Get the free APPLICATION FOR CPA LICENSE - msbpa ms

Show details

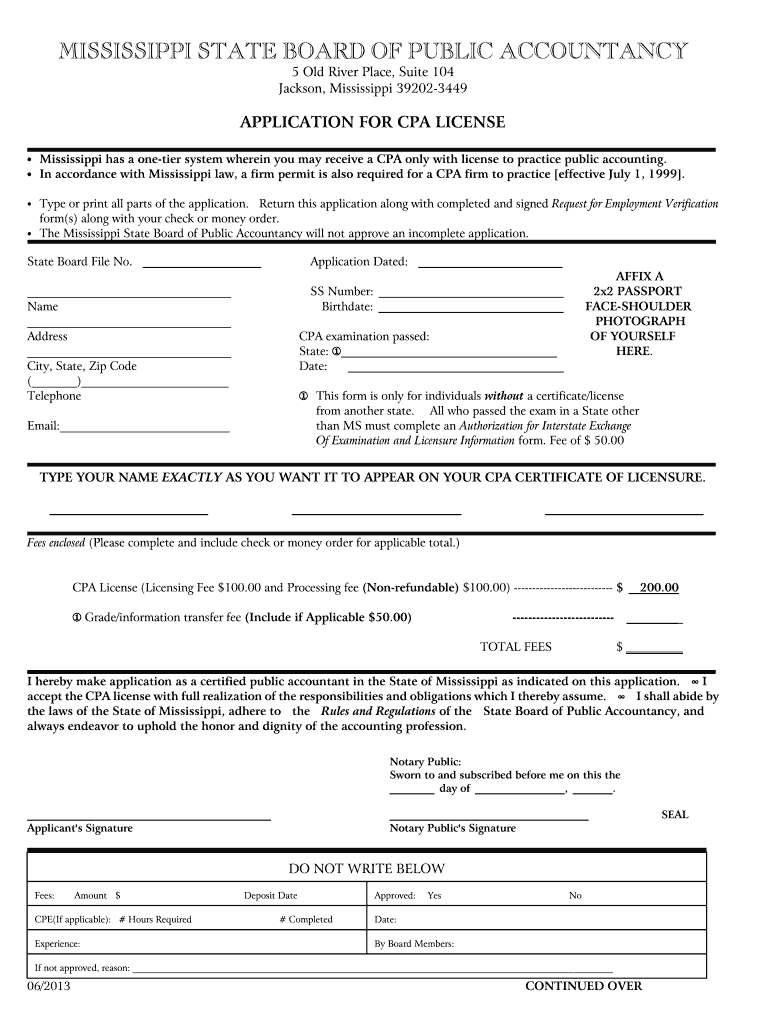

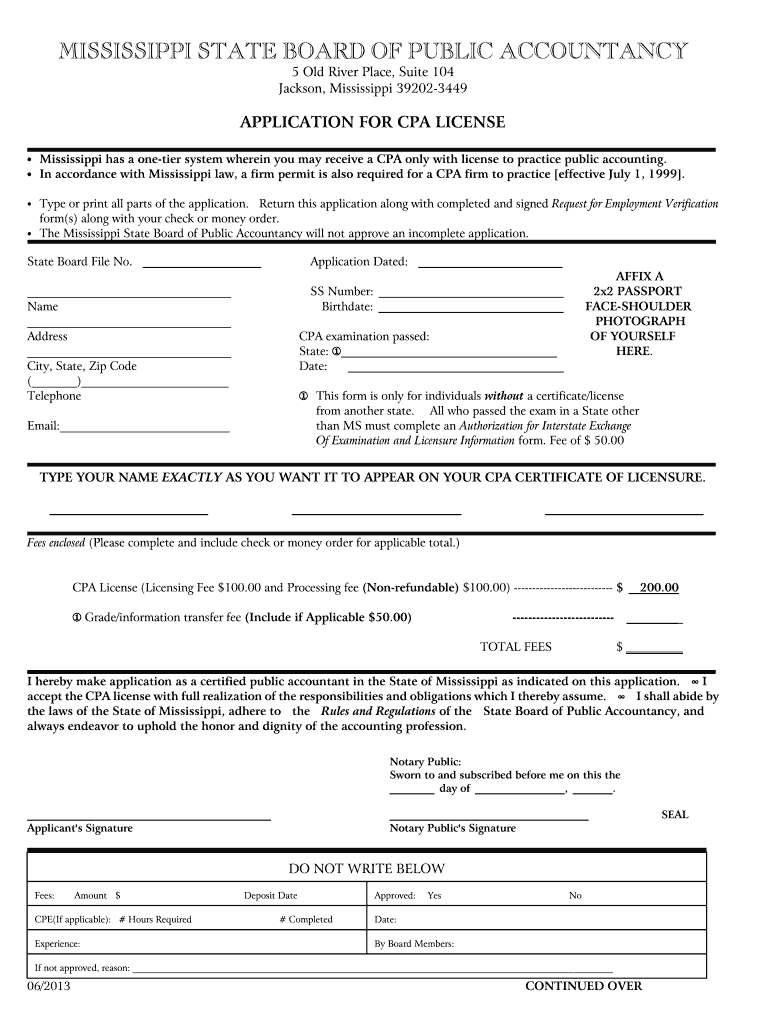

This document serves as an application for obtaining a CPA license in the State of Mississippi, detailing requirements, fees, and necessary information for submission.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for cpa license

