brokers execute trades on behalf of a client, but typically don't provide investment advice. Full-service brokers provide execution services as well as tailored investment advice and solutions.

What is the difference between a brokerage and a non-brokerage account?

Brokerage accounts are generally less restrictive than IRAs or retirement accounts: They have no contribution limits, and you can withdraw your money at any time for any reason. However, brokerage accounts are often not tax advantaged — you may have to pay taxes on any earnings you receive.

Are there different types of brokerage accounts?

When you open a brokerage account, you need to choose between an individual or joint brokerage account. Joint brokerage accounts are beneficial if you're looking to pool your investments with another person, such as a spouse or family member, and can be a way to simplify investment management and/or estate planning.

What is the difference between a Type 1 and Type 2 brokerage account?

Most brokerage firms offer at least two types of accounts. A Quick Course on Account Types: A “cash” account is generally coded as a Type 1 account and a “margin” account is typically coded as a Type 2 account. These codes are explained in the “Disclosures and Definitions” section of your statement.

What are the two types of brokerage accounts?

In a cash account, you are not allowed to borrow funds from your broker to pay for transactions in the account. A margin account is a type of brokerage account in which your brokerage firm can lend you money to buy securities, with the securities in your portfolio serving as collateral for the loan.

Why have two brokerage accounts?

One broker may offer low trading commissions but average customer service, while another could have a great trading platform but no discounts for buying and selling mutual funds. Because of these differences, it may make sense for you to have more than one brokerage account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Brokerage and Non-Brokerage Accounts?

Brokerage accounts are investment accounts that allow individuals to buy and sell securities through a licensed brokerage firm. Non-brokerage accounts, on the other hand, may involve other types of financial accounts like savings accounts, checking accounts, or investment accounts that do not require the use of a brokerage firm.

Who is required to file Brokerage and Non-Brokerage Accounts?

Individuals and entities who invest in securities, earn interest, or receive dividends are generally required to file brokerage accounts. Non-brokerage accounts may need to be reported by those holding significant assets or generating taxable income.

How to fill out Brokerage and Non-Brokerage Accounts?

To fill out Brokerage accounts, provide your personal information, account number, and tax identification number, along with details of trades and transactions made within the period. Non-brokerage accounts generally require personal identification and tax information, as well as details on interest earned and tax-exempt funds.

What is the purpose of Brokerage and Non-Brokerage Accounts?

The purpose of brokerage accounts is to facilitate buying and selling of stocks and other securities. Non-brokerage accounts serve to hold cash, savings, and other assets, offering different types of liquidity and investment options.

What information must be reported on Brokerage and Non-Brokerage Accounts?

Reported information generally includes account holder details, transaction history, capital gains, losses, income from dividends and interest, and tax identification numbers. It may also include the account balances at the end of the reporting period.

Fill out your brokerage and non-brokerage accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Brokerage And Non-Brokerage Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.