Get the free Property Valuation Appeal - City of Woonsocket

Show details

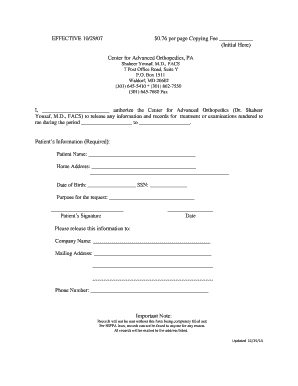

STATE OF RHODE ISLAND FISCAL YEAR: 2014 CITY OF WOONSOCKET APPLICATION FOR APPEAL OF PROPERTY TAX For appeals to the tax assessor, this form must be filed with the local office of tax assessment within

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property valuation appeal

Edit your property valuation appeal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property valuation appeal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property valuation appeal online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit property valuation appeal. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property valuation appeal

How to Fill Out Property Valuation Appeal:

01

Gather necessary documents: Start by collecting all relevant documents such as property assessment notices, tax bills, and any other supporting documentation you may have.

02

Understand the appeal process: Familiarize yourself with the specific procedures and deadlines for filing a property valuation appeal in your jurisdiction. This information is typically available on your local government's website or through the assessor's office.

03

Determine the grounds for appeal: Identify the reasons why you believe your property's valuation is inaccurate or unjust. Common grounds for appeal include errors in property description, comparable sales discrepancies, or significant changes in the property's condition.

04

Conduct a thorough property assessment: Assess your property's value by researching recent sales of similar properties in your neighborhood. Collect information on size, amenities, location, and condition to support your appeal.

05

Complete the appeal form: Fill out the property valuation appeal form provided by your local government. Include all relevant details such as property address, owner information, and a clear explanation of your reasons for the appeal.

06

Attach supporting evidence: Include any supporting documentation that strengthens your case, such as recent appraisal reports, photographs, or expert opinions.

07

Submit the appeal: Follow the specified submission process outlined by your local government. Ensure that you meet all relevant deadlines and include all required documents.

08

Attend the hearing (if applicable): Depending on the jurisdiction, you may be required to attend a hearing to present your case before a review board. This gives you the opportunity to provide additional evidence and arguments to support your appeal.

09

Await the decision: After submitting your appeal, you will have to wait for the review board's decision. This process may take some time, so be patient and prepare for any potential outcomes.

10

Implement the decision: If your appeal is successful and the property valuation is adjusted in your favor, you may be entitled to a refund or adjustment in your tax bill. If your appeal is denied, you can explore further options such as appealing to a higher authority or seeking professional advice.

Who Needs Property Valuation Appeal?

01

Property owners: Anyone who owns a property and believes that the assessed value is incorrect or unfair may need to file a property valuation appeal.

02

Business owners: Commercial property owners who believe their tax assessment is inaccurate or excessive may also need to go through the property valuation appeal process.

03

Real estate investors: Investors who own multiple properties or those who recently acquired a property and suspect an incorrect valuation may find it beneficial to file an appeal.

04

Homeowners' associations: In some cases, homeowners' associations as a collective entity may decide to file a property valuation appeal on behalf of all its members if they believe the assessments are unjustifiably high.

05

Real estate professionals: Real estate agents, appraisers, or other industry professionals may assist property owners in evaluating the accuracy of an assessed value and guide them through the appeal process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is property valuation appeal?

Property valuation appeal is a process through which a property owner can challenge the assessed value of their property for taxation purposes.

Who is required to file property valuation appeal?

Any property owner who believes that the assessed value of their property is incorrect or unfair may file a property valuation appeal.

How to fill out property valuation appeal?

To fill out a property valuation appeal, you will need to obtain the appropriate forms from your local tax assessor's office and provide accurate information about your property, including any supporting documentation or evidence.

What is the purpose of property valuation appeal?

The purpose of a property valuation appeal is to allow property owners to challenge and potentially reduce their property's assessed value, leading to lower property taxes.

What information must be reported on property valuation appeal?

The information required to be reported on a property valuation appeal may vary depending on the jurisdiction, but generally it includes details about the property, such as its address, size, and condition, as well as any evidence or documentation supporting the appeal.

How do I complete property valuation appeal online?

Completing and signing property valuation appeal online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for signing my property valuation appeal in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your property valuation appeal and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out property valuation appeal on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your property valuation appeal, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your property valuation appeal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Valuation Appeal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.