Get the free Registration Form Tax Invoice - Impact Enviro

Show details

Registration Form / Tax Invoice Waste 2016 Waste Avoidance & Resource Recovery Conference Opal Cove Resort, Coffs Harbour NSW, 35 May 2016 Impact Environmental Consulting Pty Ltd t×an Impact Environmental

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registration form tax invoice

Edit your registration form tax invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registration form tax invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit registration form tax invoice online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit registration form tax invoice. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out registration form tax invoice

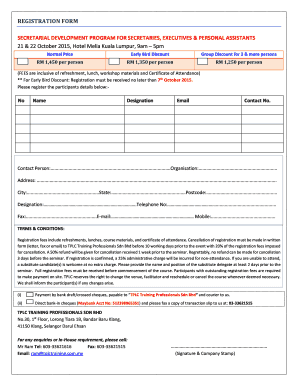

How to fill out a registration form tax invoice:

01

Start by gathering all the necessary information and documents required to fill out the registration form tax invoice. This may include your business details, such as your business name, address, and contact information.

02

Make sure to include your tax identification number, as it is crucial for tax purposes and identification purposes.

03

Specify the date of the transaction or sale for which the tax invoice is being issued. This helps in accurately recording the transaction and ensures compliance with tax regulations.

04

Itemize and describe the products or services being sold or provided. Include the quantity, unit price, and total amount for each item.

05

Calculate and include the applicable taxes, such as sales tax or value-added tax, based on the tax rates in your jurisdiction. This will depend on the nature of your business and the tax laws in your country.

06

Total up the invoice by adding the subtotal and any taxes applicable. This will give the final amount that the customer needs to pay.

07

Provide your business's banking details, such as the account number and name, to facilitate payments. This information should be easily readable and clearly stated on the invoice.

08

Double-check all the information on the registration form tax invoice for accuracy and completeness before issuing it to the customer.

09

Keep a copy of the invoice for your records and give the original or a duplicate to the customer.

Who needs a registration form tax invoice:

01

Businesses and individuals engaged in selling goods or providing services may require a registration form tax invoice. This includes retailers, wholesalers, service providers, and contractors.

02

It is especially important for businesses that are registered for tax purposes, as tax invoices are necessary for proper invoicing, bookkeeping, and tax compliance.

03

Customers who require a tax invoice for their records or reimbursement purposes may also request a registration form tax invoice from the seller or service provider. This is often the case for corporate clients or government entities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send registration form tax invoice for eSignature?

Once your registration form tax invoice is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for signing my registration form tax invoice in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your registration form tax invoice and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out registration form tax invoice on an Android device?

Use the pdfFiller mobile app to complete your registration form tax invoice on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is registration form tax invoice?

Registration form tax invoice is a document used to report sales and purchases for tax purposes.

Who is required to file registration form tax invoice?

Businesses and individuals who are registered for GST are required to file registration form tax invoice.

How to fill out registration form tax invoice?

To fill out registration form tax invoice, you need to enter all the relevant details such as the name and address of the seller and buyer, invoice number, date of invoice, description of goods or services, quantity, rate, and total amount.

What is the purpose of registration form tax invoice?

The purpose of registration form tax invoice is to document sales and purchases accurately for tax reporting purposes.

What information must be reported on registration form tax invoice?

Information such as the name and address of the seller and buyer, invoice number, date of invoice, description of goods or services, quantity, rate, and total amount must be reported on registration form tax invoice.

Fill out your registration form tax invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registration Form Tax Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.