IRS 941-V 2014 free printable template

Show details

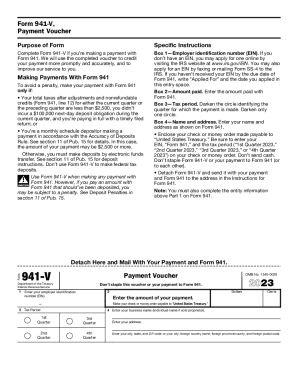

Form 941V, Payment Voucher Purpose of Form Specific Instructions Complete Form 941V, Payment Voucher, if you are making a payment with Form 941, Employers QUARTERLY Federal Tax Return. We will use

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 941-V

How to edit IRS 941-V

How to fill out IRS 941-V

Instructions and Help about IRS 941-V

How to edit IRS 941-V

To edit IRS 941-V, access the form through a reliable source, such as the IRS website or a trusted document management tool like pdfFiller. Ensure all edits comply with IRS guidelines. After making necessary changes, save the updated form in a secure format for submission.

How to fill out IRS 941-V

To fill out IRS 941-V, first, gather required information, such as your Employer Identification Number (EIN) and payment amount. Start filling the form by completing the identifying information at the top and then providing the necessary payment details. Be thorough, as inaccuracies could lead to processing delays. Once completed, review the form and ensure all information is correct before submission.

About IRS 941-V 2014 previous version

What is IRS 941-V?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 941-V 2014 previous version

What is IRS 941-V?

IRS 941-V is a payment voucher used by employers to submit payments of withheld federal income tax and employee Social Security tax. This form assists in ensuring timely and accurate payment alongside Form 941, which reports payroll taxes. It is crucial for maintaining proper tax compliance.

What is the purpose of this form?

The purpose of IRS 941-V is to provide a streamlined method for making tax payments directly to the IRS for payroll withholding. This form is used to accompany any payments made for taxes reported on Form 941, ensuring that payments are applied correctly to the employer's account.

Who needs the form?

Employers who withhold federal income tax and Social Security tax from their employees are required to use IRS 941-V if they are making a payment associated with Form 941. This includes businesses of all sizes, non-profits, and governmental agencies that report payroll taxes.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 941-V if you are not required to make a federal tax deposit or if you do not owe any taxes for the period covered by the form. Additionally, certain small employers under specific thresholds may not need to file or make payments.

Components of the form

The components of IRS 941-V include the employer's name, address, EIN, and the payment amount. These elements help the IRS identify the payment and apply it to the correct account. Accurate completion of these components is essential to avoid misallocation of funds.

Due date

The due date for submitting IRS 941-V coincides with the due date for Form 941. For most employers, this is the last day of the month following the end of each quarter. Timely submission is crucial for compliance and to avoid penalties.

What are the penalties for not issuing the form?

Failing to issue IRS 941-V when required can result in penalties, including fines imposed by the IRS. These penalties may accumulate if payments are not made timely, leading to further financial implications for over- or under-reporting taxes.

What information do you need when you file the form?

When filing IRS 941-V, you will need your EIN, the amount you are remitting, and any relevant periods associated with the payment. Having this information readily available can streamline the completion and submission process.

Is the form accompanied by other forms?

IRS 941-V is typically submitted alongside Form 941, which reports total payroll tax liabilities. There are instances where other supporting documentation may also be required, depending on the specific circumstances of the employer's tax reporting.

Where do I send the form?

IRS 941-V should be sent to the address specified in the Form 941 instructions, which varies based on the employer's location and the type of payment being made. Review the instructions carefully to ensure it is sent to the correct address.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It is good to have a form to fill out but with w2 it is very laborious doing one at a time

so far I am able to figure everything out and it is working for me.

See what our users say