Get the free 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return - reven...

Show details

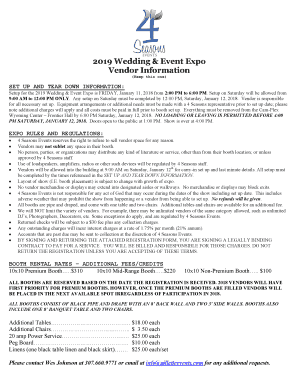

This document provides guidelines and instructions for nonresident professional athletes regarding the filing of their Louisiana individual income tax return, detailing requirements, forms, deadlines,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2010 louisiana nonresident professional

Edit your 2010 louisiana nonresident professional form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2010 louisiana nonresident professional form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2010 louisiana nonresident professional online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2010 louisiana nonresident professional. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2010 louisiana nonresident professional

How to fill out 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return

01

Obtain the 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return form.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate your nonresident status and provide details about your professional athletic income earned in Louisiana.

04

Report any other income and deductions applicable to your situation.

05

Calculate your total tax liability based on Louisiana tax rates.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to the Louisiana Department of Revenue by the specified deadline.

Who needs 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return?

01

Professional athletes who earned income from performing in Louisiana but are residents of another state.

02

Athletes who are required to report their income to the Louisiana Department of Revenue for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Does Louisiana have state income tax for non-residents?

Every nonresident shall pay a tax upon such net income as is derived from property located, or from services rendered, or from business transacted within the state, or from sources within the state, except as hereinafter exempted.

How are non-residents taxed?

For resident and non-resident aliens engaged in trade or business in the Philippines, the maximum rate on income subject to final tax (usually passive investment income) is 20%. For non-resident aliens not engaged in trade or business in the Philippines, the rate is a flat 25%.

Do professional athletes pay income tax in every state they play in?

Professional athletes are subject to the “jock tax,” which means they may have to pay income taxes in every state in which they play a game.

How does income tax work for professional athletes?

While professional sports players are focused on training and performance, they might also need a little help in regards to taxes. Many states and large cities levy a “jock tax” on professional athlete income. That includes taxing the value of humongous championship rings, salaries and bonuses.

What is form R 6180?

a completed Louisiana Form R-6180, Net Capital Gains Deduction Worksheet; b. documentary evidence of the date the taxpayer acquired an equity interest in the business, such as articles of incorporation or organization, acts of sale or exchange, or donative instruments; c.

How does Louisiana tax non-residents?

Nonresident and Part-Year Resident Individual Income Tax Only income earned from Louisiana sources, however, is taxed. Gambling winnings earned in Louisiana are considered to be Louisiana sourced income.

Why does Louisiana have two taxes?

The State of Louisiana and the parish in which the event is being held are two separate taxing jurisdictions. The state tax rate, administered by the Louisiana Department of Revenue, is 5%.

How much is $100,000 a year after taxes in Louisiana?

What is the average salary in United States of America? If you make $100,000 a year living in the region of Louisiana, United States of America, you will be taxed $26,087. That means that your net pay will be $73,913 per year, or $6,159 per month. Your average tax rate is 26.1% and your marginal tax rate is 35.5%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return?

The 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return is a tax form specifically designed for nonresident professional athletes who earn income from their athletic activities in Louisiana. This form allows them to report their Louisiana-source income and pay any applicable state taxes.

Who is required to file 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return?

Nonresident professional athletes who earn income from participating in sporting events or activities within Louisiana are required to file the 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return.

How to fill out 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return?

To fill out the 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return, an athlete should gather all relevant income information, complete the required sections of the form, including details about their income earned in Louisiana, and calculate the tax owed based on the provided guidelines.

What is the purpose of 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return?

The purpose of the 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return is to ensure that nonresident professional athletes comply with Louisiana tax laws by reporting and paying taxes on income earned from their athletic activities within the state.

What information must be reported on 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return?

The 2010 Louisiana Nonresident Professional Athlete Individual Income Tax Return must report information including the athlete's name, address, Social Security number, the total income earned in Louisiana, the type of athletic activity, and any deductions or credits applicable to their specific situation.

Fill out your 2010 louisiana nonresident professional online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2010 Louisiana Nonresident Professional is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.