Get the free BPetitionb for bReassessmentb - FTP Directory Listing

Show details

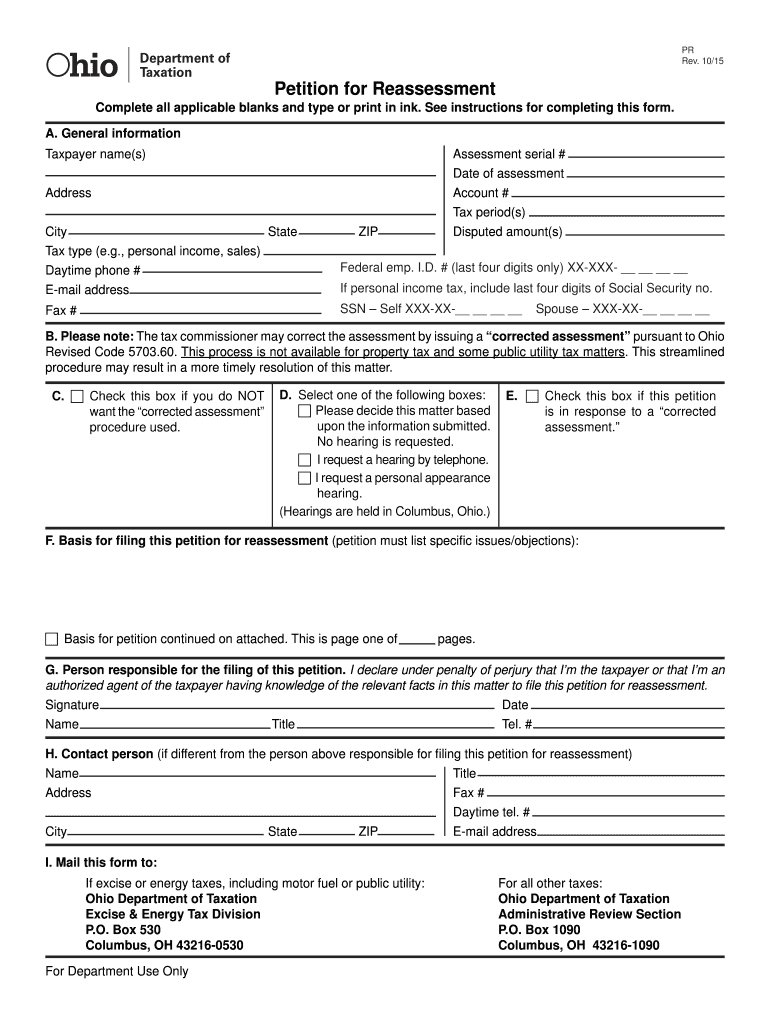

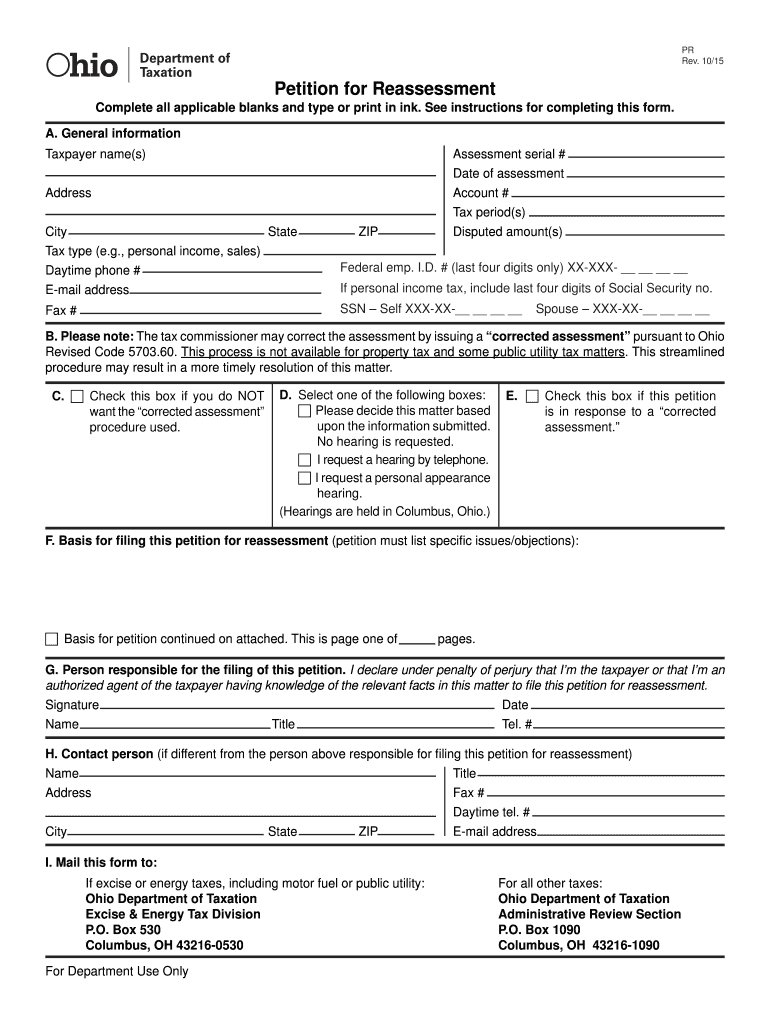

Reset Form PR Rev. 10×15 Petition for Reassessment Complete all applicable blanks and type or print in ink. See instructions for completing this form. A. General information Taxpayer name’s) Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bpetitionb for breassessmentb

Edit your bpetitionb for breassessmentb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bpetitionb for breassessmentb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bpetitionb for breassessmentb online

Follow the steps below to use a professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bpetitionb for breassessmentb. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bpetitionb for breassessmentb

How to fill out a petition for reassessment?

01

Start by obtaining the necessary forms. Contact the appropriate department or agency to request the petition for reassessment form. This could be the local tax assessor's office or any regulatory body relevant to your situation.

02

Read the instructions carefully. Once you have the petition form, take the time to thoroughly understand the instructions provided. Make sure you comprehend all the requirements and any supporting documents that may be needed.

03

Gather all the required information. Before filling out the petition, collect all the necessary information to support your case. This may include property records, financial documents, or any other relevant evidence that demonstrates the need for reassessment.

04

Complete the petition form accurately. Fill in the required details in the form, such as your name, address, contact information, and any specific details related to your case. Be concise and provide all the necessary information as requested.

05

Attach supporting documentation. Ensure that you have all the supporting documents that were mentioned in the instructions. These may include property appraisal reports, tax assessment records, or any other pertinent evidence that supports your claim for reassessment.

06

Review and proofread. Once you have completed the petition form and attached the required documents, take the time to review everything. Proofread for any errors or omissions that may cause delays or complications in the reassessment process.

Who needs a petition for reassessment?

01

