Get the free University of Connecticut Income Tax School Registration

Show details

This document provides details about the 2011 University of Connecticut Income Tax School, a two-day program designed for tax practitioners, accountants, and consultants. It includes information on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign university of connecticut income

Edit your university of connecticut income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your university of connecticut income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing university of connecticut income online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit university of connecticut income. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

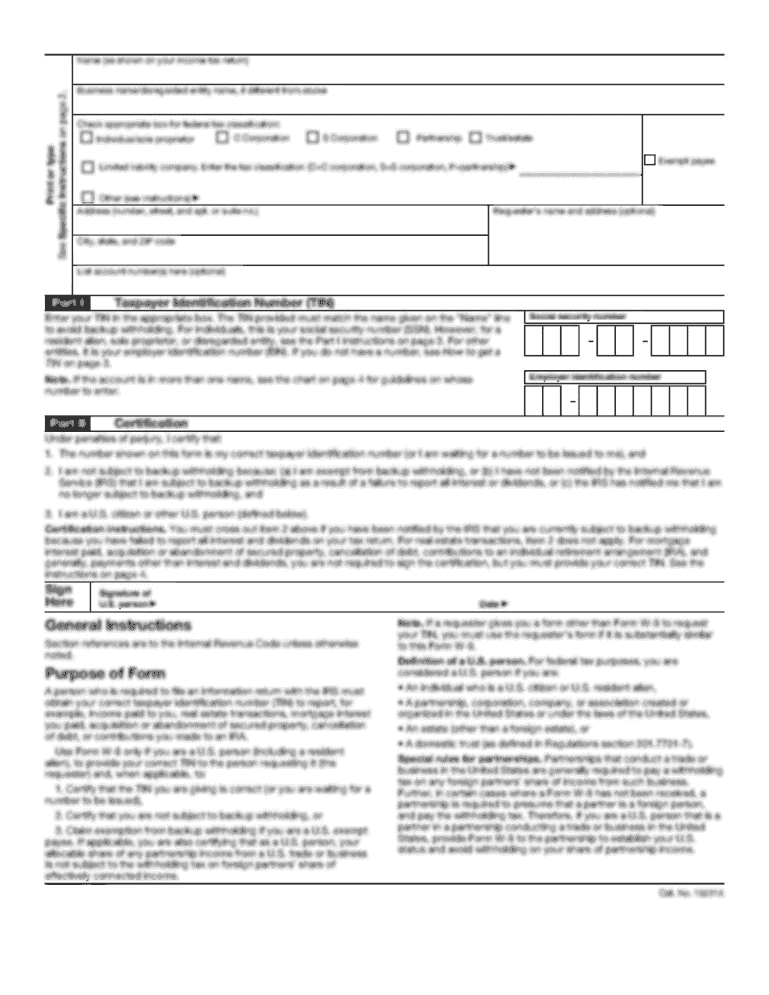

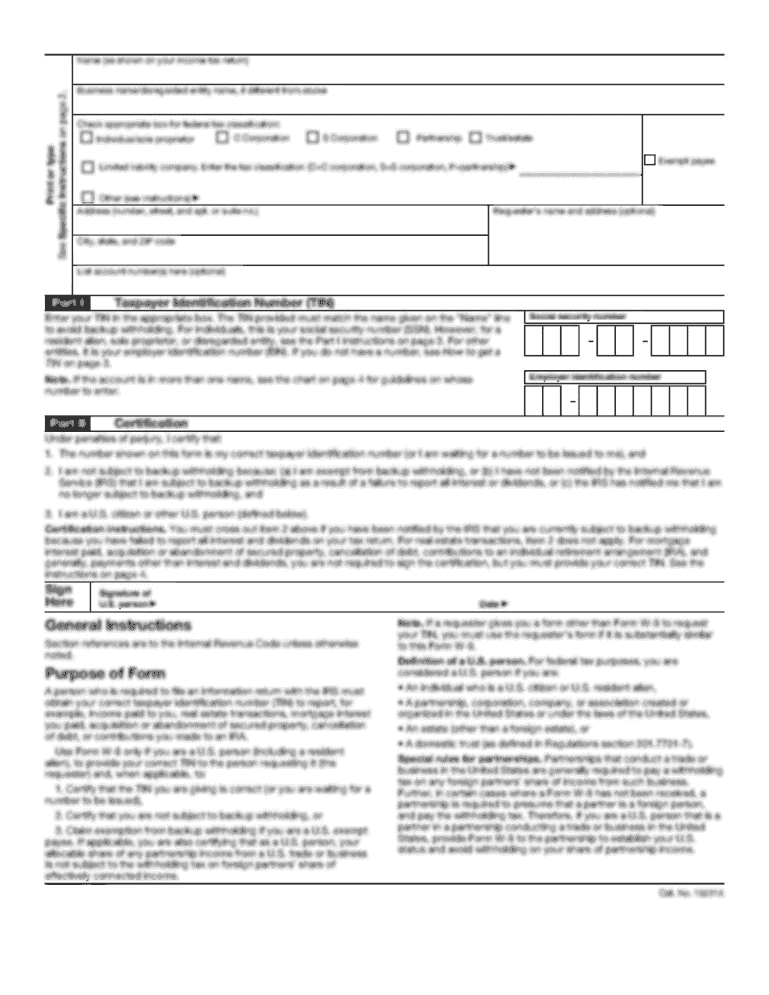

How to fill out university of connecticut income

How to fill out University of Connecticut Income Tax School Registration

01

Visit the University of Connecticut's Income Tax School Registration webpage.

02

Locate the registration form for Income Tax School.

03

Fill out all personal details including your name, address, and contact information.

04

Provide your Social Security number if required.

05

Select your desired course or session dates.

06

Review any additional requirements or prerequisites for the program.

07

Submit the registration form along with payment if necessary.

08

Confirm your registration via email or on the website.

Who needs University of Connecticut Income Tax School Registration?

01

Individuals looking to enhance their knowledge in tax preparation.

02

Tax professionals seeking CE credits or certifications.

03

Students interested in pursuing a career in tax accounting.

04

Anyone planning to file taxes independently and wishing to learn more.

Fill

form

: Try Risk Free

People Also Ask about

Can non-resident returns be e-filed?

Non-residents can now use EFILE and NETFILE to submit their 2024 income tax and benefit returns. The CRA is constantly improving its services to help Canadians file their income tax and benefit returns. By doing so, taxpayers are able to get any refunds, and benefit and credit payments they may be entitled to.

Is a non-resident required to file an ITR?

As an NRI, PIO, or OCI, you may be required to file tax returns in India if your Indian income surpasses the specified threshold or if you seek to claim refunds for excess tax deductions. While filing an ITR is mandatory only under certain circumstances, voluntary filing can be beneficial in many ways.

Who is not required to file an income tax return?

