Get the free CONFIDENTIAL OFFERING MEMORANDUM

Show details

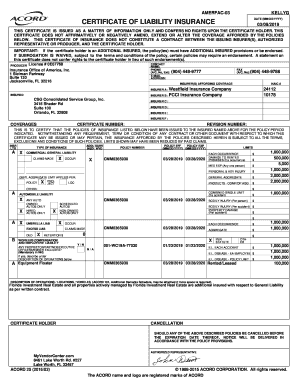

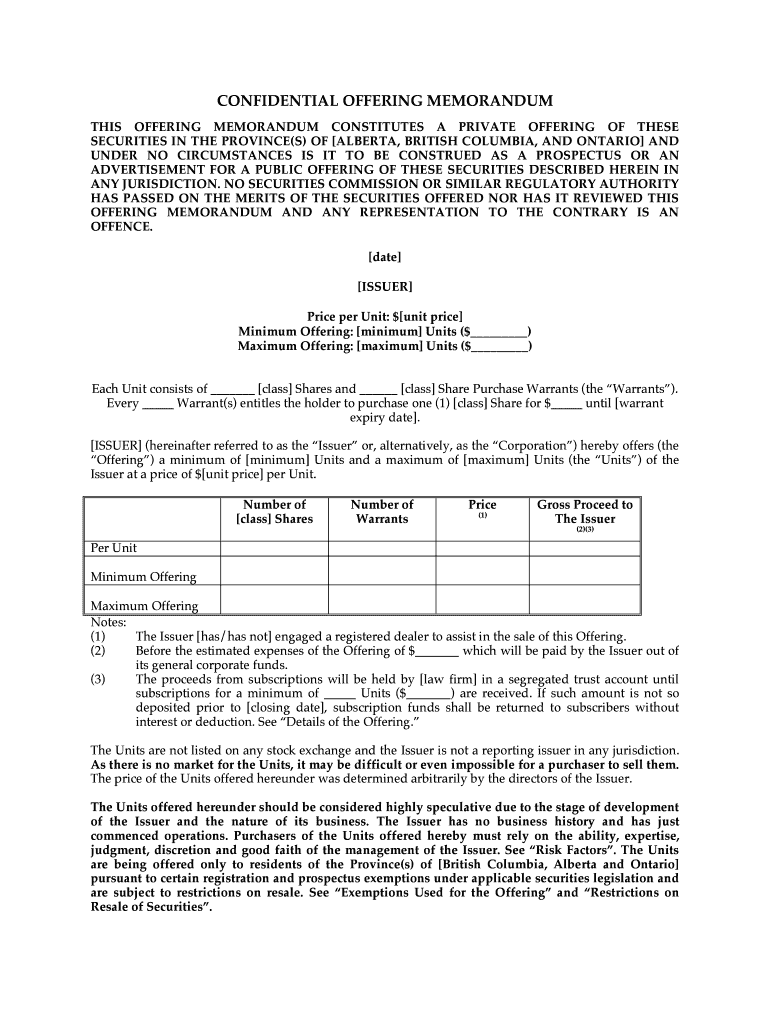

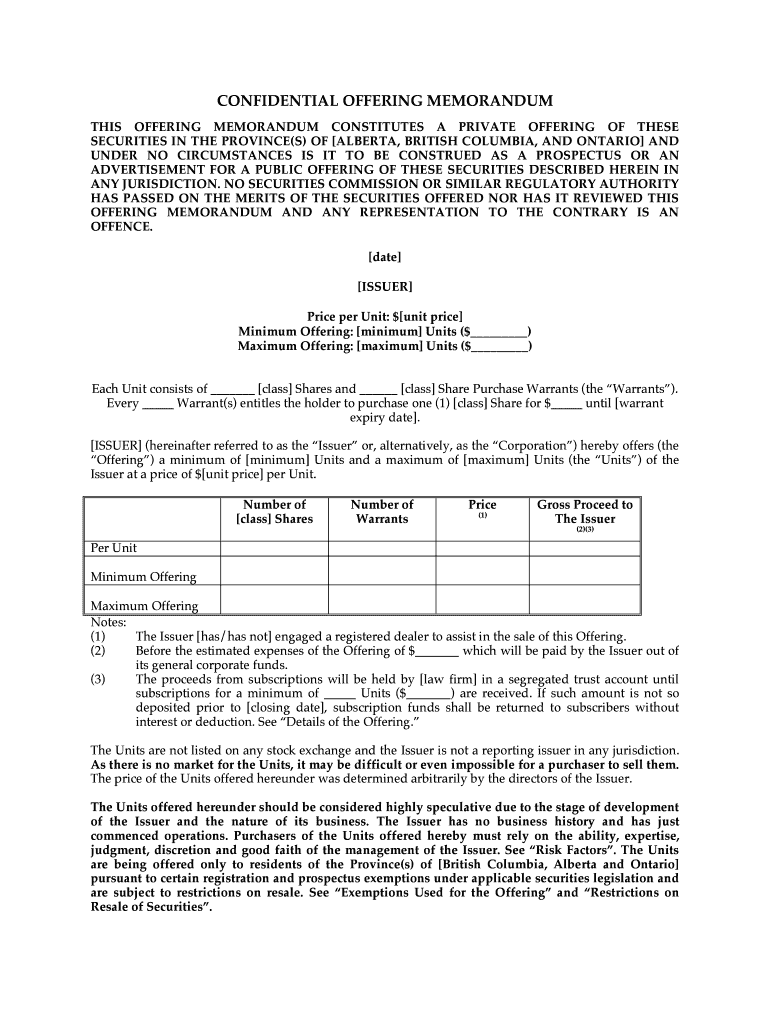

This document serves as a private offering memorandum for securities distributed in Alberta, British Columbia, and Ontario, outlining the terms of the offering, associated risks, and subscription

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign confidential offering memorandum

Edit your confidential offering memorandum form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your confidential offering memorandum form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit confidential offering memorandum online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit confidential offering memorandum. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out confidential offering memorandum

How to fill out CONFIDENTIAL OFFERING MEMORANDUM

01

Start with a cover page that includes the title 'Confidential Offering Memorandum' and relevant company information.

02

Include a table of contents for easy navigation.

03

Begin the introduction section with a brief overview of the company and its objectives.

04

Provide a detailed description of the business, including its history, products or services, and unique selling points.

05

Present the market analysis, highlighting industry trends, target market, and competition.

06

Include financial statements, such as income statements, balance sheets, and cash flow forecasts.

07

Outline the investment opportunity, detailing the terms and conditions for potential investors.

08

Add risk factors that investors should consider.

09

Include appendices with additional supporting documents, such as legal agreements or marketing materials.

10

Ensure the memorandum is clear, concise, and professionally formatted.

Who needs CONFIDENTIAL OFFERING MEMORANDUM?

01

Private companies seeking to raise capital.

02

Investors looking for potential investment opportunities.

03

Financial advisors who guide clients in investment decisions.

04

Mergers and acquisitions professionals involved in business transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is a confidential Offering Memorandum?

Capital Markets, a confidential information memorandum (also known as an offering circular, OC, offering memorandum, OM, private placement memorandum, or PPM) is a disclosure document delivered to potential investors in a private placement that provides information on the issuer and the securities being offered.

How to write a confidential information memorandum?

The following are some key sections of a confidential information memorandum (CIM). An overview of the key financials, products or business lines. A summary of historical financials and projections. A review of the company's competitive landscape, operations, business lines, products and strategy.

What is the difference between a pitch deck and a CIM?

