Get the free Non-Profit Solicitation Application - ci camarillo ca

Show details

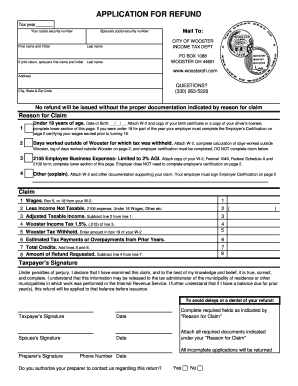

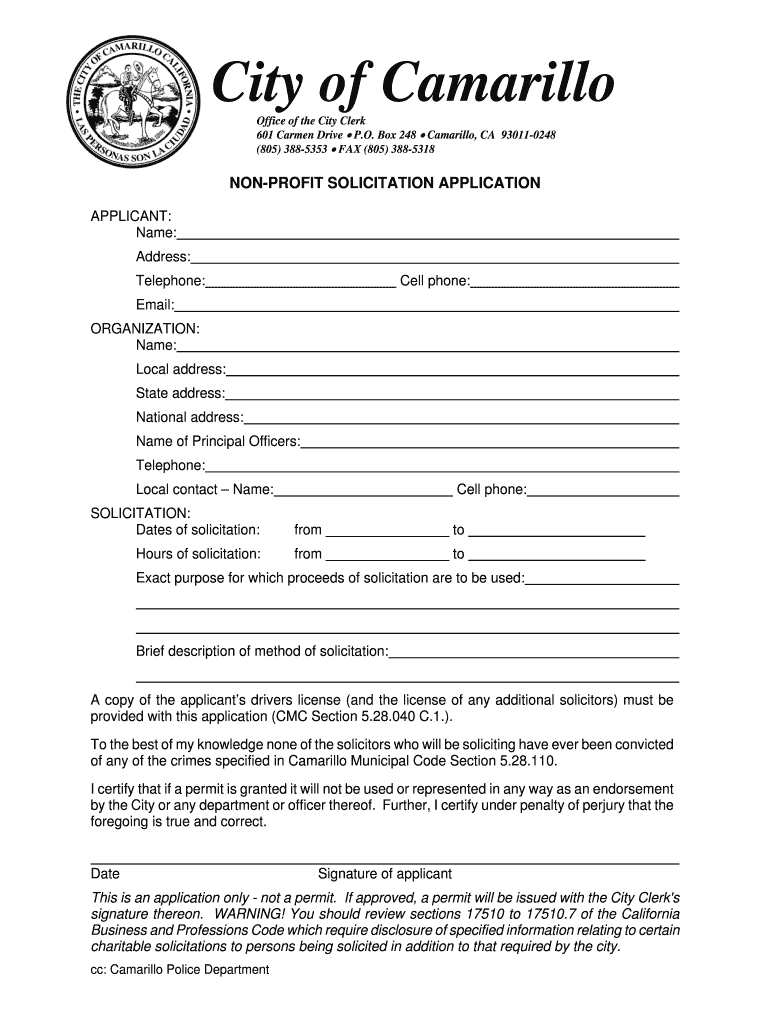

A document for non-profit organizations to apply for a permit to solicit contributions, outlining requirements, rules, and regulations for solicitation within the City of Camarillo.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-profit solicitation application

Edit your non-profit solicitation application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-profit solicitation application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-profit solicitation application online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit non-profit solicitation application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-profit solicitation application

How to fill out Non-Profit Solicitation Application

01

Obtain the Non-Profit Solicitation Application form from the appropriate state agency or website.

02

Read the application guidelines carefully to understand the requirements.

03

Gather necessary documentation including your organization’s tax-exempt status, budget, and program descriptions.

04

Fill out the application form accurately, providing all requested information such as mission statement, purpose, and financial data.

05

Review the completed application for accuracy and completeness before submission.

06

Submit the application to the designated agency along with any required fees or additional documents.

Who needs Non-Profit Solicitation Application?

01

Non-profit organizations seeking to solicit donations or contributions from the public.

02

Charitable organizations that engage in fundraising activities.

03

Religious organizations that wish to raise funds for their initiatives.

04

Community groups that want to inform the public about their programs and funding needs.

Fill

form

: Try Risk Free

People Also Ask about

What is the best way to request donations?

Ask for a small donation first, then follow up with a request for more. Either as a second, larger donation or as repeated, recurrent small donations. For larger donations, be prepared to provide publicly to the donor (if they wish it). Be prepared to offer support around the tax benefits of donation (if any).

How to start a solicitation letter?

Essential Elements of a Donation Solicitation Letter Clear and Concise Introduction 1. Begin by addressing the recipient politely and establishing the purpose of the letter. Mention how the recipient's support can make a difference. Explanation of the Organization's Mission and Impact 2.

What is the 80/20 rule for nonprofits?

In the context of fundraising, this principle suggests that a small number of donors (20%) may contribute the majority of funds (80%). In this blog post, we'll further dig into the concept of the 80/20 rule in fundraising and how you can use it to maximize your fundraising efforts.

What is the 33% rule for nonprofits?

If your organization receives more than 10 percent but less than 33-1/3 percent of its support from the general public or a governmental unit, it can qualify as a public charity if it can establish that, under all the facts and circumstances, it normally receives a substantial part of its support from governmental

How do nonprofits solicit donations?

Individuals Your nonprofit website. Text-to-donate. Direct mail. Crowdfunding pages. Peer-to-peer fundraising campaigns. Legacy or planned gifts. Payroll giving programs. In-kind donations.

What is the best way to solicit donations for nonprofits?

Multi-channel fundraising is the ideal option for the modern nonprofit. By asking for donations in a number of ways, such as your website, email, social media, text messages, and more, you can better engage with your donors and gain their attention for your cause.

How to write a solicitation letter for asking donations?

1. The Basic Donation Letter Format Salutation. Greet your potential donor with a friendly opening, and personalize it with their name whenever possible. Explanation of your mission. Your project, event, or needs. Compelling details. A specific request. A call-to-action.

How do I write a request for charitable donations?

Dear [Donor], My name is [Name], and I am [describe your position/situation/background]. I am looking to raise [amount of money] to help me pay for [project/expense/cause/etc.]. [Include information about why the cause or project is important to you and how it could potentially impact the reader or those you serve].

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Non-Profit Solicitation Application?

A Non-Profit Solicitation Application is a legal document that non-profit organizations must submit to request permission to solicit donations from the public, ensuring compliance with state regulations.

Who is required to file Non-Profit Solicitation Application?

Non-profit organizations that wish to solicit charitable contributions from the public are generally required to file a Non-Profit Solicitation Application, particularly if they operate in certain states that mandate this process.

How to fill out Non-Profit Solicitation Application?

To fill out a Non-Profit Solicitation Application, organizations should gather required information such as their mission statement, fundraising plans, financial statements, and details about officers and directors, then complete the application form provided by the relevant authority.

What is the purpose of Non-Profit Solicitation Application?

The purpose of a Non-Profit Solicitation Application is to regulate charitable solicitations, protect the public from fraudulent practices, and ensure that non-profits are transparent about their activities and financial practices.

What information must be reported on Non-Profit Solicitation Application?

The application must typically report information including the organization's name, address, purpose, methods of solicitation, a copy of the organization's bylaws, financial statements, and details about the compensation of directors and executives.

Fill out your non-profit solicitation application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Profit Solicitation Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.