Get the free Yamhill County Assessment And Taxation Department Property Owners' Request For Appra...

Show details

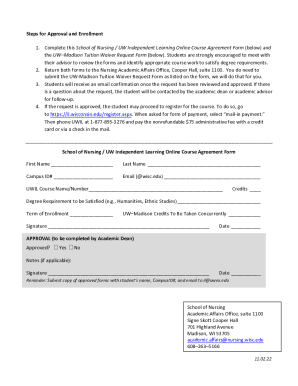

This form is used by property owners to request a review of the appraisal of their property. It requires supporting market evidence to substantiate the requested Real Market Value (RMV).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign yamhill county assessment and

Edit your yamhill county assessment and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your yamhill county assessment and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit yamhill county assessment and online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit yamhill county assessment and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out yamhill county assessment and

How to fill out Yamhill County Assessment And Taxation Department Property Owners' Request For Appraisal Review

01

Obtain the Yamhill County Assessment And Taxation Department Property Owners' Request For Appraisal Review form from the official website or local office.

02

Fill in your personal information, including your name, address, and contact information.

03

Provide the property details, including the property address and parcel number.

04

State the reason for your request, clearly explaining why you believe the current appraisal is incorrect.

05

Attach any supporting documents or evidence that validate your claim, such as photos, previous appraisals, or market analysis.

06

Review the completed form for accuracy and completeness.

07

Submit the form either in person, by mail, or via email to the Yamhill County Assessment and Taxation Department by the specified deadline.

Who needs Yamhill County Assessment And Taxation Department Property Owners' Request For Appraisal Review?

01

Property owners in Yamhill County who believe their property has been inaccurately appraised for tax purposes.

02

Individuals seeking a reassessment of their property value to potentially lower their property tax liability.

03

Residents who have recently made improvements to their property that may affect its value.

Fill

form

: Try Risk Free

People Also Ask about

How can I lower my local property taxes?

Ask for Your Property Tax Card. Don't Build. Limit Curb Appeal. Research Neighboring Homes. Allow the Assessor Access to Your Home. Walk the Home With the Assessor. Look for Exemptions. Appeal Your Tax Bill.

How often are property values reassessed in Oregon?

The value of property is determined as of January 1 of each year. Property subject to taxation includes all privately owned real property (land, buildings, and fixed machinery and equipment), manufactured homes, and personal property used in a business.

How to successfully protest property taxes?

Gather Comparable Sales Data and Assess the Market A great argument when protesting your property tax assessment is showing that your home is overvalued compared to properties in your community with similar features to your own. This is known as finding “comps”, or comparable sales.

Is it worth protesting property taxes?

Our short answer is yes, it is worth it to protest because doing so can mean a lower tax bill for you. If you never protest your property taxes, your tax bill could continue to increase year after year. The amount you can save will depend on your circumstances and the strength of the evidence you present to the county.

How successful are property tax appeals?

The success rate for property tax appeals is surprisingly high. Studies indicate that 40% to 60% of property tax appeals result in a reduction of the assessed value. This figure is significant, as it suggests that a large portion of property assessments are, in fact, inaccurate or inflated.

What is the best evidence to protest property taxes?

The best type of documents is usually estimates for repairs from contractors and photographs of physical problems. All documentation should be signed and attested. This means you must furnish "documented" evidence of your property's needs.

What is the property tax rate in Yamhill County Oregon?

Median Yamhill County effective property tax rate: 0.74%, significantly lower than the national median of 1.02%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Yamhill County Assessment And Taxation Department Property Owners' Request For Appraisal Review?

It is a formal request submitted by property owners in Yamhill County to review the assessed value of their property.

Who is required to file Yamhill County Assessment And Taxation Department Property Owners' Request For Appraisal Review?

Property owners who believe their property's assessed value is incorrect are required to file this request.

How to fill out Yamhill County Assessment And Taxation Department Property Owners' Request For Appraisal Review?

Property owners should complete the designated form by providing necessary personal information, property details, and a rationale for the review request.

What is the purpose of Yamhill County Assessment And Taxation Department Property Owners' Request For Appraisal Review?

The purpose is to allow property owners to contest their property's assessed value and seek a reassessment if they believe it is inaccurately high.

What information must be reported on Yamhill County Assessment And Taxation Department Property Owners' Request For Appraisal Review?

Property owners must report their name, contact information, parcel number, current assessed value, and the reason for requesting the appraisal review.

Fill out your yamhill county assessment and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Yamhill County Assessment And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.