Get the free Letter of Credit No - Town of Bethlehem - townofbethlehem

Show details

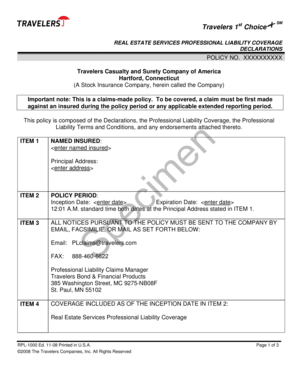

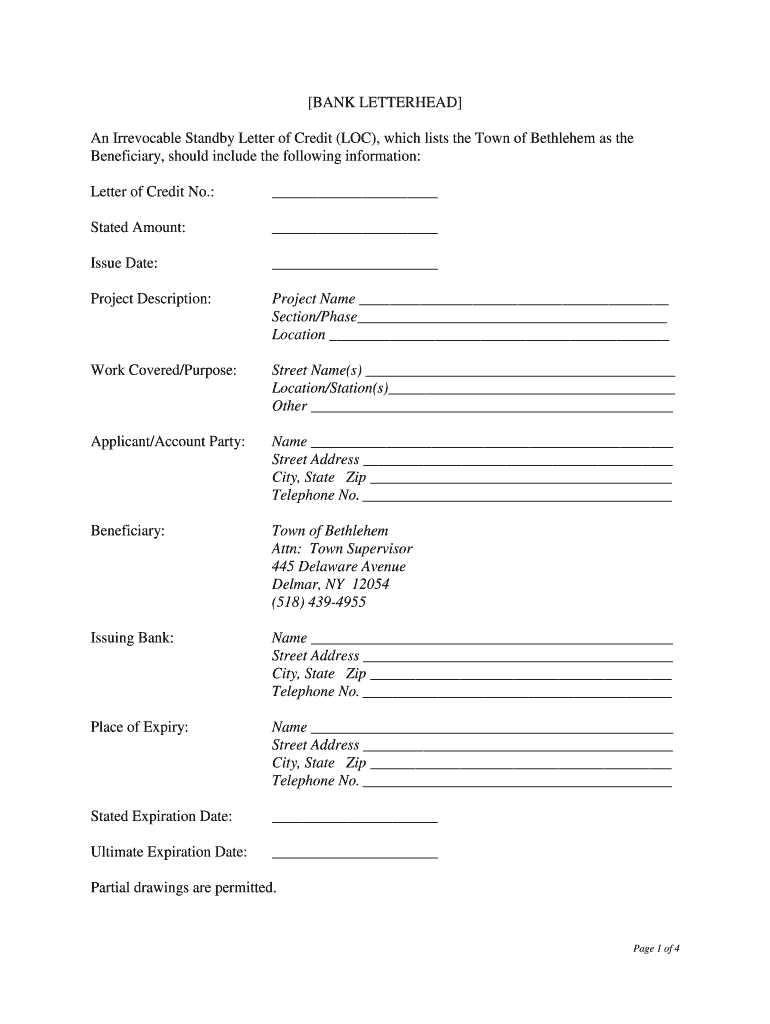

BANK LETTERHEAD An Irrevocable Standby Letter of Credit (LOC×, which lists the Town of Bethlehem as the Beneficiary, should include the following information: Letter of Credit No.: Stated Amount:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign letter of credit no

Edit your letter of credit no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your letter of credit no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit letter of credit no online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit letter of credit no. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out letter of credit no

How to fill out a letter of credit:

01

Start by gathering all the necessary information and documents required for the letter of credit. This may include details about the buyer, seller, goods or services being traded, and the financing terms.

02

Carefully review the letter of credit application form provided by your bank or financial institution. Fill out all the required fields accurately and completely. Double-check the information to avoid any errors or discrepancies.

03

Include all relevant details about the transaction, such as the amount, currency, delivery terms, and any specific conditions agreed upon between the buyer and seller. These details should be clearly specified in the letter of credit to avoid any misunderstandings or disputes.

04

Provide supporting documents that correspond to the terms and conditions of the letter of credit. This may include invoices, bills of lading, packing lists, insurance certificates, and any other relevant documents. Ensure that these documents comply with the letter of credit requirements and are accurately filled out.

05

Once you have completed the necessary paperwork, submit the letter of credit application and supporting documents to your bank or financial institution. They will then review and process your request.

Who needs a letter of credit:

01

Importers: Importers often require a letter of credit to minimize the risk of non-payment when purchasing goods or services from foreign suppliers. It provides them with a guarantee that payment will be made to the supplier once the terms of the letter of credit are met.

02

Exporters: Exporters may also require a letter of credit to protect themselves from non-payment or other risks when selling goods or services to overseas buyers. It ensures that payment will be received once the required documents are provided and the terms of the letter of credit are fulfilled.

03

Banks and Financial Institutions: Banks and financial institutions play a crucial role in the letter of credit process. They issue, confirm, or advise letters of credit to facilitate international trade and provide a guarantee of payment to the parties involved.

In summary, filling out a letter of credit involves gathering all necessary information, accurately completing the application, including relevant transaction details, and submitting the application along with the required supporting documents to your bank. Both importers and exporters may need a letter of credit to minimize payment risks, while banks and financial institutions are essential in facilitating the letter of credit process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my letter of credit no in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your letter of credit no and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send letter of credit no for eSignature?

Once your letter of credit no is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out letter of credit no using my mobile device?

Use the pdfFiller mobile app to complete and sign letter of credit no on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is letter of credit no?

A letter of credit number is a unique reference number assigned to a specific letter of credit.

Who is required to file letter of credit no?

The party issuing the letter of credit is required to provide the letter of credit number.

How to fill out letter of credit no?

The letter of credit number should be filled out on the relevant forms or documentation provided by the issuing party.

What is the purpose of letter of credit no?

The letter of credit number is used to track and verify the authenticity of the letter of credit during transactions.

What information must be reported on letter of credit no?

The letter of credit number, issuing party details, beneficiary details, and terms of the letter of credit must be reported.

Fill out your letter of credit no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Letter Of Credit No is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.