Get the free Senior Citizens Saving Scheme-2004- Relevant Circulars.doc

Show details

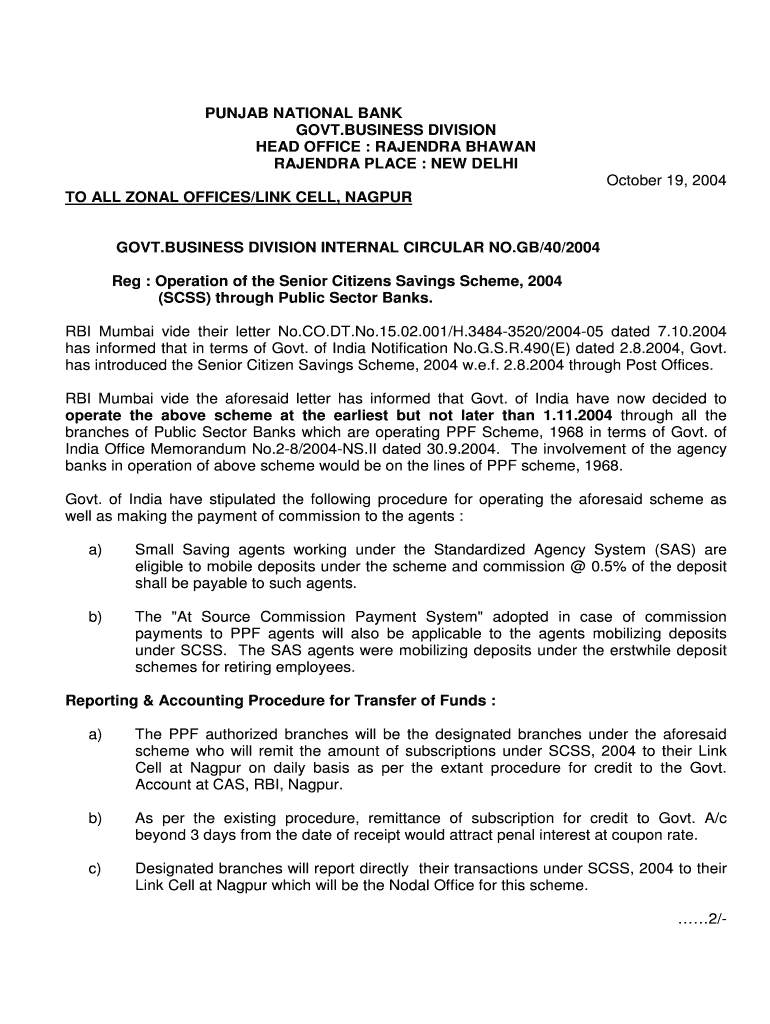

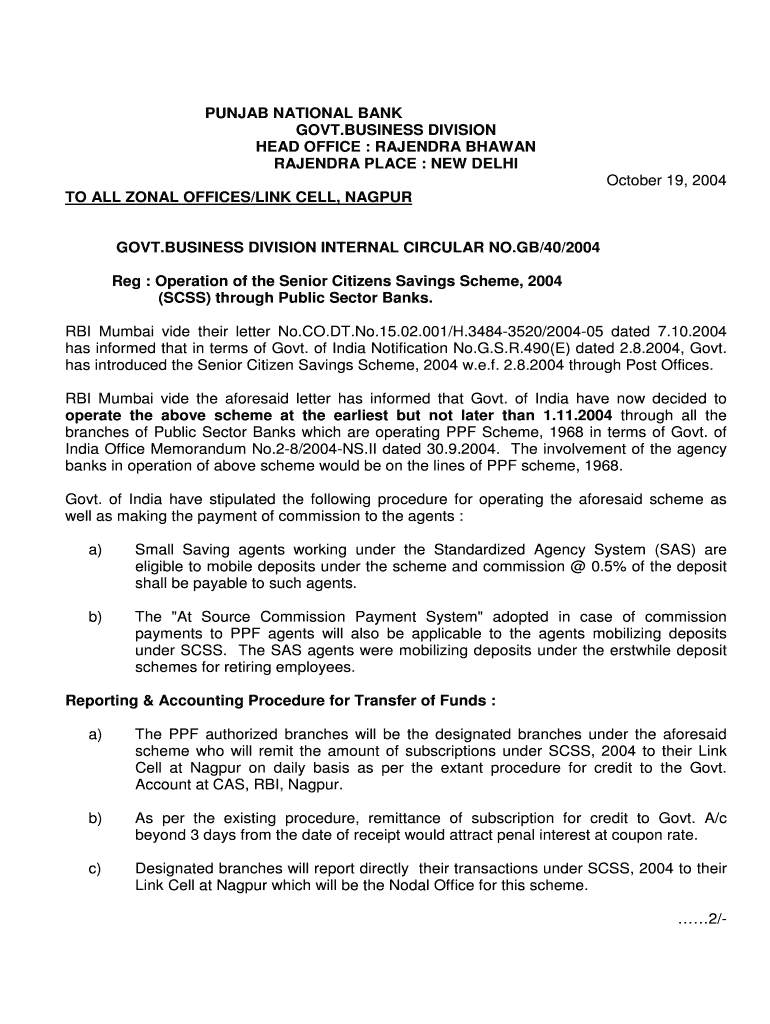

PUNJAB NATIONAL BANK

GOVT.BUSINESS DIVISION

HEAD OFFICE : RAJENDRA SHAWN

RAJENDRA PLACE : NEW DELHI

October 19, 2004,

TO ALL ZONAL OFFICES×LINK CELL, NAGPUR

GOVT.BUSINESS DIVISION INTERNAL CIRCULAR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign senior citizens saving scheme-2004

Edit your senior citizens saving scheme-2004 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your senior citizens saving scheme-2004 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing senior citizens saving scheme-2004 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit senior citizens saving scheme-2004. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out senior citizens saving scheme-2004

How to fill out senior citizens saving scheme-2004:

01

Obtain the application form: The first step in filling out the senior citizens saving scheme-2004 is to obtain the application form. This form can be acquired from a designated bank or post office.

02

Provide personal information: Fill in the required personal information such as name, date of birth, address, contact details, and identification proof. Ensure that all the details are accurate and up to date.

03

Nomination details: In this step, you need to provide the nomination details. Nomination allows you to designate a person who will receive the benefits in case of your unfortunate demise. Fill in the nominee's name, address, and relationship with you.

04

Initial deposit amount: Decide on the initial deposit amount that you wish to invest in the senior citizens saving scheme-2004. The minimum investment amount is Rs. 1,000, and the maximum is Rs. 15 lakhs. Make sure to provide the relevant details regarding the amount and mode of payment.

05

Submit the form: After accurately filling in all the required information, submit the completed application form along with the necessary documents. These documents may include proof of age, address, identification, and income, as specified by the bank or post office.

Who needs senior citizens saving scheme-2004:

01

Senior citizens: The senior citizens saving scheme-2004 is specifically designed for individuals above the age of 60. It provides them with a safe and reliable investment option to secure their financial future.

02

Retired individuals: Retired individuals who are looking for investment options that offer attractive returns can benefit from the senior citizens saving scheme-2004. It provides them with the opportunity to earn higher interest rates compared to traditional savings accounts.

03

Risk-averse investors: The senior citizens saving scheme-2004 is suitable for investors who prefer low-risk investment options. This scheme is backed by the government, making it a secure investment choice.

