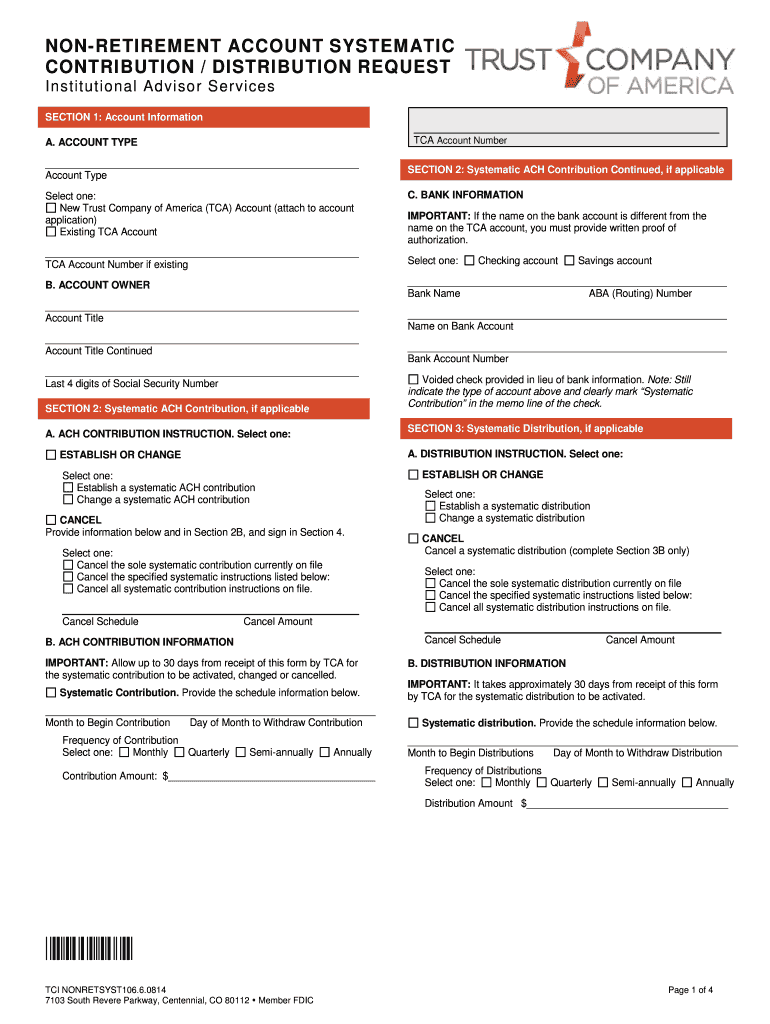

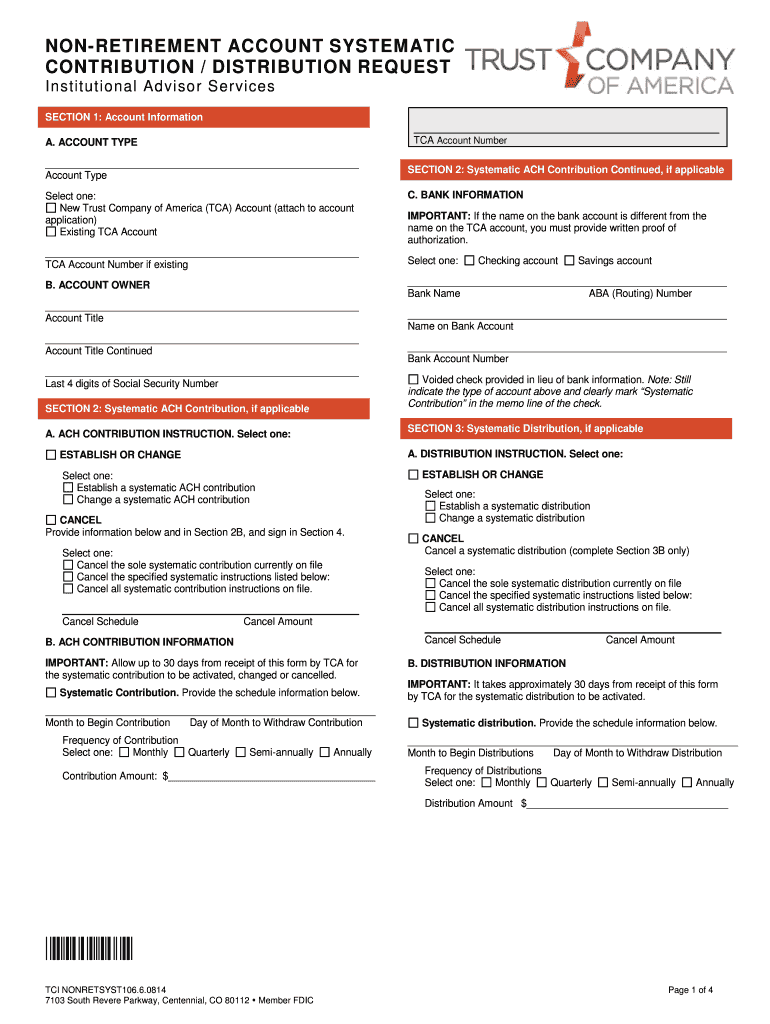

Get the free Non-retirement account systematic contribution distribution request

Show details

Use this form to request a complete, partial or systematic redemption from ... Note : Providing a phone number above will replace the current contact information on file with Putnam (if applicable×.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-retirement account systematic contribution

Edit your non-retirement account systematic contribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-retirement account systematic contribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-retirement account systematic contribution online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit non-retirement account systematic contribution. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-retirement account systematic contribution

How to fill out non-retirement account systematic contribution:

01

Gather the relevant information: Before starting the process, collect all the necessary details related to your non-retirement account, including account number, personal information, and contribution amount.

02

Determine the contribution frequency: Decide how often you want to make systematic contributions to your non-retirement account. Common options include monthly, quarterly, or annually. Select the frequency that aligns with your financial goals and budget.

03

Contact your financial institution: Get in touch with your financial institution that manages your non-retirement account. This could be a bank, brokerage firm, or investment company. Reach out to their customer service department or visit their website for instructions on how to set up systematic contributions.

04

Complete the required forms: In most cases, you will need to fill out a specific form provided by your financial institution. This form usually asks for your personal information, account details, contribution frequency, and the desired investment allocation for the contributions. Carefully fill out this form, ensuring accuracy and completeness.

05

Specify the contribution amount: Determine the amount you wish to contribute with each systematic contribution. This could be a fixed dollar amount or a percentage of your income. Make sure to indicate this clearly on the form.

06

Select the investment allocation: If your non-retirement account offers investment options, indicate your desired allocation for the contributions. This may involve choosing from various asset classes such as stocks, bonds, or mutual funds. If you are unsure about the investment aspect, consider seeking advice from a financial advisor.

07

Submit the form and authorize contributions: Once you have completed the form, review it to ensure all the information is accurate. Sign the form, authorize the institution to deduct contributions from your designated account, and submit it as instructed by your financial institution. Some may require you to mail or fax the form, while others allow online submission.

08

Monitor your contributions: After setting up systematic contributions, keep an eye on your account to ensure that the contributions are occurring as scheduled and the correct amount is being deducted. Regularly review your account statements and make any necessary adjustments or updates as your financial goals evolve.

