Get the free Marion County Annual Tax Sale Information

Show details

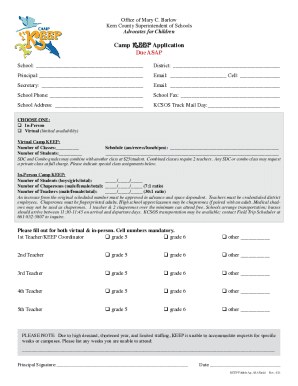

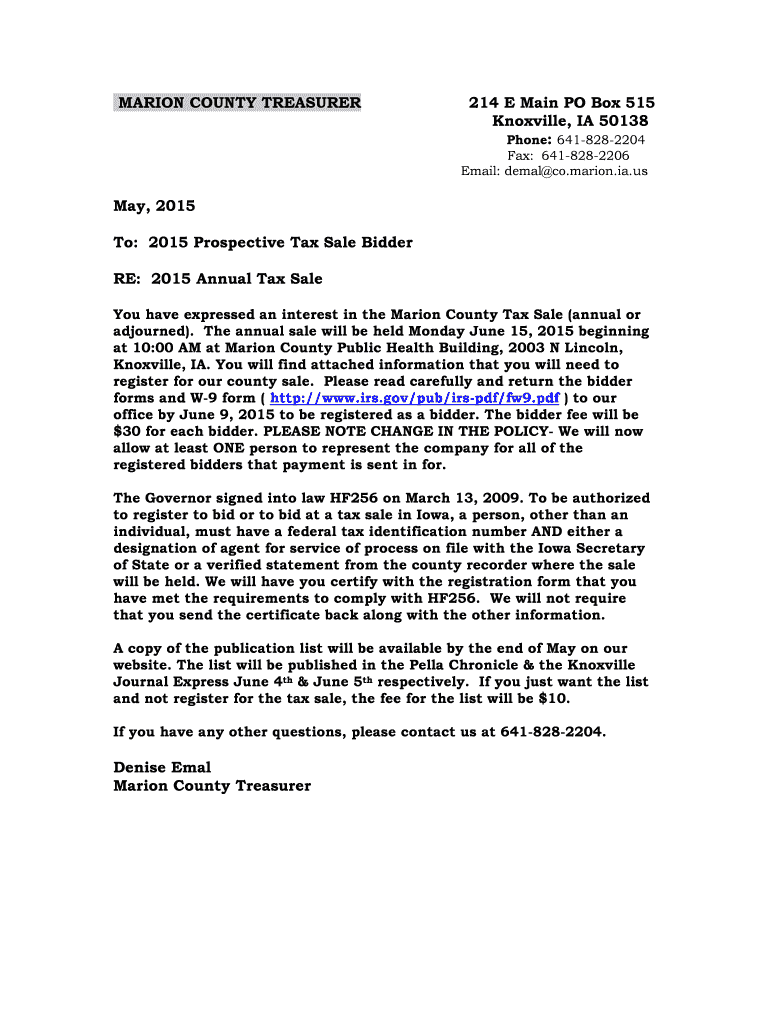

This document provides information regarding the registration and participation in the Marion County Annual Tax Sale held on June 15, 2015, including registration instructions, fees, and legal requirements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign marion county annual tax

Edit your marion county annual tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your marion county annual tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing marion county annual tax online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit marion county annual tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out marion county annual tax

How to fill out Marion County Annual Tax Sale Information

01

Obtain the Marion County Annual Tax Sale Information form from the official county website or office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information including name, address, and contact details.

04

Provide property details, including parcel number and property address.

05

Indicate the reason for the tax sale application if required.

06

Review your completed form for accuracy.

07

Submit the form by the specified deadline along with any required fees or documents.

Who needs Marion County Annual Tax Sale Information?

01

Property owners facing tax liens or delinquent taxes.

02

Investors looking to purchase tax lien certificates.

03

Real estate professionals wanting to understand the tax sale process.

04

Individuals seeking a clear record of tax obligations for properties.

Fill

form

: Try Risk Free

People Also Ask about

How can I look up my property tax information in Marion County?

The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill. Information printed from this site should not be used in lieu of a tax bill. IF YOU USE THIS AS A TAXBILL, YOU MUST REMIT A $5.00 DUPLICATE BILL FEE, OR YOU WILL BE BILLED FOR THE FEE.

How much are Marion County property taxes?

Summary Statistics for this County and the State Property Tax Rates in Marion County, INProperty Tax Rates in State Highest 5.0638 9.432 Lowest 2.3309 0.8547 Median 3 2.08

What is a tax sale certificate in Iowa?

Each year in June, county treasurers across Iowa recover the revenue lost to unpaid property taxes by selling these liens at tax sale auctions. The person or company who buys a tax lien receives a tax sale certificate for that property, and is called the certificate holder.

What is the Marion County sales tax?

Beginning January 1, 2025, the total state and local sales and use tax rate for Marion County will increase from 7% to 7.5%. The total rate for Marion County is composed of the 6% state sales and use tax rate, a 1% local government infrastructure surtax rate, and the 0.5% school capital outlay surtax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Marion County Annual Tax Sale Information?

The Marion County Annual Tax Sale Information provides details about the annual tax sale conducted by Marion County, where properties with delinquent taxes are auctioned to recover owed taxes.

Who is required to file Marion County Annual Tax Sale Information?

Property owners with delinquent tax obligations are typically required to file Marion County Annual Tax Sale Information to ensure their property is not sold during the tax sale.

How to fill out Marion County Annual Tax Sale Information?

To fill out the Marion County Annual Tax Sale Information, property owners must provide accurate details including their personal information, property information, and any tax payment history as required by the county tax authority.

What is the purpose of Marion County Annual Tax Sale Information?

The purpose of the Marion County Annual Tax Sale Information is to inform property owners about their tax obligations and the process that will be followed if taxes remain unpaid, ultimately aiming to recover tax revenue for the county.

What information must be reported on Marion County Annual Tax Sale Information?

The information that must be reported includes property owner's name, property address, amount of delinquent taxes, applicable fees, and any prior communications regarding the tax status of the property.

Fill out your marion county annual tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Marion County Annual Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.