04

Individuals seeking regular income: The scheme offers quarterly interest payments, making it an ideal choice for individuals who rely on a steady income source. It ensures a regular inflow of funds for meeting day-to-day expenses.

05

Those looking for tax benefits: The investment made in the senior citizens saving scheme-2004 is eligible for tax deductions under Section 80C of the Income Tax Act, up to a specified limit. This makes it an attractive option for individuals seeking tax benefits alongside regular income.

Overall, the senior citizens saving scheme-2004 caters to the needs of senior citizens, retirees, risk-averse investors, individuals who require regular income, and those looking for tax benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is senior citizens saving scheme?

The senior citizens saving scheme is a government-backed savings plan specifically designed for senior citizens to provide regular income and financial security during their retirement years.

Who is required to file senior citizens saving scheme?

Senior citizens who are looking to secure their financial future and have reached the age of 60 years or above are required to file for the senior citizens saving scheme.

How to fill out senior citizens saving scheme?

To fill out the senior citizens saving scheme, individuals need to visit the nearest bank or post office that offers this scheme and submit the required documentation along with the prescribed form.

What is the purpose of senior citizens saving scheme?

The purpose of the senior citizens saving scheme is to provide senior citizens with a secure and reliable source of income after retirement, ensuring a comfortable and stress-free life.

What information must be reported on senior citizens saving scheme?

The senior citizens saving scheme typically requires individuals to report their personal details, contact information, nominee details, and initial deposit amount.

Can I create an eSignature for the senior citizens saving scheme-2004 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your senior citizens saving scheme-2004 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit senior citizens saving scheme-2004 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share senior citizens saving scheme-2004 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete senior citizens saving scheme-2004 on an Android device?

Use the pdfFiller mobile app and complete your senior citizens saving scheme-2004 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your senior citizens saving scheme-2004 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Senior Citizens Saving Scheme-2004 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.