Get the free Application Verifying Eligibility as Surplus Lines Insurer - ldi la

Show details

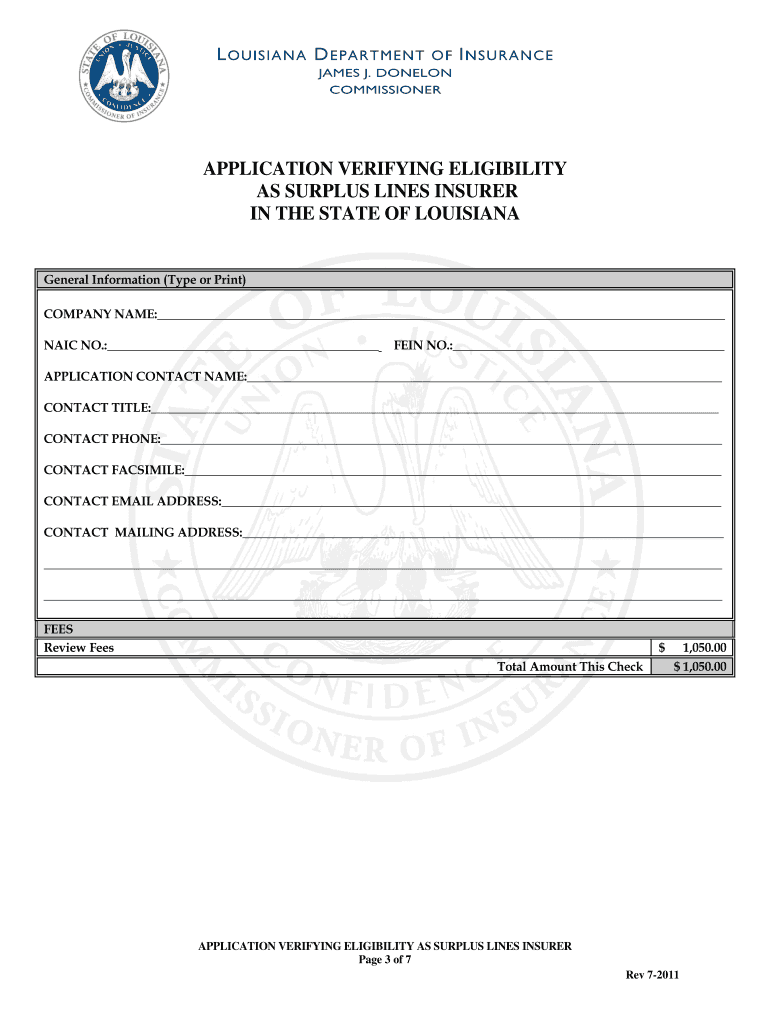

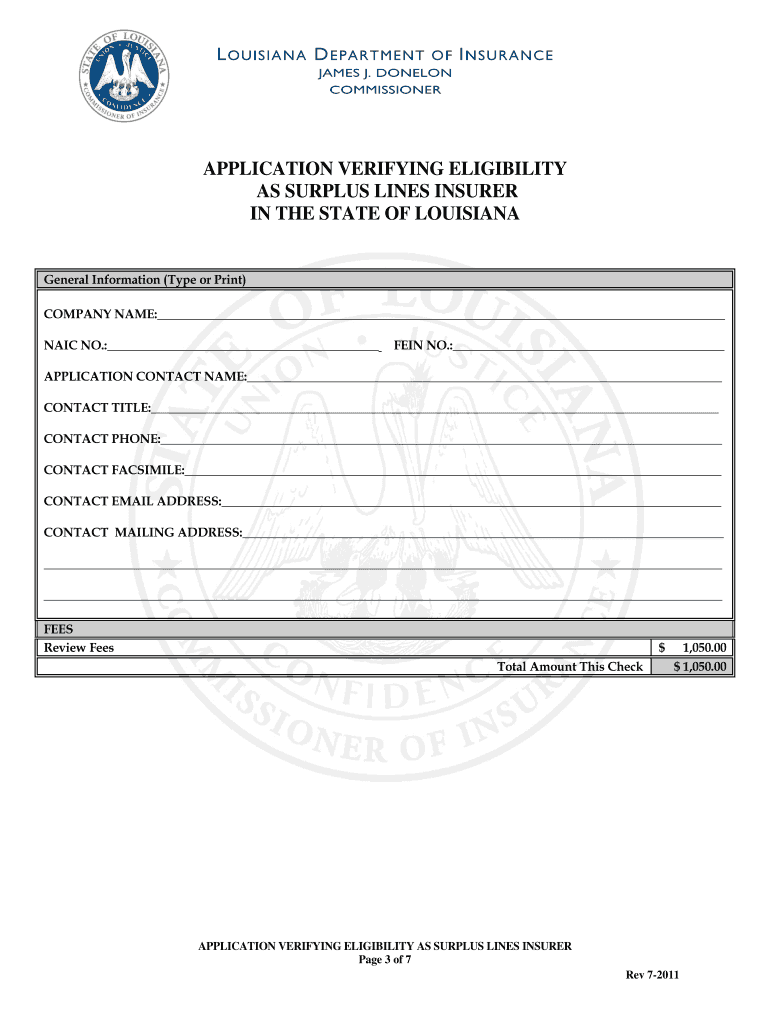

This document provides instructions for submitting an application to verify eligibility as a surplus lines insurer in Louisiana, detailing the submission process, required information, and guidelines

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application verifying eligibility as

Edit your application verifying eligibility as form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application verifying eligibility as form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application verifying eligibility as online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application verifying eligibility as. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application verifying eligibility as

How to fill out Application Verifying Eligibility as Surplus Lines Insurer

01

Obtain the Application Verifying Eligibility form from the relevant regulatory agency or surplus lines association.

02

Fill out your business information, including the name, address, and contact details of your insurer.

03

Provide details about the types of insurance coverage you plan to offer as a surplus lines insurer.

04

Include any required documentation, such as financial statements and proof of licensing.

05

Specify any prior surplus lines activities if applicable, including past regulatory compliance.

06

Review the completed application for accuracy and completeness.

07

Submit the application along with any required fees to the appropriate regulatory authority.

Who needs Application Verifying Eligibility as Surplus Lines Insurer?

01

Insurance companies that wish to operate as surplus lines insurers.

02

Insurers looking to offer coverage in the market for risks that are not available through standard insurance providers.

03

Entities seeking to comply with state regulations for surplus lines insurance.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between standard and surplus lines insurance?

Regular insurance carriers, also called standard or admitted carriers, must follow state regulations concerning how much they can charge and what risks they can and cannot cover. Surplus lines carriers do not have to follow these regulations, which allows them to take on higher risks.

What is a surplus line of insurance?

Surplus lines insurance is a special type of insurance that covers unique risks. It fills a gap in the standard market by covering things that most companies can't or won't insure.

What is surplus line insurance?

Surplus lines insurance is a special type of insurance that covers unique risks. It fills a gap in the standard market by covering things that most companies can't or won't insure.

