Get the free EXTRACURRICULAR ACTIVITY FEE TAX CREDIT PAYROLL DEDUCTION FORM - havasu k12 az

Show details

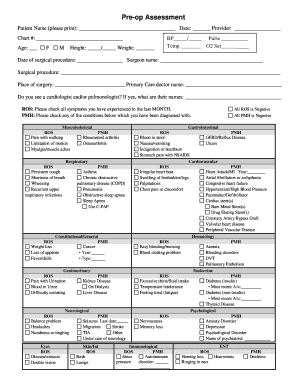

This document provides details on how to contribute to the Lake Havasu Unified Schools through tax credits for extracurricular activities, including eligibility, participation forms, and necessary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign extracurricular activity fee tax

Edit your extracurricular activity fee tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your extracurricular activity fee tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit extracurricular activity fee tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit extracurricular activity fee tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out extracurricular activity fee tax

How to fill out EXTRACURRICULAR ACTIVITY FEE TAX CREDIT PAYROLL DEDUCTION FORM

01

Obtain the EXTRACURRICULAR ACTIVITY FEE TAX CREDIT PAYROLL DEDUCTION FORM from your school or local education office.

02

Fill in your personal information, including your name, address, and student identification number.

03

Indicate the type of extracurricular activity for which you are seeking a fee tax credit.

04

Provide details about the fee amount associated with the extracurricular activity.

05

Select the payroll deduction option that best suits your financial planning.

06

Sign and date the form to confirm that the information provided is accurate.

07

Submit the completed form to the designated school authority, ensuring you keep a copy for your records.

Who needs EXTRACURRICULAR ACTIVITY FEE TAX CREDIT PAYROLL DEDUCTION FORM?

01

Parents or guardians of students enrolled in extracurricular activities.

02

Students who have incurred fees for participating in school-sponsored extracurricular programs.

03

Individuals seeking tax credits related to payments made for extracurricular activities in an educational setting.

Fill

form

: Try Risk Free

People Also Ask about

What is the extracurricular tax credit in Arizona?

You Choose Where Your Money Goes! As an Arizona taxpayer, you have the unique opportunity to redirect a portion of your state tax dollars to support public education. The credit allows you to contribute $200 per individual tax return or $400 per joint tax return to any school's extracurricular program.

What is the $6000 tax credit?

The deduction — up to $6,000 per eligible taxpayer — applies to taxpayers who are 65 or older with a modified adjusted gross income of less than $175,000 ($250,000 for married couples filing jointly). The deduction takes effect for the 2025 tax year and is set to expire after the 2028 tax year.

What is the ECA tax credit in Arizona?

As an Arizona taxpayer, you have the unique opportunity to redirect a portion of your state tax dollars to support public education. The credit allows you to contribute $200 per individual tax return or $400 per joint tax return to any school's extracurricular program. It's easy to make your tax contribution online!

What is the ECA tax allowance?

You can claim an enhanced capital allowance (ECA) of 100 per cent of the cost of certain types of equipment in the year that you buy them. These are also known as first-year allowances.

What is the tax credit for Gilbert Public Schools?

Choose where your money goes! Direct a portion of your state tax dollars to support public education and Gilbert Public Schools. Up to $200 per individual and up to $400 for married couples filing jointly may be claimed on personal income taxes. You do not have to have a child in a Gilbert Public School to participate!

Does Arizona have EV tax credit?

For Arizonans considering an EV lease or purchase, the following programs can help offset initial costs. As of April 2025, there aren't any Arizona EV incentives, nor does the state offer rebates or tax credits. However, EV owners can save time thanks to a statewide HOV lane exemption.

What is the school tax credit in Arizona?

Taxpayers Making Contributions or Paying Fees The public school tax credit is claimed by the individual taxpayer on Form 322. The maximum credit allowed is $400 for married filing joint filers and $200 for single, heads of household and married filing separate filers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is EXTRACURRICULAR ACTIVITY FEE TAX CREDIT PAYROLL DEDUCTION FORM?

The EXTRACURRICULAR ACTIVITY FEE TAX CREDIT PAYROLL DEDUCTION FORM is a document used by employees to authorize their employers to withhold payroll deductions for extracurricular activity fees, allowing them to claim a tax credit.

Who is required to file EXTRACURRICULAR ACTIVITY FEE TAX CREDIT PAYROLL DEDUCTION FORM?

Individuals who participate in programs eligible for extracurricular activity fee tax credits and wish to have deductions from their payroll to cover these fees are required to file this form.

How to fill out EXTRACURRICULAR ACTIVITY FEE TAX CREDIT PAYROLL DEDUCTION FORM?

To fill out the form, individuals should provide their personal information, including name and employee ID, specify the amount they wish to deduct, and sign the form to authorize the payroll deduction.

What is the purpose of EXTRACURRICULAR ACTIVITY FEE TAX CREDIT PAYROLL DEDUCTION FORM?

The purpose of the form is to streamline the process of payroll deductions for fees associated with extracurricular activities, enabling employees to receive a tax credit for those fees.

What information must be reported on EXTRACURRICULAR ACTIVITY FEE TAX CREDIT PAYROLL DEDUCTION FORM?

The form must report the employee's name, identification number, the amount to be deducted, the specific extracurricular activity fees, and the employee's signature to authorize the deductions.

Fill out your extracurricular activity fee tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Extracurricular Activity Fee Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

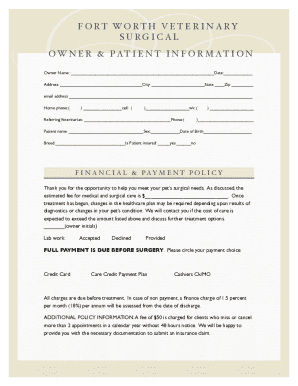

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.