Get the free New Revenue Sharing Disclosure Form - Prime Capital Services, Inc.

Show details

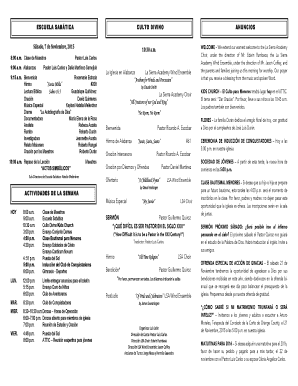

Prime Capital Services, Inc 2010-12 Compliance Memo To: Registered Representatives, Registered Principals, Sales Assistants, and Home Office Employees From: Compliance Department Date: July 12, 2010,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new revenue sharing disclosure

Edit your new revenue sharing disclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new revenue sharing disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new revenue sharing disclosure online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit new revenue sharing disclosure. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new revenue sharing disclosure

How to fill out new revenue sharing disclosure:

01

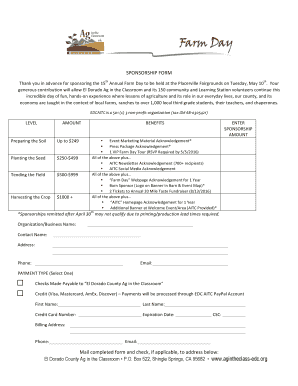

Gather all relevant financial information: Before filling out the revenue sharing disclosure, collect any documents or records that contain details about the revenue sharing agreements, such as contracts, invoices, or receipts.

02

Identify the parties involved: Clearly identify the individuals or organizations participating in the revenue sharing arrangement. This may include the company providing the product or service, as well as any partners or affiliates.

03

Specify the nature of the arrangement: Describe the specific terms and conditions of the revenue sharing agreement. This should include how the revenues will be shared, the duration of the agreement, and any performance metrics or milestones that need to be met.

04

Disclose any conflicts of interest: If there are any potential conflicts of interest regarding the revenue sharing arrangement, it is essential to disclose them honestly and transparently. This includes any personal interests or affiliations that may influence the sharing of revenues.

05

Provide disclosure statements to relevant parties: Once the revenue sharing disclosure is completed, distribute the document to all parties involved in the arrangement. This ensures that everyone is aware of their rights, obligations, and financial responsibilities.

Who needs new revenue sharing disclosure?

01

Companies with revenue sharing agreements: Any business or organization that has entered into a revenue sharing arrangement with another entity needs to have a new revenue sharing disclosure. This ensures transparency and promotes fair practices in revenue sharing.

02

Partners or affiliates: If an individual or organization is participating in a revenue sharing arrangement as a partner or affiliate, they also need to be provided with a new revenue sharing disclosure. This helps them understand their role in the agreement and the financial implications involved.

03

Regulatory agencies: Depending on the industry and jurisdiction, regulatory agencies may require companies to submit new revenue sharing disclosures as part of their compliance obligations. It is important to be aware of any specific regulations or guidelines that apply to your business.

In summary, filling out a new revenue sharing disclosure involves gathering financial information, identifying the parties involved, specifying the arrangement details, disclosing conflicts of interest, and distributing the document to relevant parties. This disclosure is necessary for companies, partners, affiliates, and may be required by regulatory agencies to ensure transparency and fairness in revenue sharing agreements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is new revenue sharing disclosure?

The new revenue sharing disclosure is a document that details the distribution of revenue between different parties in a business or investment arrangement.

Who is required to file new revenue sharing disclosure?

All businesses or individuals involved in a revenue sharing arrangement are required to file the new revenue sharing disclosure.

How to fill out new revenue sharing disclosure?

The new revenue sharing disclosure should be filled out by providing accurate information about the revenue distribution, including the parties involved, the amounts received or paid, and any relevant details or agreements.

What is the purpose of new revenue sharing disclosure?

The purpose of the new revenue sharing disclosure is to promote transparency and provide stakeholders with information about how revenue is shared between different entities or individuals.

What information must be reported on new revenue sharing disclosure?

The new revenue sharing disclosure must include details about the parties involved, the total revenue generated, the specific amounts or percentages shared with each party, and any relevant terms or conditions of the revenue sharing arrangement.

How do I execute new revenue sharing disclosure online?

pdfFiller has made it simple to fill out and eSign new revenue sharing disclosure. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make edits in new revenue sharing disclosure without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing new revenue sharing disclosure and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit new revenue sharing disclosure straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing new revenue sharing disclosure right away.

Fill out your new revenue sharing disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Revenue Sharing Disclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.