Get the free Third Party Administrator License Application

Show details

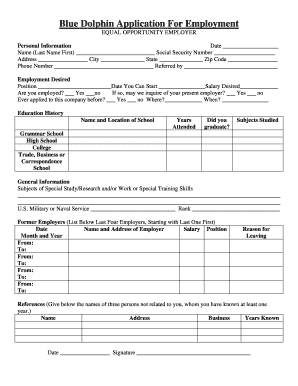

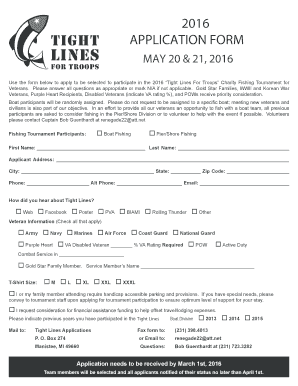

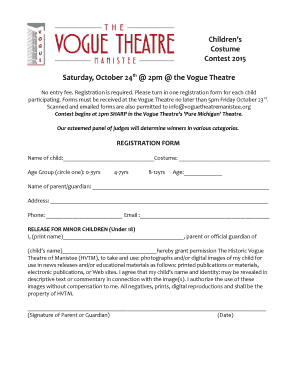

This document is an application form for obtaining a Third Party Administrator license through the Mississippi Insurance Department. It requires information about the business entity, its owners,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign third party administrator license

Edit your third party administrator license form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your third party administrator license form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing third party administrator license online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit third party administrator license. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out third party administrator license

How to fill out Third Party Administrator License Application

01

Obtain the Third Party Administrator License Application form from the relevant regulatory authority's website or office.

02

Read the instructions provided with the application form carefully before filling it out.

03

Provide your personal and business information accurately, including your name, address, contact details, and the legal structure of your business.

04

Detail the services your organization will provide as a Third Party Administrator.

05

Include information on your organization's financial stability and any relevant experience in administering benefits.

06

Provide any necessary documentation, such as proof of insurance and compliance with state regulations.

07

Review the application to ensure all information is complete and accurate.

08

Submit the completed application along with any required fees to the appropriate regulatory authority.

Who needs Third Party Administrator License Application?

01

Any organization or individual intending to act as a Third Party Administrator for insurance plans or benefits must obtain this license.

02

Businesses providing administrative services to health insurance companies, self-insured employers, or public health programs are required to have this license.

Fill

form

: Try Risk Free

People Also Ask about

How much does a third party administrator cost?

In these cases, many TPAs and carriers apply an additional administrative charge known as a percentage-of-savings fee. These fees typically range from 20% to 30% of the “savings”, which is the difference between the provider's original bill and the amount your plan actually pays.

What is another name for a third party administrator?

A third party administrator, otherwise known as a TPA, is a business organization that performs administrative services for a health plan such as billing, plan design, claims processing, record keeping, and regulatory compliance activities. TPAs are sometimes referred to as Administrative Services Only (ASO) entity.

What does a third-party administrator do?

A third party administrator pays claims on behalf of a company using a self-funded plan and handles all the administrative details of the plan.

What's the future for third-party administrators?

Third-party administrators face intense market consolidation as private equity drives unprecedented M&A activity in insurance services. In the last half of 2024, there were over 300 announced M&A transactions in the insurance space, valued at more than $20 billion.

What is the role of a third party administrator?

A third party administrator pays claims on behalf of a company using a self-funded plan and handles all the administrative details of the plan. The third party administrator also provides access to a certain healthcare network, which will determine the employee benefits.

How to become a third party administrator?

The typical certification process involves attending training and taking exams to prove administrative skills. TPA niches offer broader services and prove to potential clients that your business specializes in the services they need. Examples include companies that handle: Family and Medical Leave Act (FMLA)

How to become TPA?

How can I as a Company get registered as a TPA? Eligibility Criteria (in brief) Only a company with a share capital and registered under the Companies Act, 2013 (18 of 2013) as amended from time to time, can function as a TPA. Application for License(-) Fee Structure.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Third Party Administrator License Application?

The Third Party Administrator License Application is a formal request submitted to regulatory authorities by entities seeking authorization to operate as third party administrators (TPAs) which manage and process insurance claims, benefits, and other administrative tasks on behalf of insurance companies or other organizations.

Who is required to file Third Party Administrator License Application?

Entities that wish to operate as third party administrators, including businesses and organizations involved in managing insurance claims or benefits, are required to file this application to ensure compliance with state licensing laws.

How to fill out Third Party Administrator License Application?

To fill out the Third Party Administrator License Application, applicants must provide accurate information regarding their business details, ownership structure, financial stability, and relevant professional qualifications, along with any required documentation as stipulated by the state's insurance department.

What is the purpose of Third Party Administrator License Application?

The purpose of the Third Party Administrator License Application is to ensure that TPAs meet regulatory standards and are qualified to handle administrative functions pertaining to insurance policies and claims, thus protecting consumers and maintaining the integrity of the insurance market.

What information must be reported on Third Party Administrator License Application?

The information required on the Third Party Administrator License Application typically includes business name and address, ownership details, financial statements, operational procedures, dispute resolution processes, and proof of any required insurance or bonding.

Fill out your third party administrator license online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Third Party Administrator License is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.