Get the free Mutual Fund Breakpoints Memo

Show details

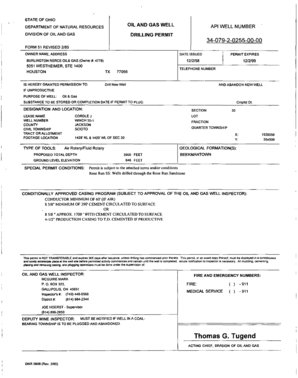

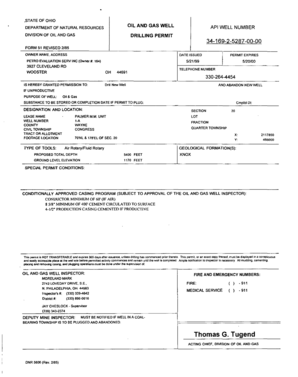

This memo provides guidance on mutual fund purchase and breakpoint schedules, emphasizing the need for compliance with sales charges and informing customers about their entitlements to breakpoint

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual fund breakpoints memo

Edit your mutual fund breakpoints memo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual fund breakpoints memo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mutual fund breakpoints memo online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mutual fund breakpoints memo. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual fund breakpoints memo

How to fill out Mutual Fund Breakpoints Memo

01

Start by gathering all necessary data regarding your mutual fund investments.

02

Identify the breakpoint levels for your mutual fund, which usually depend on the amount of your investment.

03

Complete the header section of the memo with your name, date, and the fund details.

04

Clearly outline the investment amount and specify which breakpoint you are aiming to achieve.

05

If applicable, include information about any special arrangements or agreements that affect breakpoint eligibility.

06

Review the memo for accuracy and completeness before submitting it to your investment advisor or fund manager.

Who needs Mutual Fund Breakpoints Memo?

01

Investors looking to maximize their mutual fund investments by taking advantage of lower fee structures.

02

Financial advisors assisting clients in understanding potential cost savings from breakpoints.

03

Compliance officers ensuring that investment processes adhere to regulations regarding pricing.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take for 7% return to double?

7% Rate of Return: Similarly, for an average return of 7%, it would take a little over 10 years for your money to double.

Can I get 20% return in mutual funds?

Based on historical analysis, mutual funds have provided solid returns, often around 9 – 12% annually. However, these returns can be higher depending on market conditions. For example, in India, mutual funds have given an average 20% return over ten years and have shown strong market growth.

What are the breakpoints for mutual funds?

Breakpoint discounts are volume discounts to the front-end sales load charged to investors who purchase Class A mutual fund shares. The extent of the discount depends on the amount invested in a particular family of funds.

What is the 7/5/3-1 rule in mutual funds?

The 7-5-3-1 framework is such a practical and memorable compass for investors — 7 years for compounding to work its magic, 5 strategies to reduce overdependence, 3 asset classes for diversification, and 1 disciplined annual review to stay on course.

What is the 3-5-10 rule for mutual funds?

Section 12(d)(1) of the 1940 Act limits the amount an acquiring fund can invest in an acquired fund to 3% of the outstanding voting stock of the acquired fund, 5% of the value of the acquiring fund's total assets in any one other acquired fund, and 10% of the value of the acquiring fund's total assets in all other

What is the breakpoint rule?

The Rule Notices. (a) No member shall sell investment company shares in dollar amounts just below the point at which the sales charge is reduced on quantity transactions so as to share in the higher sales charges applicable on sales below the breakpoint.

How to avoid paying taxes on a mutual fund?

Selling in less than a year can trigger higher capital gains taxes if you make a profit. Buy mutual fund shares through your traditional IRA or Roth IRA. If you put money in a traditional IRA, your investments grow tax-deferred; you're not taxed until you withdraw money.

What is the 8 4 3 rule in mutual funds?

As per this thumb rule, the first 8 years is a period where money grows steadily, the next 4 years is where it accelerates and the next 3 years is where the snowball effect takes place.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mutual Fund Breakpoints Memo?

The Mutual Fund Breakpoints Memo is a document that outlines the breakpoint discounts available to investors in mutual funds, which can reduce the overall cost of investment based on the amount invested.

Who is required to file Mutual Fund Breakpoints Memo?

Registered investment advisors and financial professionals who facilitate mutual fund transactions on behalf of clients are typically required to file the Mutual Fund Breakpoints Memo.

How to fill out Mutual Fund Breakpoints Memo?

To fill out the Mutual Fund Breakpoints Memo, one must provide relevant investor information, detail the amounts being invested, specify the mutual fund in question, and outline any applicable breakpoint discounts based on the investment amount.

What is the purpose of Mutual Fund Breakpoints Memo?

The purpose of the Mutual Fund Breakpoints Memo is to ensure that investors are aware of, and can take advantage of, available discounts on mutual fund purchases corresponding to their investment amounts.

What information must be reported on Mutual Fund Breakpoints Memo?

The information that must be reported includes the investor's name, the amount invested, the specific mutual fund details, applicable breakpoint tiers, and any corresponding discounts that apply to the transaction.

Fill out your mutual fund breakpoints memo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Fund Breakpoints Memo is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.