Get the free BALLOON PROMISSORY NOTE (WITH COLLATERAL)

Show details

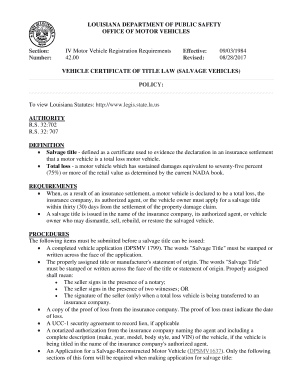

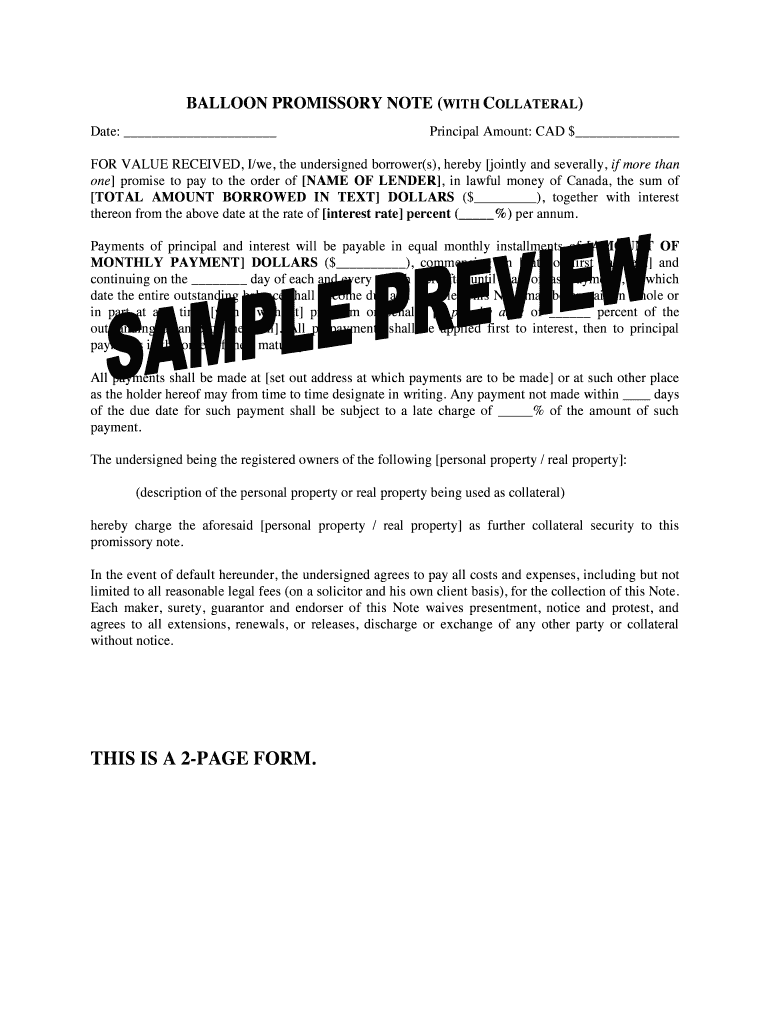

This document is a promissory note that outlines the terms of a loan, including the repayment schedule, interest rate, collateral for the loan, and conditions in the event of default.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign balloon promissory note with

Edit your balloon promissory note with form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your balloon promissory note with form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing balloon promissory note with online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit balloon promissory note with. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out balloon promissory note with

How to fill out BALLOON PROMISSORY NOTE (WITH COLLATERAL)

01

Title the document as 'Balloon Promissory Note with Collateral'.

02

Enter the date of the loan agreement.

03

Include the names and addresses of both the borrower and the lender.

04

Specify the principal amount being borrowed.

05

State the interest rate and how it will be calculated.

06

Outline the payment terms, including the maturity date of the balloon payment.

07

Describe the collateral being used to secure the note (e.g., a car or property).

08

Include a section for any fees or penalties for late payments.

09

Provide signature lines for both the borrower and lender.

10

Have the document notarized if required by state law.

Who needs BALLOON PROMISSORY NOTE (WITH COLLATERAL)?

01

Individuals or businesses seeking a loan but unable to make regular payments.

02

Borrowers who have valuable collateral to secure a loan.

03

Lenders looking to invest in secured loans with potential for larger returns.

Fill

form

: Try Risk Free

People Also Ask about

How do you write a promissory note with collateral?

To secure a promissory note with real property, first draft the note specifying the loan details and repayment terms. Then, create a mortgage or deed of trust that links the debt to the property as collateral. This legal document must be signed in accordance with state laws, often requiring notarization.

Can a promissory note have a balloon payment?

Promissory notes with balloon payments are a financing option you may be considering for your business. These types of loans may be secured by collateral or not, but they always end their repayment schedule with a big payment, known as the balloon payment.

Can a promissory note be used as collateral?

A secured promissory note is an agreement where the borrower puts something of value up as collateral to safeguard the value of the loan. In the event the borrower is unable to make payments and defaults on the loan, a secured promissory note empowers the lender to take possession of the collateral in lieu of payment.

Do promissory notes have collateral?

Promissory notes may also be secured or unsecured, depending on the situation. These are backed by collateral. If the borrower defaults, the lender may have the right to repossess the property.

What is the major problem with balloon payments?

The biggest risk: If you can't afford the balloon payment — often a very large sum — you'll lose the home.

Will the promissory note be secured by collateral?

Promissory notes may also be secured or unsecured, depending on the situation. These are backed by collateral. If the borrower defaults, the lender may have the right to repossess the property. This type of note is common in mortgage lending.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BALLOON PROMISSORY NOTE (WITH COLLATERAL)?

A Balloon Promissory Note with collateral is a type of loan agreement where the borrower agrees to make periodic payments that are smaller than the total amount, with a 'balloon' payment due at the end of the loan term to pay off the remaining balance. The note is secured with collateral, providing lenders assurance that they can reclaim the collateral if the borrower defaults.

Who is required to file BALLOON PROMISSORY NOTE (WITH COLLATERAL)?

Typically, the borrower is required to file a Balloon Promissory Note with collateral, particularly when seeking a loan, to outline the terms of the loan and the secured collateral to protect the interests of the lender.

How to fill out BALLOON PROMISSORY NOTE (WITH COLLATERAL)?

To fill out a Balloon Promissory Note with collateral, the borrower should include specific information such as the names of the parties involved, the loan amount, the interest rate, the payment schedule, the due date for the balloon payment, and a detailed description of the collateral being offered.

What is the purpose of BALLOON PROMISSORY NOTE (WITH COLLATERAL)?

The purpose of a Balloon Promissory Note with collateral is to provide a structured loan agreement that allows borrowers to pay lower monthly installments while ensuring lenders have a claim over collateral if the borrower fails to repay the loan.

What information must be reported on BALLOON PROMISSORY NOTE (WITH COLLATERAL)?

The information reported on a Balloon Promissory Note with collateral must include the borrower and lender details, the principal amount, the interest rate, the payment schedule, the balloon payment date, and a complete description of the collateral securing the note.

Fill out your balloon promissory note with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Balloon Promissory Note With is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.