Edit your application for cpa license form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for cpa license form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for cpa license online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for cpa license. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for cpa license

How to fill out APPLICATION FOR CPA LICENSE

01

Obtain the APPLICATION FOR CPA LICENSE form from your state board of accountancy website.

02

Fill in your personal information including your full name, address, and contact details.

03

Provide your educational background, detailing your degree(s) and the institutions attended.

04

List your work experience in accounting, specifying the duration and the type of work performed.

05

Include the required documentation such as transcripts, proof of work experience, and any other supplementary materials specified by your state board.

06

Pay the applicable licensing fee as instructed on the application form.

07

Review the application for accuracy and completeness before submission.

08

Submit the application by mail or online as directed by your state board of accountancy.

Who needs APPLICATION FOR CPA LICENSE?

01

Individuals who have completed the necessary education and experience requirements in accounting.

02

Candidates who have passed the CPA examination and wish to practice as Certified Public Accountants.

03

Accountants seeking to provide professional services that require a CPA license.

Fill

form

: Try Risk Free

People Also Ask about

How can I apply for CPA?

Steps to a CPA Career Earn a Degree in Accounting (or Related Field) CPAs need a bachelor's degree at minimum, usually in accounting. Complete Additional Credits if Applicable. Gain Relevant Experience. Pass the CPA Exam. Apply for State Licensure. Continue Education as Needed.

How to get a US CPA license?

To become a CPA, you need a degree in accounting or a related field, at least 120 total college credits, 1-2 years of CPA-supervised experience, passing the four-part CPA exam, and state licensure. Having a CPA can significantly increase your earning potential.

Where do I apply for CPA?

Apply for the CPA exam You must first apply with the state board before taking the CPA exam. The application cost varies by state, but it usually costs between $50 and $200 and is non-refundable. Once approved, you'll receive a Notice to Schedule (NTS), which you'll use to book your exam appointments.

Is a CPA harder than a bar?

Many candidates find the CPA Exam more challenging due to its multifaceted nature, which requires a deep understanding of various accounting principles, tax regulations, and financial reporting standards. Here are some factors that make the CPA Exam harder: Requires knowledge across four distinct sections.

How long does it take to get US CPA?

You'll need 150 semester hours (225 quarter hours) which takes most people around five years. You'll need at least 120 semester hours (180 quarter hours) to sit for the CPA Exam. Passing all four sections of the CPA Exam takes between one and two years. You'll need at least one year of qualifying employment.

What is the fastest way to get a CPA?

Focus on your education and join the Pros. Pursuing a degree in Commerce or Business (with a major in accounting) is your quickest route to earning a professional accounting designation.

How do I get a US CPA license?

To become a licensed Certified Public Accountant (CPA), you must meet the education, examination, and experience requirements. All candidates must pass the Uniform CPA Examination ® (CPA Exam), which consists of three four-hour Core sections and one four-hour Discipline section of your choice.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR CPA LICENSE?

The APPLICATION FOR CPA LICENSE is a formal request submitted by individuals seeking to obtain a Certified Public Accountant (CPA) license, allowing them to practice as professional accountants.

Who is required to file APPLICATION FOR CPA LICENSE?

Individuals who have completed the necessary education, passed the CPA examination, and met the experience requirements are required to file the APPLICATION FOR CPA LICENSE.

How to fill out APPLICATION FOR CPA LICENSE?

To fill out the APPLICATION FOR CPA LICENSE, applicants should provide their personal information, educational background, work experience, exam scores, and any other required documentation as specified by the respective state board.

What is the purpose of APPLICATION FOR CPA LICENSE?

The purpose of the APPLICATION FOR CPA LICENSE is to assess whether an individual meets the qualifications established by the state board to practice as a CPA, ensuring competency and adherence to professional standards.

What information must be reported on APPLICATION FOR CPA LICENSE?

The APPLICATION FOR CPA LICENSE typically requires information such as the applicant's name, contact information, education history, work experience, CPA examination results, and any disciplinary actions taken by professional bodies.

Fill out your application for cpa license online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Cpa License is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.