Get the free TRANSFER ON DEATH DISTRIBUTION 2013 cash out

Show details

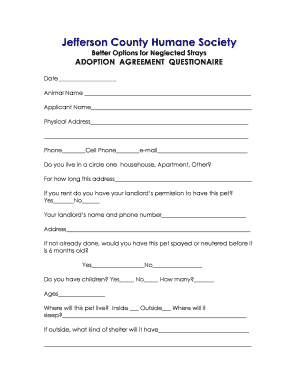

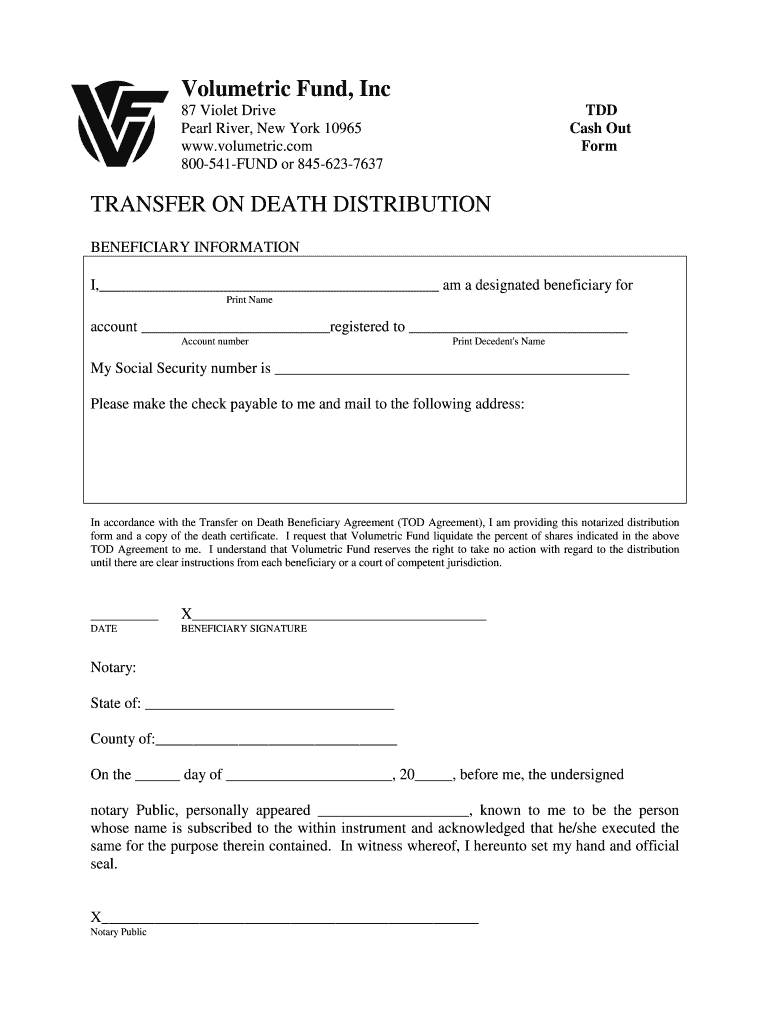

Volumetric Fund, Inc 87 Violet Drive Pearl River, New York 10965 www.volumetric.com 800541FUND or 8456237637 TDD Cash Out Form TRANSFER ON DEATH DISTRIBUTION BENEFICIARY INFORMATION I, am a designated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer on death distribution

Edit your transfer on death distribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer on death distribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transfer on death distribution online

To use the professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit transfer on death distribution. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer on death distribution

How to fill out transfer on death distribution:

01

Obtain the necessary forms: Start by acquiring the transfer on death (TOD) distribution form from the financial institution where the assets are held. This form may also be available online on the institution's website.

02

Provide personal information: Fill out your personal information accurately on the form, including your full name, address, Social Security number, and contact details. Ensure all the details are up to date and correct.

03

Identify the beneficiaries: Clearly indicate the beneficiaries who will receive the assets upon your death. Include their full names, addresses, Social Security numbers, and their relationship to you. You may have multiple beneficiaries, and it's important to accurately identify each one.

04

Specify the distribution percentages: Assign the percentage of assets that each beneficiary will receive. Ensure the percentages listed add up to 100%. For example, if you have three beneficiaries, one may receive 50%, another 30%, and the third 20%.

05

Include contingent beneficiaries: If desired, you can name alternate or contingent beneficiaries who will receive the assets if the primary beneficiaries pass away before you. Provide their complete information just as you did for the primary beneficiaries.

06

Review and sign the form: Carefully review all the information you have provided on the TOD distribution form. Ensure there are no errors or omissions. Once you are satisfied, sign and date the form as required. Some financial institutions may also require a witness or a notary public to verify the signature.

Who needs transfer on death distribution:

01

Individuals with significant assets: If you possess substantial financial assets, such as real estate, bank accounts, investment portfolios, or retirement plans, it is advisable to consider transfer on death distribution. This can simplify the process of transferring these assets to designated beneficiaries upon your death, without the need for probate.

02

Those who desire to avoid probate: Probate is a legal process that verifies and distributes a deceased person's assets, often involving court proceedings. Transfer on death distribution can help bypass the probate process, reducing delays, costs, and potential complications.

03

Individuals concerned about privacy: Probate proceedings are typically public record, meaning anyone can access information on your assets, beneficiaries, and the distribution process. By using transfer on death distribution, you can maintain a higher level of privacy, as it may not require public disclosure.

Note: It is always recommended to consult with an estate planning attorney or a financial advisor to ensure your transfer on death distribution aligns with your specific circumstances and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send transfer on death distribution to be eSigned by others?

To distribute your transfer on death distribution, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I edit transfer on death distribution on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing transfer on death distribution right away.

How do I complete transfer on death distribution on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your transfer on death distribution. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is transfer on death distribution?

Transfer on death distribution is a legal process that allows an individual to designate who will inherit their assets or property upon their death without the need for probate.

Who is required to file transfer on death distribution?

The individual who wishes to transfer their assets or property upon their death is required to file transfer on death distribution.

How to fill out transfer on death distribution?

To fill out transfer on death distribution, the individual must complete the necessary forms provided by their financial institution or legal advisor, and ensure that the designated beneficiaries are named correctly.

What is the purpose of transfer on death distribution?

The purpose of transfer on death distribution is to simplify the inheritance process for beneficiaries and avoid the time and expense of probate court.

What information must be reported on transfer on death distribution?

The information that must be reported on transfer on death distribution includes the names of the beneficiaries, the assets or property being transferred, and any specific instructions or conditions for the transfer.

Fill out your transfer on death distribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer On Death Distribution is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.