A pitch deck is a visual presentation, often used to attract investors or raise capital. While it provides an overview of the business, it lacks the depth and detail of a CIM. The CIM is a more formal and data-driven document used primarily in the M&A process.

What is a confidential memorandum?

Purpose of Offering Memorandum The offering memorandum is used to communicate to investors that the company is seeking an investment, and where the investor's funds will be used, and how they will be repaid. This means that the document is essentially a business plan aimed at investors.

What is the purpose of a confidential information memorandum?

CIM, meaning Confidential Information Memorandum, is a 30-150-page document typically used in M&A deals that tells potential buyers or investors in detail about a company's operations, financials, market position, and growth potential. If you want to sell your business or raise funding, you need to craft a CIM.

What is a confidential memorandum?

A Confidential Information Memorandum (CIM) is a professionally prepared summary of your business that is presented to prescreened buyers who are interested in purchasing your business. The CIM addresses the buyer's questions quickly and efficiently, saving countless hours.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CONFIDENTIAL OFFERING MEMORANDUM?

A Confidential Offering Memorandum (COM) is a legal document provided to potential investors that outlines the details of an investment opportunity, including the business plan, financial projections, and risks associated with the investment.

Who is required to file CONFIDENTIAL OFFERING MEMORANDUM?

Typically, companies seeking to raise capital from private placements or accredited investors are required to file a Confidential Offering Memorandum as part of the fundraising process.

How to fill out CONFIDENTIAL OFFERING MEMORANDUM?

To fill out a Confidential Offering Memorandum, one must include the company overview, details about the investment opportunity, risks, financials, and terms of the offering. It should be completed accurately and comprehensively to ensure transparency and compliance.

What is the purpose of CONFIDENTIAL OFFERING MEMORANDUM?

The purpose of a Confidential Offering Memorandum is to inform potential investors about the details of the investment opportunity, enabling them to make informed decisions while protecting sensitive information about the company.

What information must be reported on CONFIDENTIAL OFFERING MEMORANDUM?

A Confidential Offering Memorandum must report information such as the company’s business description, management team, financial statements, use of proceeds from the offering, risks involved, and legal disclaimers.

Fill out your confidential offering memorandum online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Confidential Offering Memorandum is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.