Get the free Application for Credit - Missouri Carbide

Show details

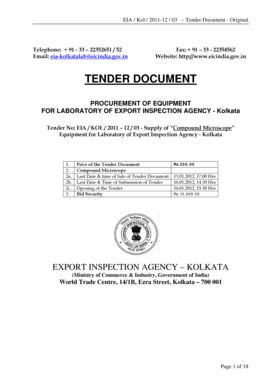

Missouri Carbide, Inc 13965 Lawrence 2143 Mt. Vernon, MO 65712 Phone: (800×4303101 FAX (417×4711037 APPLICATION FOR CREDIT Firm Name: Date established: / / AddressShipping: Billing: Telephone: FAX:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for credit

Edit your application for credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for credit online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for credit

How to fill out an application for credit:

01

Gather all necessary documents: Before starting the application, make sure you have the required documents such as identification proof, income statements, and any other relevant financial information.

02

Research different lenders: It's essential to explore different lenders and their credit offerings. This will help you find the best fit for your needs and increase your chances of getting approved.

03

Understand the application form: Take some time to carefully read and understand the application form. Pay attention to the information being asked and ensure you have all the necessary details before proceeding.

04

Fill in personal information: Begin by providing your personal information, including your full name, address, contact details, and social security number. Ensure accuracy as any mistakes can lead to delays or rejections.

05

Employment and income details: Share information about your employment status, including your current employer's name, address, and contact details. Additionally, provide details about your income, such as your salary, bonuses, or other sources.

06

Financial information: You may be required to disclose your current expenses, assets, and liabilities. These details help the lender assess your financial stability and repayment ability.

07

Desired credit amount: Specify the credit amount you are seeking, along with any specific terms or conditions you may prefer. Be realistic about what you can afford to borrow.

08

Double-check and review: Before submitting the application, carefully review all the information you have provided. Ensure there are no errors or missing details.

09

Submitting the application: If applying online, click on the submit button. If applying in person or by mail, follow the lender's instructions to send the application along with any supporting documents.

Who needs an application for credit:

01

Individuals looking for loans: Anyone who requires financial assistance through a loan, such as an auto loan, mortgage, personal loan, or credit card, will need to fill out an application for credit.

02

Small business owners: Entrepreneurs seeking business loans or lines of credit for their ventures will typically need to complete a credit application.

03

Students applying for educational loans: Students pursuing higher education often need to complete credit applications to apply for student loans to cover tuition fees and other related expenses.

04

Individuals seeking to establish or build credit history: For those who have limited credit history or are working on rebuilding their credit, applying for credit and maintaining a positive repayment record is crucial.

05

Consumers wanting to take advantage of credit card offers: Many credit card companies require individuals to complete an application to be considered for their credit card offerings.

Remember, it is essential to only apply for credit when necessary and to borrow responsibly, ensuring that you can comfortably repay any borrowed funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is application for credit?

An application for credit is a formal request submitted by an individual or a business to a financial institution or lender for the purpose of obtaining a loan or credit line.

Who is required to file application for credit?

Any individual or business seeking to borrow money or obtain credit is required to file an application for credit.

How to fill out application for credit?

To fill out an application for credit, the applicant typically needs to provide personal information, financial information, details about the intended use of the credit, and any other relevant information requested by the lender.

What is the purpose of application for credit?

The purpose of an application for credit is to allow lenders to assess the creditworthiness of the applicant and determine whether to approve the requested loan or credit line.

What information must be reported on application for credit?

Information that must be reported on an application for credit typically includes personal information (such as name, address, and social security number), financial information (such as income and assets), and details about the desired credit (such as amount requested and purpose of the credit).

How can I send application for credit to be eSigned by others?

application for credit is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find application for credit?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the application for credit in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out application for credit using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign application for credit and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your application for credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.