Get the free BT Lifetime Super Employer Plan Payroll Deduction authority form

Show details

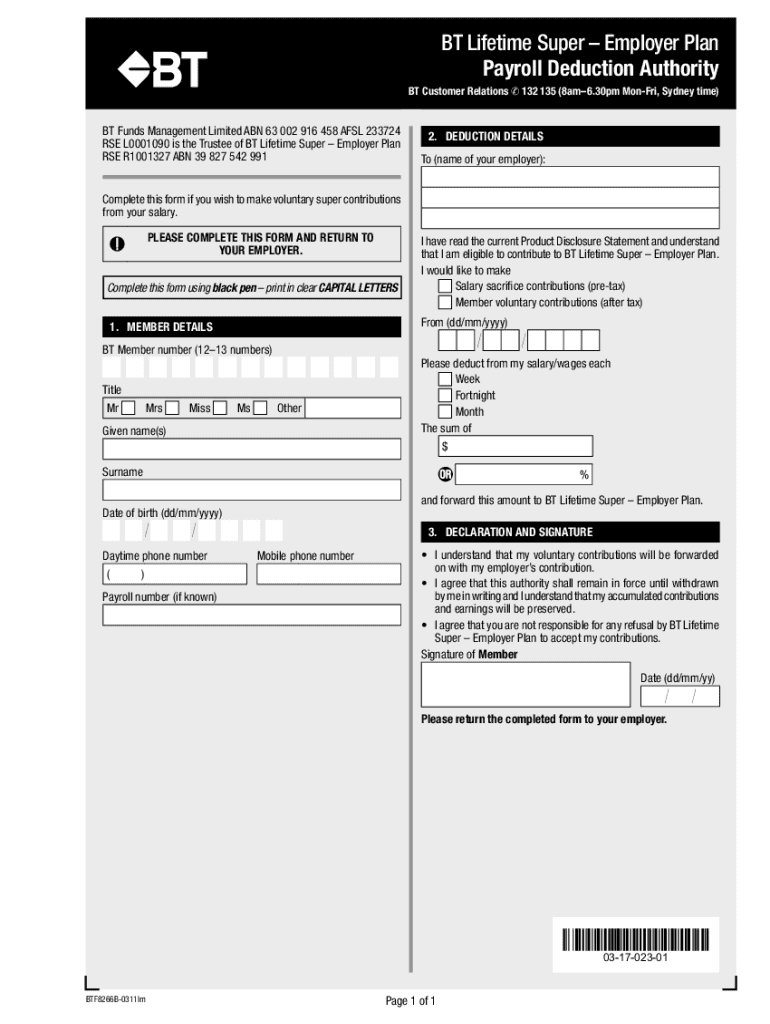

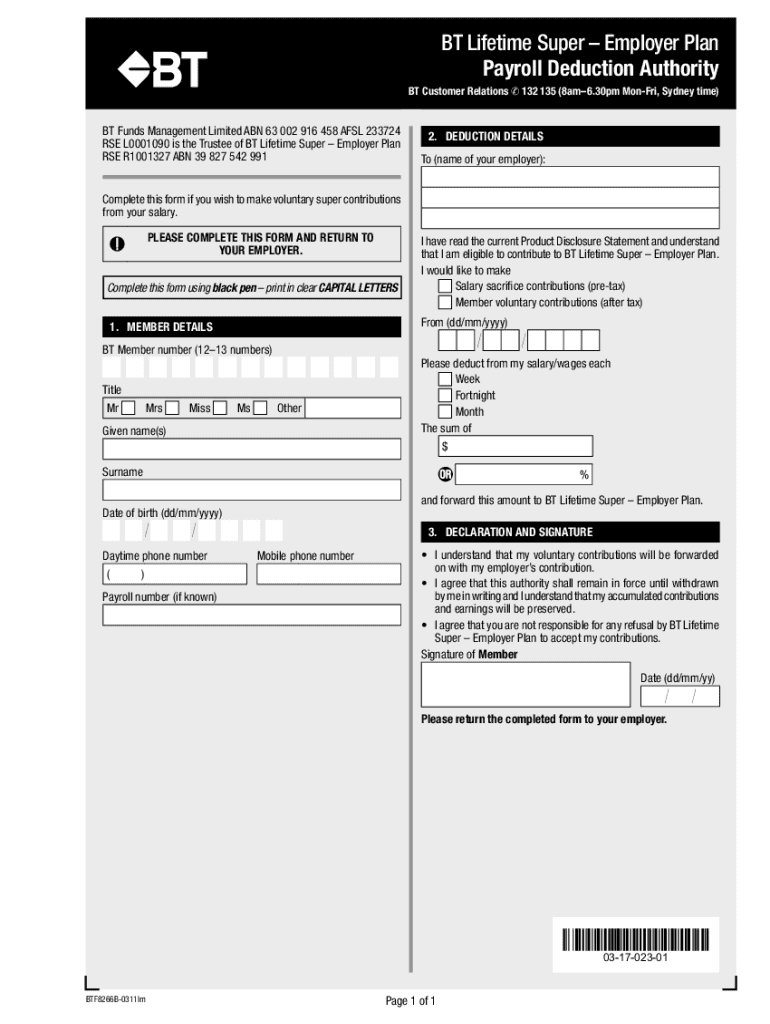

BT Lifetime Super Employer Plan Payroll Deduction Authority BT Customer Relations 132 135 (8am6.30pm Mon Fri, Sydney time×BT Funds Management Limited ABN 63 002 916 458 ADSL 233724 RSE L0001090 is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bt lifetime super employer

Edit your bt lifetime super employer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bt lifetime super employer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bt lifetime super employer online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bt lifetime super employer. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bt lifetime super employer

How to fill out BT Lifetime Super Employer?

01

Gather necessary information: Before you start filling out the BT Lifetime Super Employer form, make sure you have all the relevant details at hand. This includes your personal information, such as full name, date of birth, and contact details, as well as your tax file number (TFN) and the details of your employer.

02

Access the form: Visit the BT website or contact their customer service to obtain the BT Lifetime Super Employer form. You can usually find it under the superannuation or employer section. Make sure you have the latest version of the form to ensure accuracy.

03

Personal information: Start by providing your personal details accurately on the form. This includes your full name, date of birth, and contact information. Remember to double-check your details before moving on to the next section.

04

Tax file number (TFN): Fill in your TFN in the designated space. Providing your TFN ensures that your employer can make contributions to your superannuation account and that you receive the maximum tax benefits. If you do not have a TFN, consider applying for one from the Australian Taxation Office (ATO).

05

Employment details: Now, it's time to provide the necessary employment details. This includes your employer's name, address, and Australian business number (ABN). Ensure that you enter this information accurately to avoid any issues with your super contributions.

06

Contribution instructions: Specify how you want your employer contributions to be invested within your BT Lifetime Super account. You can choose from various investment options, such as growth, balanced, conservative, or self-managed. Review the investment options carefully and select the one that aligns with your financial goals and risk tolerance.

07

Insurance options: Determine if you require any insurance coverage through your BT Lifetime Super account. This may include life insurance, total and permanent disability (TPD) insurance, or income protection insurance. If needed, indicate the desired coverage amount and any additional beneficiaries.

08

Nominate a beneficiary: Consider nominating a beneficiary who will receive your super benefits in case of your untimely demise. This ensures that your money goes to the person or people you want to provide for. Enter their full name, date of birth, and their relationship to you.