Who is Exempted from ITR Filing in India? Senior citizens should be more than 75 years of age. Senior citizens should be 'Resident' in India in the previous years. He earns income from interest and pension only.

Is non resident not required to file income tax return?

Generally, NRIs are not mandated to file ITRs solely based on their non-resident status. However, their obligation to file hinges on their total income generated in India during a specific financial year. The Income Tax Act 1961 dictates the income threshold that triggers mandatory ITR filing for NRIs.

Which return is required to be filed for non-resident taxable persons?

Every registered NRTP is required to furnish a return in Form GSTR 5 on GST Portal. It will contain all business detail including Sales & Purchases. Form GSTR 5 is a monthly return, due every 20th of the next month. If there is any delay in return filing, he will be liable to pay interest @18% per annum.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is University of Connecticut Income Tax School Registration?

The University of Connecticut Income Tax School Registration is a program that provides training and education for individuals seeking to become proficient in preparing income tax returns.

Who is required to file University of Connecticut Income Tax School Registration?

Individuals who wish to attend the Income Tax School courses and gain certification or improve their tax preparation skills are required to file the University of Connecticut Income Tax School Registration.

How to fill out University of Connecticut Income Tax School Registration?

To fill out the University of Connecticut Income Tax School Registration, individuals need to complete the registration form available online, providing personal information, course selection, and payment details.

What is the purpose of University of Connecticut Income Tax School Registration?

The purpose of the University of Connecticut Income Tax School Registration is to enroll students in comprehensive tax training programs, equipping them with the knowledge to effectively prepare and file income taxes.

What information must be reported on University of Connecticut Income Tax School Registration?

The information that must be reported on University of Connecticut Income Tax School Registration includes personal details such as name, address, contact information, and the desired course selections.

Fill out your university of connecticut income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

University Of Connecticut Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.