Get the free Focus on Retirement - Purdue Extension - Purdue University - extension purdue

Show details

Purdue Extension CFS7278W Focus on Retirement s e Semi nit 8 U Focus on Retirement Are you looking forward to the day you retire and have more time to travel, spend with family and friends, enjoy

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign focus on retirement

Edit your focus on retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your focus on retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing focus on retirement online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit focus on retirement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out focus on retirement

How to fill out focus on retirement:

01

Start by assessing your current financial situation. This involves gathering all relevant information such as your income, expenses, investments, and debts. It is important to have a clear understanding of your financial standing before planning for retirement.

02

Set specific retirement goals. Determine the lifestyle you want to enjoy during retirement and estimate the expenses associated with it. Consider factors like healthcare, travel, and hobbies. Setting clear goals provides direction and helps you stay focused on building a retirement plan.

03

Create a budget and stick to it. Analyze your income and expenses to identify areas where you can save more for retirement. Cut back on unnecessary expenses and allocate a portion of your income towards retirement savings. Regularly review your budget to ensure you are on track.

04

Maximize your retirement savings. Take advantage of retirement savings accounts like 401(k) or Individual Retirement Accounts (IRAs). Contribute as much as possible, and if your employer offers a matching contribution, aim to meet the maximum that they will match. Explore options like Roth IRAs for tax advantages.

05

Diversify your investment portfolio. Avoid putting all your eggs in one basket by investing in a variety of assets such as stocks, bonds, mutual funds, and real estate. Diversification helps to minimize risk and increase the potential for long-term gains.

06

Continuously educate yourself about retirement planning. Stay updated with the latest trends, rules, and regulations related to retirement. Attend seminars, read books, and consult with financial advisors to make informed decisions regarding your retirement strategy.

Who needs focus on retirement:

01

Individuals approaching their retirement age: Those who are close to retirement should prioritize focusing on retirement planning to ensure a smooth transition and financial security during their golden years.

02

Younger individuals: It is never too early to start planning for retirement. The earlier you start saving and investing, the more time your money has to grow and compound. Younger individuals who prioritize retirement planning have a higher likelihood of achieving their desired retirement goals.

03

Self-employed individuals: Without the benefits of employer-sponsored retirement plans, self-employed individuals need to be proactive in setting up and contributing to their retirement accounts. Focus on retirement is crucial for establishing a solid financial foundation and secure retirement for self-employed individuals.

04

Individuals with inadequate retirement savings: If you currently have insufficient retirement savings, focusing on retirement becomes even more important. By implementing smart saving and investment strategies, you can work towards catching up and building a comfortable retirement nest egg.

Remember, retirement planning is a personal and unique journey, so it is essential to tailor your approach based on your individual circumstances and goals. Seek professional financial advice to develop a comprehensive retirement plan that suits your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit focus on retirement online?

With pdfFiller, the editing process is straightforward. Open your focus on retirement in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit focus on retirement on an Android device?

You can edit, sign, and distribute focus on retirement on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out focus on retirement on an Android device?

Use the pdfFiller mobile app to complete your focus on retirement on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

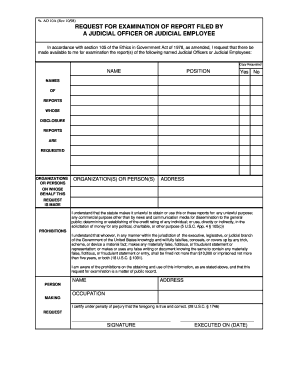

What is focus on retirement?

Focus on retirement is a form that individuals must complete to report their retirement savings and investments.

Who is required to file focus on retirement?

Any individual who has retirement savings or investments is required to file focus on retirement.

How to fill out focus on retirement?

To fill out focus on retirement, individuals must gather information about their retirement savings and investments and accurately report them on the form.

What is the purpose of focus on retirement?

The purpose of focus on retirement is to provide the government with information about individuals' retirement savings and investments.

What information must be reported on focus on retirement?

Individuals must report details about their retirement accounts, contributions, and investment income on focus on retirement.

Fill out your focus on retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Focus On Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.