Who needs non-retirement account systematic contribution:

01

Individuals saving for short-term financial goals: Systematic contributions to a non-retirement account can be beneficial for those who want to save for short-term goals such as buying a house, planning for a wedding, or funding an upcoming vacation.

02

Individuals with additional income: If you have surplus income that you want to put to work, systematic contributions to a non-retirement account can help you grow your savings over time. This can be especially useful for individuals looking to diversify their investment portfolio beyond retirement accounts.

03

Self-employed individuals: Non-retirement account systematic contributions are advantageous for self-employed individuals who do not have access to employer-sponsored retirement plans. It offers them a structured way to save for their future, whether it's for retirement or other financial goals.

Remember, it is always a good idea to consult with a financial advisor or tax professional to ensure non-retirement account systematic contributions align with your overall financial plan and tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute non-retirement account systematic contribution online?

Completing and signing non-retirement account systematic contribution online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit non-retirement account systematic contribution online?

The editing procedure is simple with pdfFiller. Open your non-retirement account systematic contribution in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete non-retirement account systematic contribution on an Android device?

Complete non-retirement account systematic contribution and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is non-retirement account systematic contribution?

Non-retirement account systematic contribution refers to regular, automated contributions made to a non-retirement investment account, such as a brokerage or savings account.

Who is required to file non-retirement account systematic contribution?

Individuals who have set up automatic contributions to their non-retirement investment accounts are required to report these contributions.

How to fill out non-retirement account systematic contribution?

To fill out non-retirement account systematic contribution, individuals can typically log into their account online and view the transaction history to determine the total contribution amount for the reporting period.

What is the purpose of non-retirement account systematic contribution?

The purpose of non-retirement account systematic contribution is to regularly invest funds into non-retirement accounts to build savings or investments over time.

What information must be reported on non-retirement account systematic contribution?

The information that must be reported on non-retirement account systematic contribution includes the total amount of contributions made during the reporting period.

Fill out your non-retirement account systematic contribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Retirement Account Systematic Contribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.