Get the free Guide to Financial Planning for Retirement - rtu-ser@rtu-ser.ca

Show details

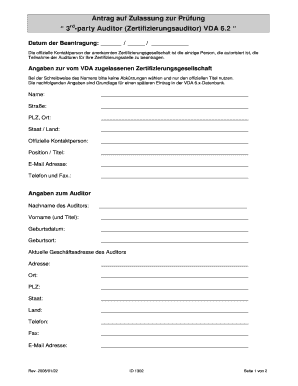

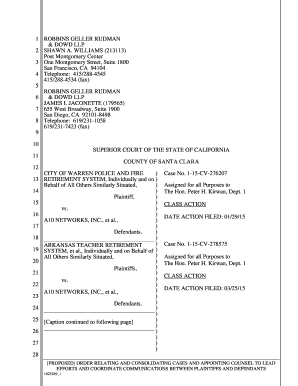

GUIDE to financial planning for retirement start planning today for tomorrow 20122013 EDITION 65 60 45 35 55 40 GUIDE to financial planning for retirement This is the latest edition of the Guide to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guide to financial planning

Edit your guide to financial planning form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guide to financial planning form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guide to financial planning online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit guide to financial planning. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guide to financial planning

To fill out a guide to financial planning, follow these steps:

01

Start by assessing your current financial situation. Take stock of your income, expenses, assets, and liabilities. This will give you a clear picture of your financial standing and help you set realistic goals.

02

Determine your financial goals. Think about what you want to achieve in the short-term and long-term. Whether it's saving for retirement, buying a house, or paying off debt, having clear goals will guide your financial planning process.

03

Create a budget to manage your income and expenses. Identify your fixed and variable expenses and allocate your income accordingly. Make sure to set aside funds for savings and emergency expenses.

04

Evaluate your insurance needs. Understand the importance of having adequate coverage for health, life, property, and other valuable assets. Review your current insurance policies and make adjustments if necessary.

05

Develop an investment strategy. Consider your risk tolerance, time horizon, and investment knowledge. Explore different investment options such as stocks, bonds, mutual funds, or real estate. Seek professional advice if needed.

06

Plan for retirement. Estimate how much you will need for retirement and determine the best savings vehicles like 401(k), Individual Retirement Accounts (IRAs), or pensions. Understand the tax implications of your retirement savings.

07

Consider estate planning. Think about how you want your assets to be distributed after your passing. Create a will, establish trusts, and designate beneficiaries for insurance policies and retirement accounts.

08

Monitor and review your financial plan regularly. Life circumstances change, and so should your financial plan. Regularly assess your progress, make necessary adjustments, and seek professional advice when needed.

Who needs a guide to financial planning?

01

Individuals who are just starting to manage their finances and want to create a solid foundation for their future.

02

Young professionals who want to make the most of their income, save for their goals, and invest wisely.

03

Couples who want to synchronize their financial goals and work together towards a secure financial future.

04

Parents who want to secure their children's education and plan for their own retirement simultaneously.

05

Individuals facing major life events such as marriage, divorce, or the birth of a child, which require financial planning adjustments.

06

Those nearing retirement who need assistance in maximizing their savings and developing a retirement income strategy.

07

Business owners and entrepreneurs aiming to effectively manage their personal and business finances.

08

Anyone looking to gain control over their financial situation, make informed financial decisions, and achieve financial stability.

By following a guide to financial planning and tailor it to your specific circumstances, you can improve your financial well-being and work towards a secure future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is guide to financial planning?

Financial planning guide is a comprehensive document that outlines an individual's or organization's financial goals, strategies, and steps to achieve them.

Who is required to file guide to financial planning?

Individuals, companies, and organizations who want to manage their finances effectively are required to file guide to financial planning.

How to fill out guide to financial planning?

To fill out a guide to financial planning, one must first gather information about their financial goals, assets, liabilities, income, and expenses. Then, they can create a plan that outlines how to achieve these goals.

What is the purpose of guide to financial planning?

The purpose of a guide to financial planning is to help individuals or organizations organize their finances, set goals, and create a roadmap to achieve those goals.

What information must be reported on guide to financial planning?

Information such as financial goals, assets, liabilities, income, expenses, investment strategies, retirement plans, insurance policies, and tax considerations must be reported on a guide to financial planning.

How do I make changes in guide to financial planning?

With pdfFiller, it's easy to make changes. Open your guide to financial planning in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I edit guide to financial planning on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing guide to financial planning, you can start right away.

Can I edit guide to financial planning on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign guide to financial planning right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your guide to financial planning online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guide To Financial Planning is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.