Property owners who believe their property is over or underassessed. If you strongly believe that the tax assessment on your property is inaccurate and does not reflect its current value, you may need to file a petition for reassessment.

02

Individuals disputing other types of assessments. Beyond property assessments, reassessment petitions may also apply to various other assessments, such as business or income tax assessments. If you believe these assessments are unfair or incorrect, filing a petition for reassessment may be necessary.

03

Taxpayers seeking to challenge a tax increase. In some cases, local authorities may increase taxes without proper justification. If you believe your tax increase is unjust, you can file a petition for reassessment to challenge the higher tax amount.

Remember, specific requirements and processes may vary depending on your jurisdiction and the type of assessment involved. It is essential to follow the instructions provided by the authorities and seek legal or professional advice if needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute bpetitionb for breassessmentb online?

Filling out and eSigning bpetitionb for breassessmentb is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I fill out bpetitionb for breassessmentb on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your bpetitionb for breassessmentb, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit bpetitionb for breassessmentb on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as bpetitionb for breassessmentb. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is bpetitionb for breassessmentb?

A petition for reassessment is a formal request for a review of a property's assessed value.

Who is required to file bpetitionb for breassessmentb?

Property owners or their authorized representatives are required to file a petition for reassessment.

How to fill out bpetitionb for breassessmentb?

A petition for reassessment can typically be filled out online or submitted in person at the local tax assessment office.

What is the purpose of bpetitionb for breassessmentb?

The purpose of a petition for reassessment is to challenge the current assessed value of a property and potentially lower the property taxes.

What information must be reported on bpetitionb for breassessmentb?

The petition for reassessment must include the property owner's information, details about the property, and any supporting documentation to justify the request for a reassessment.

Fill out your bpetitionb for breassessmentb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bpetitionb For Breassessmentb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.