Who needs BT Lifetime Super Employer?

01

Employees: BT Lifetime Super Employer is designed for employees who want to take control of their superannuation. It offers a range of investment options and insurance coverage, making it suitable for individuals who want flexibility and choice in managing their super.

02

Employers: BT Lifetime Super Employer is recommended for employers who want to provide their employees with a reputable and reliable superannuation option. It ensures that employees have access to a quality super fund, allowing them to save for their retirement and secure their financial future.

03

Self-employed individuals: Even if you're self-employed, you can still benefit from BT Lifetime Super Employer. It allows you to contribute to your superannuation and choose from various investment options to grow your retirement savings. Additionally, it offers insurance coverage for added peace of mind.

In summary, BT Lifetime Super Employer is suitable for employees, employers, and self-employed individuals who want to manage their superannuation effectively, invest in a range of options, and secure insurance coverage. By following the provided steps, you can successfully fill out the form and enjoy the benefits of this superannuation option.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in bt lifetime super employer?

The editing procedure is simple with pdfFiller. Open your bt lifetime super employer in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit bt lifetime super employer on an iOS device?

You certainly can. You can quickly edit, distribute, and sign bt lifetime super employer on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit bt lifetime super employer on an Android device?

With the pdfFiller Android app, you can edit, sign, and share bt lifetime super employer on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is bt lifetime super employer?

BT Lifetime Super Employer is a superannuation fund designed for employers to provide their employees with a long-term savings plan for retirement.

Who is required to file bt lifetime super employer?

Employers who have chosen BT Lifetime Super as their employees' superannuation fund are required to file the necessary paperwork.

How to fill out bt lifetime super employer?

The form can be filled out online or by submitting the required documents to BT Lifetime Super Employer.

What is the purpose of bt lifetime super employer?

The purpose of BT Lifetime Super Employer is to help employees save for retirement through employer contributions and investment options.

What information must be reported on bt lifetime super employer?

Information such as the employee's details, employer contributions, investment choices, and fund performance must be reported on BT Lifetime Super Employer.

Fill out your bt lifetime super employer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bt Lifetime Super Employer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.