What is the meaning of surplus in insurance?

In the world of finance, we often come across the term "surplus". This refers to the remaining amount after deducting an insurer's liabilities from its assets. It serves as a safety net for policyholders, providing protection in the event of unexpected and high claims.

Is excess and surplus lines insurance any type of coverage that?

Excess and surplus (E&S) lines insurance is any type of coverage that cannot be placed with an insurer admitted to do business in a certain jurisdiction.

What is surplus lines insurance best described as coverage?

Surplus lines insurance is a type of secondary coverage. It's available if your business can't get sufficient primary coverage from regular insurance providers. These policies are also known as surplus liability coverage. As they cover the excess amount of risk that other insurers won't take on.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application Verifying Eligibility as Surplus Lines Insurer?

The Application Verifying Eligibility as Surplus Lines Insurer is a document used to affirm that an insurer qualifies and meets specific regulatory criteria to operate as a surplus lines insurer in a particular jurisdiction.

Who is required to file Application Verifying Eligibility as Surplus Lines Insurer?

Insurers who wish to obtain a surplus lines license and operate as surplus lines insurers in a jurisdiction are required to file this application.

How to fill out Application Verifying Eligibility as Surplus Lines Insurer?

To fill out the Application Verifying Eligibility as Surplus Lines Insurer, one must provide accurate and complete information regarding the insurer's legal status, financial stability, and compliance with applicable regulations, typically following the guidelines set by the state's insurance department.

What is the purpose of Application Verifying Eligibility as Surplus Lines Insurer?

The purpose of the Application Verifying Eligibility as Surplus Lines Insurer is to ensure that only insurers that meet certain standards are allowed to engage in surplus lines transactions, thereby protecting consumers and maintaining market integrity.

What information must be reported on Application Verifying Eligibility as Surplus Lines Insurer?

The information that must be reported includes the insurer's name, contact details, financial information, types of insurance offered, proof of licensure, and any relevant compliance documentation as required by the state regulatory body.

Fill out your application verifying eligibility as online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application Verifying Eligibility As is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.