IRS 3520 2010 free printable template

Show details

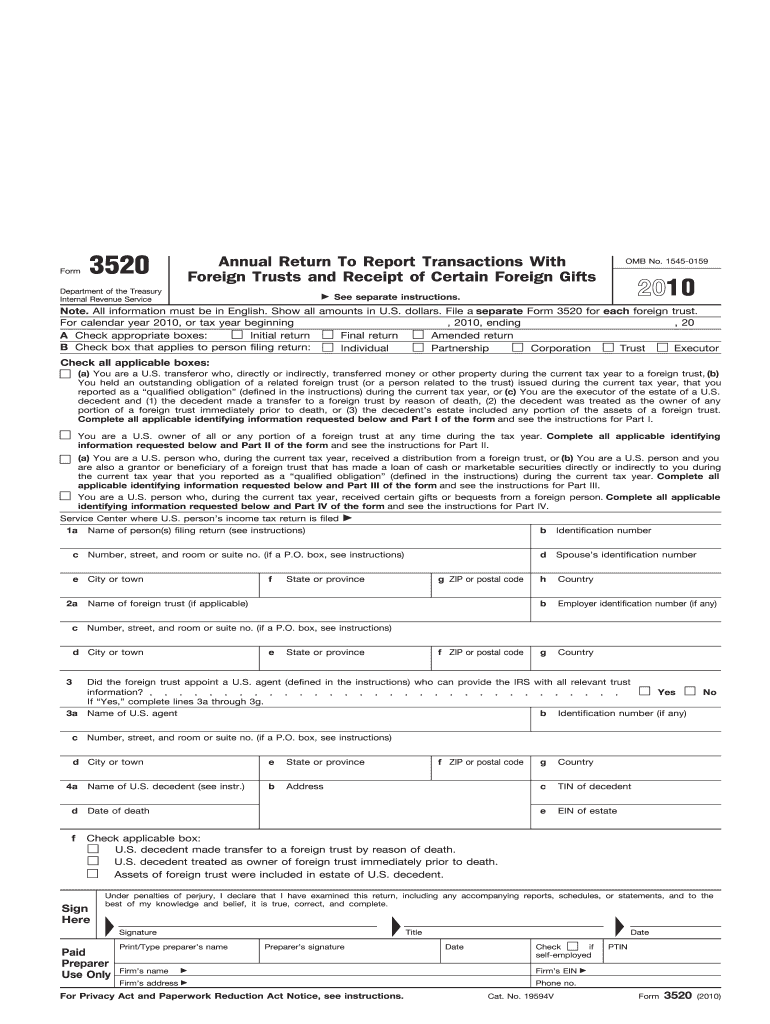

Note. All information must be in English. Show all amounts in U.S. dollars. File a separate Form 3520 for each foreign trust. For calendar year 2010 or tax year beginning 2010 ending Initial return Final return Amended return A Check appropriate boxes B Check box that applies to person filing return Individual Partnership Corporation Trust Executor Check all applicable boxes a You are a U.S. transferor who directly or indirectly transferred money or other property during the current tax year to...a foreign trust b You held an outstanding obligation of a related foreign trust or a person related to the trust issued during the current tax year that you reported as a qualified obligation defined in the instructions during the current tax year or c You are the executor of the estate of a U.S. decedent and 1 the decedent made a transfer to a foreign trust by reason of death 2 the decedent was treated as the owner of any portion of a foreign trust immediately prior to death or 3 the decedent...s estate included any portion of the assets of a foreign trust. For Privacy Act and Paperwork Reduction Act Notice see instructions. Cat. No. 19594V Form 3520 2010 Part I Page 5a Name of trust creator 6a Country code of country where trust was created Date trust was created 7a Will any person other than the U.S. transferor or the foreign trust be treated as the owner of the transferred assets after the transfer Transfers by U.S. Persons to a Foreign Trust During the Current Tax Year see...instructions i Name of other foreign trust owners if any ii iii Country of residence iv if any v Relevant Code section Was the transfer a completed gift or bequest If Yes see instructions 9a Now or in the future can any part of the income or corpus of the trust benefit any U.S. beneficiary b If No could the trust be revised or amended to benefit a U.S. beneficiary Will you continue to be treated as the owner of the transferred asset s after the transfer Schedule A Obligations of a Related...Trust see instructions 11a During the current tax year did you transfer property including cash to a related foreign trust in exchange for an obligation of the trust or an obligation of a person related to the trust see instructions b Were any of the obligations you received with respect to a transfer described in 11a above qualified obligations If No go to Schedule B and when completing columns a through i of line 13 with respect to each nonqualified obligation enter -0- in column h. TLS have...you transmitted all R text files for this cycle update Date Form I. R*S* SPECIFICATIONS TO BE REMOVED BEFORE PRINTING INSTRUCTIONS TO PRINTERS FORM 3520 PAGE 1 OF 6 MARGINS TOP 13mm 1 2 CENTER SIDES* PRINTS HEAD TO HEAD PAPER WHITE WRITING SUB. 20. INK BLACK FLAT SIZE 216mm 81 2 x 279mm 11 PERFORATE ON FOLD DO NOT PRINT DO NOT PRINT DO NOT PRINT DO NOT PRINT Action O. K. to print Revised proofs requested Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign...Gifts Department of the Treasury Internal Revenue Service Signature OMB No* 1545-0159 See separate instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 3520

