Get the free standby trust

Show details

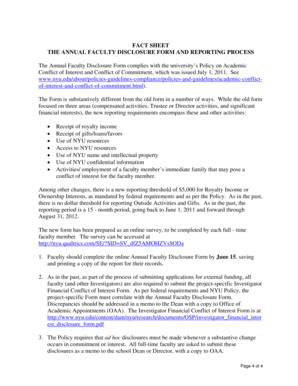

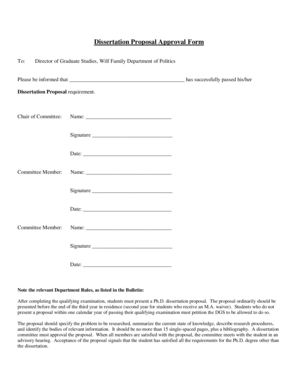

Print Form DEP Form 62-730. 900 4 f Form Title HW Facility Standby Trust Fund Effective Date January 5 1995 DEP Application No. STATE OF FLORIDA HAZARDOUS WASTE FACILITY STANDBY TRUST FUND AGREEMENT TO DEMONSTRATE FINANCIAL ASSURANCE Closure FOR Postclosure Corrective Action Check Appropriate Box es TRUST AGREEMENT the Agreement entered into as of Date by and between Name of the Owner or Operator a the Grantor Name of state Insert corporation par...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standby trust

Edit your standby trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standby trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing standby trust online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit standby trust. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standby trust

How to fill out standby trust:

01

Gather the necessary information: Start by collecting all relevant details, such as the names and contact information of the trust grantor and beneficiaries, as well as any assets that will be placed into the trust.

02

Consult with a professional: It is highly recommended to seek guidance from an experienced attorney or estate planner who specializes in trust creation. They can provide valuable advice on the specific requirements and legalities involved in establishing a standby trust.

03

Determine the purpose of the trust: Understand the purpose behind establishing a standby trust. This type of trust is typically created to ensure that assets are effectively managed and distributed in case the grantor becomes incapacitated or passes away. Identify specific wishes and instructions regarding the management and distribution of assets.

04

Select a trustee: Choose a trustworthy individual or institution who will act as the trustee responsible for managing the trust and fulfilling the grantor's instructions. Consider factors such as their financial knowledge, experience, and willingness to fulfill the trustee's responsibilities.

05

Draft the trust document: Work with the attorney or estate planner to draft the legal document that will establish the standby trust. This document should clearly outline the grantor's wishes, details about the assets included, and instructions for the trustee's actions.

06

Fund the trust: Transfer the designated assets into the trust. This may involve changing ownership titles, updating beneficiary designations, or other necessary steps to ensure that the assets are properly held within the trust.

Who needs standby trust:

01

Individuals with significant assets: Standby trusts are commonly used by individuals who have substantial or complex assets that need proper management and distribution in the event of incapacitation or death.

02

Individuals with specific wishes for asset distribution: Standby trusts can be beneficial for those who have specific instructions or wishes for how their assets should be managed and distributed to beneficiaries.

03

Individuals concerned about potential incapacity: If there is a concern about potential incapacity due to age, health, or other factors, establishing a standby trust can provide reassurance that assets will be cared for and distributed according to the grantor's wishes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in standby trust?

With pdfFiller, it's easy to make changes. Open your standby trust in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit standby trust in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing standby trust and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit standby trust straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing standby trust, you need to install and log in to the app.

What is standby trust?

A standby trust is a legal arrangement in which an individual designates a trustee to manage their assets and distribute them according to their instructions in the event of their incapacitation or death.

Who is required to file standby trust?

There is no specific requirement to file a standby trust. It is a personal choice made by the individual who wants to ensure that their assets are managed and distributed as per their wishes in case of incapacity or death.

How to fill out standby trust?

Filling out a standby trust involves working with an attorney or legal professional knowledgeable in estate planning. They will assist in drafting the trust document, naming a trustee, and specifying instructions for asset management and distribution.

What is the purpose of standby trust?

The purpose of a standby trust is to provide a mechanism for the management and distribution of assets in case the individual becomes unable to manage their affairs or passes away. It allows for the smooth transition of assets while ensuring they are handled according to the individual's wishes.

What information must be reported on standby trust?

Standby trusts do not typically require reporting to any government agency. However, the trust document should include details such as the trustee's name, instructions for asset distribution, and any specific conditions or limitations.

Fill out your standby trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standby Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.