Get the free EQUIPMENT LEASE (ONTARIO)

Show details

This document is a lease agreement between a lessor and a lessee regarding the rental of specific equipment. It outlines terms such as lease duration, payment, deposits, and responsibilities of both

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign equipment lease ontario

Edit your equipment lease ontario form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your equipment lease ontario form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit equipment lease ontario online

Follow the steps down below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit equipment lease ontario. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

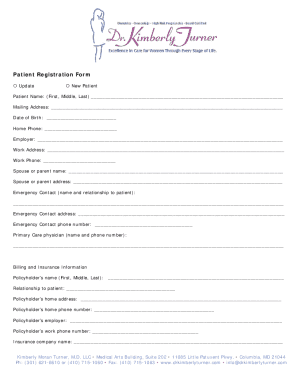

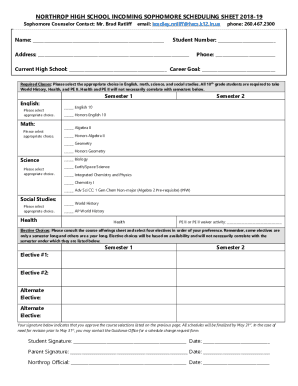

How to fill out equipment lease ontario

How to fill out EQUIPMENT LEASE (ONTARIO)

01

Title: At the top of the document, write 'EQUIPMENT LEASE (ONTARIO)'.

02

Date: Fill in the date when the lease is being executed.

03

Parties: Clearly identify the Lessor (owner of the equipment) and Lessee (person or business renting the equipment) by providing their full names and addresses.

04

Description of Equipment: Provide a detailed description of the equipment being leased, including make, model, serial numbers, and any other identifying details.

05

Lease Term: Specify the duration of the lease, including the start and end dates.

06

Payment Terms: Outline the payment schedule, including the amount, due dates, and payment method (e.g., monthly, quarterly).

07

Security Deposit: Indicate whether a security deposit is required, and if so, the amount and conditions for its return.

08

Maintenance and Repairs: Clearly state who is responsible for maintenance and repairs of the equipment during the lease term.

09

Insurance Requirements: Specify any insurance coverage required for the equipment during the lease period.

10

Indemnification Clause: Include a clause outlining liability and indemnification responsibilities between the parties.

11

Termination Conditions: State the conditions under which the lease can be terminated by either party.

12

Signatures: Ensure all parties sign and date the agreement at the end of the document.

Who needs EQUIPMENT LEASE (ONTARIO)?

01

Businesses that require temporary access to specific equipment without the commitment of purchasing it.

02

Individuals or organizations planning events that need specialized equipment for a limited time.

03

Startups or small businesses looking to manage cash flow by leasing rather than buying equipment outright.

04

Construction companies needing heavy machinery for short-term projects.

Fill

form

: Try Risk Free

People Also Ask about

How do I get out of an equipment lease agreement?

If you need to exit your lease, consider these quick solutions: Review the cancellation clause in your contract for penalty-free options. Identify any breach of contract by your lessor that might allow for termination. Find a suitable sub-lessee to take over your lease. Negotiate with your lessor for early termination.

How does equipment leasing work?

Equipment leasing differs from equipment lending in that you are not buying the equipment, so you don't have to come up with a cash down payment. Instead, the financing provider purchases the equipment that your business needs, and you make a monthly lease payment to use it.

What are the disadvantages of leasing equipment?

While leasing can be easier on cash flow, in the long run the cost is usually higher than buying. Another drawback is that when the lease term ends, you'll need to replace the equipment. Lease payments for the replacement could be significantly higher.

What is the structure of equipment leasing?

The lessee enters an equipment leasing agreement with the option to purchase at the end of the contract. The lessor applies a percentage of each payment to the equipment's purchase price. At the end of the contract, the lessor pays the remaining balance to gain ownership of the equipment.

Is it better to lease equipment or buy?

Leasing equipment preserves cash and offers upgrade flexibility, but typically costs more overall and doesn't build ownership equity. Buying equipment gives you valuable ownership and tax breaks, but requires more upfront cash and risks getting stuck with outdated assets.

What happens at the end of an equipment lease?

Balloon Payment: A large, final payment due at the end of some lease agreements, particularly in capital leases, to purchase the equipment. End-of-Lease Options: Choices available to the lessee at the end of the lease term, typically including returning the equipment, renewing the lease, or purchasing the equipment.

What is the equipment financing rate in Canada?

How lenders typically price equipment loans Borrower Profile (Indicative)Common Loan APR Range Prime credit (≈680+), 2+ years in business, stable cash flow ~7%–10% Mid-tier credit (≈620–679) or thin file ~10%–14% Early-stage/startup or credit challenges ~14%–20%+ Aug 31, 2025

Is it better to buy or lease equipment?

buying equipment by weighing upfront costs, tax benefits, equipment lifespan, and whether you need frequent upgrades. Leasing equipment preserves cash and offers upgrade flexibility, but typically costs more overall and doesn't build ownership equity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is EQUIPMENT LEASE (ONTARIO)?

An Equipment Lease (Ontario) is a legal agreement that allows one party (the lessee) to use equipment owned by another party (the lessor) for a specified period in exchange for periodic payments.

Who is required to file EQUIPMENT LEASE (ONTARIO)?

Businesses and individuals who are leasing equipment in Ontario and wish to document the leasing agreement for legal and tax purposes are required to file an Equipment Lease.

How to fill out EQUIPMENT LEASE (ONTARIO)?

To fill out an Equipment Lease in Ontario, both parties should provide their legal names and addresses, describe the equipment, specify lease terms, including duration and payment amounts, and sign the document to ensure it is legally binding.

What is the purpose of EQUIPMENT LEASE (ONTARIO)?

The purpose of an Equipment Lease (Ontario) is to outline the terms of the lease arrangement, protect the interests of both parties, and provide a clear record of the leasing transaction for legal and financial purposes.

What information must be reported on EQUIPMENT LEASE (ONTARIO)?

The Equipment Lease must include the names and addresses of both the lessor and lessee, a description of the leased equipment, lease duration, payment terms, and any conditions or clauses relevant to the lease.

Fill out your equipment lease ontario online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Equipment Lease Ontario is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.