How to edit IRS 3520

How to fill out IRS 3520

Instructions and Help about IRS 3520

How to edit IRS 3520

To edit IRS 3520, utilize a document editing tool like pdfFiller, which allows you to modify text fields and correct errors efficiently. Ensure all required fields are filled accurately before saving the changes. Review the edited document carefully to avoid any mistakes before submission.

How to fill out IRS 3520

To fill out IRS 3520, start by gathering necessary information such as your personal details, specifics about foreign gifts, and related accounts. Follow these steps for correct completion:

01

Read the form’s instructions thoroughly to understand requirements.

02

Fill in your name, address, and taxpayer identification number.

03

Report any foreign gifts or bequests accurately in the specified sections.

04

Sign and date the form upon completion.

05

Submit the form by the due date to avoid penalties.

About IRS 3 previous version

What is IRS 3520?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 3 previous version

What is IRS 3520?

IRS 3520 is a tax form used to report certain transactions with foreign trusts and the receipt of foreign gifts and bequests. This form helps the IRS monitor financial transactions that may involve potential tax implications for U.S. citizens and residents.

What is the purpose of this form?

The purpose of IRS 3520 is to ensure that taxpayers disclose specific foreign transactions that may not be reported on standard tax forms. This includes receiving gifts from foreign individuals that exceed a certain threshold or engaging with foreign trusts, which can have complex tax treatments.

Who needs the form?

Individuals, corporations, or partnerships that receive gifts or bequests from foreign individuals exceeding $100,000, or engage with foreign trusts, are required to file IRS 3520. This requirement applies to U.S. citizens, residents, and certain non-resident aliens.

When am I exempt from filling out this form?

You may be exempt from filing IRS 3520 if the total amount received from a foreign source does not exceed $100,000 in a single year. Additionally, if you do not have any foreign trusts or gifts to report, this form is not necessary.

Components of the form

The IRS 3520 consists of several sections, including personal identification information, details about foreign gifts received, and information regarding foreign trusts. Each part requires precise information to ensure compliance with tax regulations.

What are the penalties for not issuing the form?

Failure to file IRS 3520 on time can result in significant penalties, often starting at $10,000 and increasing based on the amount of unreported foreign gifts or transactions. Additionally, there can be further penalties for failure to provide accurate information.

What information do you need when you file the form?

When filing IRS 3520, you need your personal identification information, details about the foreign gifts received (including amounts and sources), and information regarding any foreign trusts you are part of. Collecting this information beforehand will streamline the process.

Is the form accompanied by other forms?

IRS 3520 may need to be filed alongside other forms if you are also reporting related transactions or income. It's essential to review the instructions associated with IRS 3520 to determine if you need to submit additional forms like IRS 8938 or others related to foreign assets.

Where do I send the form?

IRS 3520 should be sent to the address specified in the instructions accompanying the form. Typically, this may be a specific IRS service center depending on your location and the nature of the filing.

See what our users say