Get the free ECONOMIC HARDSHIP DEFERMENT REQUEST

Show details

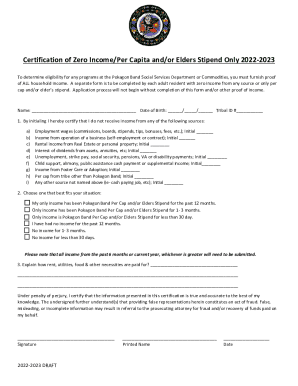

This document provides a request form for borrowers seeking an economic hardship deferment for their Federal Family Education Loans (FFEL) as well as guidelines and eligibility criteria for deferments

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign economic hardship deferment request

Edit your economic hardship deferment request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your economic hardship deferment request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing economic hardship deferment request online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit economic hardship deferment request. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out economic hardship deferment request

How to fill out ECONOMIC HARDSHIP DEFERMENT REQUEST

01

Obtain the ECONOMIC HARDSHIP DEFERMENT REQUEST form from your loan servicer's website or request a physical copy.

02

Fill out your personal information, including your name, address, and Social Security number.

03

Provide details about your economic hardship situation, which may include recent job loss, low income, or rising expenses.

04

Attach any necessary documentation that supports your claim, such as pay stubs, unemployment benefits documentation, or medical bills.

05

Review the completed form for accuracy and ensure all required information is provided.

06

Submit the form and any attachments to your loan servicer via mail, fax, or their online portal, if available.

07

Follow up with your loan servicer to confirm receipt of your request and to monitor the status of your deferment application.

Who needs ECONOMIC HARDSHIP DEFERMENT REQUEST?

01

Borrowers struggling financially due to job loss, reduced income, medical expenses, or other economic difficulties.

02

Individuals seeking temporary relief from student loan payments due to economic hardship.

03

Students or graduates who may need to defer loan payments during periods of financial instability.

Fill

form

: Try Risk Free

People Also Ask about

What is hardship deferral?

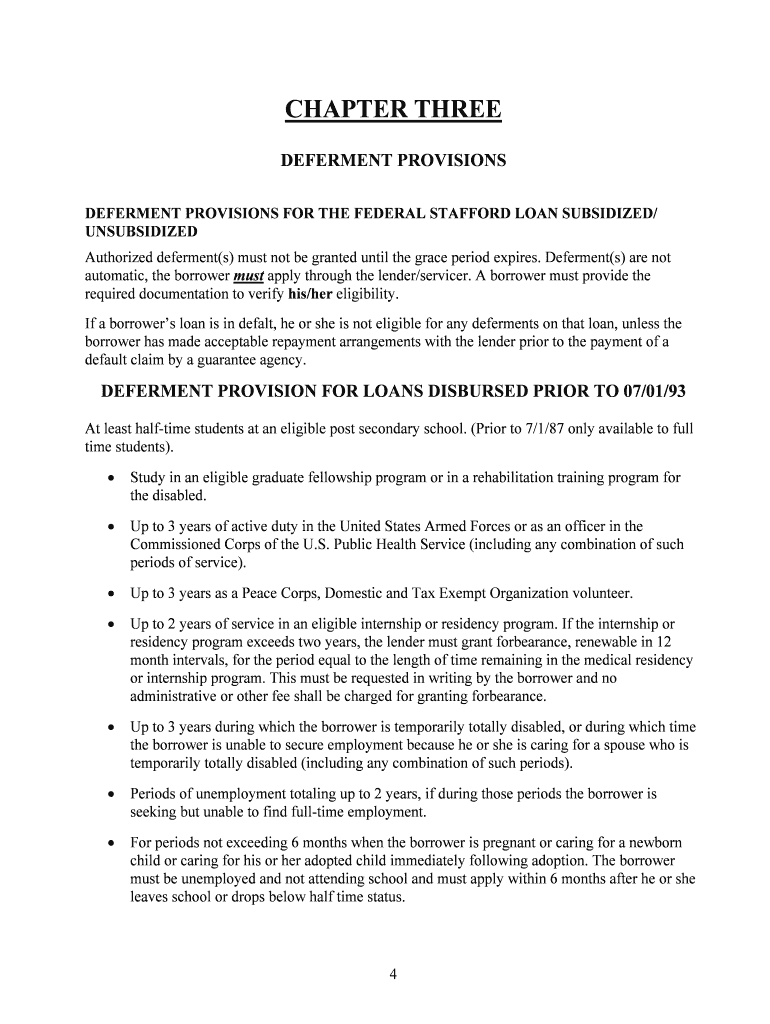

A deferment is a way to postpone paying back your student loans for a certain period of time. The economic hardship deferment is available only if you have a federal student loan. You are eligible only if you are not in default on your loans and if you obtained the loans on or after July 1, 1993.

How do I request economic hardship deferment?

To apply for the economic hardship deferment for federal loans, borrowers must submit an Economic Hardship Deferment Request form to their loan servicer. Borrowers must also submit documentation of income such as a copy of a recent pay stub or the borrower's most recently filed federal income tax return.

How do you qualify for deferred payments?

Lenders usually ask for proof of financial hardship to approve you for loan deferment. While payments aren't required, interest may continue to accrue. This can result in higher payments when deferment ends.

What is considered a hardship reason?

People do this for many reasons, including: Unexpected medical expenses or treatments that are not covered by insurance. Costs related to the purchase or repair of a home, or eviction prevention. Tuition, educational fees and related expenses. Burial or funeral expenses.

What qualifies as financial hardship for student loans?

It is a circumstance in which the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan, exceeds 15 percent (for IBR) or 10 percent (for Pay As You Earn) of the difference between your adjusted gross income (AGI) and 150 percent of the poverty line for your family size in the

What qualifies as financial hardship?

It is a circumstance in which the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan, exceeds 15 percent (for IBR) or 10 percent (for Pay As You Earn) of the difference between your adjusted gross income (AGI) and 150 percent of the poverty line for your family size in the

What is a hardship deferral?

A deferment is a way to postpone paying back your student loans for a certain period of time. The economic hardship deferment is available only if you have a federal student loan. You are eligible only if you are not in default on your loans and if you obtained the loans on or after July 1, 1993.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ECONOMIC HARDSHIP DEFERMENT REQUEST?

An Economic Hardship Deferment Request is a formal request made by borrowers for a temporary suspension of student loan payments due to financial difficulties.

Who is required to file ECONOMIC HARDSHIP DEFERMENT REQUEST?

Borrowers who are experiencing significant financial challenges that affect their ability to make regular student loan payments are required to file an Economic Hardship Deferment Request.

How to fill out ECONOMIC HARDSHIP DEFERMENT REQUEST?

To fill out the Economic Hardship Deferment Request, borrowers need to obtain the appropriate form, provide personal and financial information, and submit any required documentation that supports their financial hardship.

What is the purpose of ECONOMIC HARDSHIP DEFERMENT REQUEST?

The purpose of the Economic Hardship Deferment Request is to provide relief to borrowers who are unable to make loan payments due to economic difficulties, allowing them to temporarily postpone payments without accumulating interest on certain loans.

What information must be reported on ECONOMIC HARDSHIP DEFERMENT REQUEST?

Borrowers must report personal information such as name, contact details, loan information, financial situation, including income and expenses, and any supporting documents that verify their economic hardship.

Fill out your economic hardship deferment request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Economic Hardship Deferment Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.