Get the free PTAX-324 Application for Senior Citizens Homestead Exemption - co champaign il

Show details

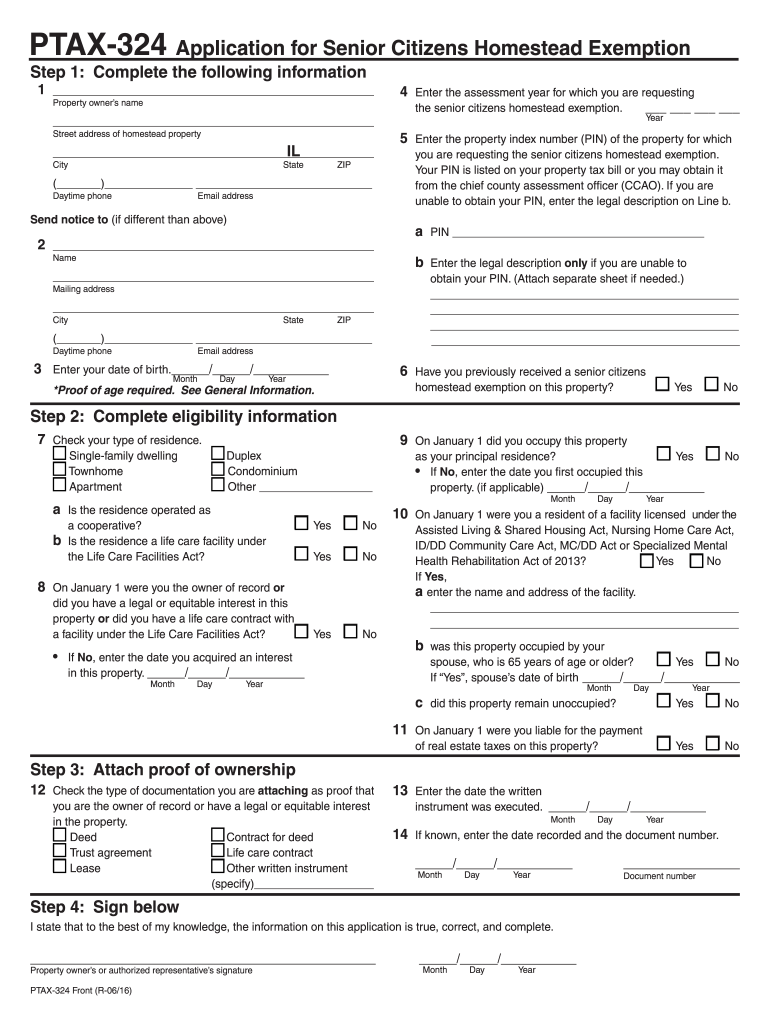

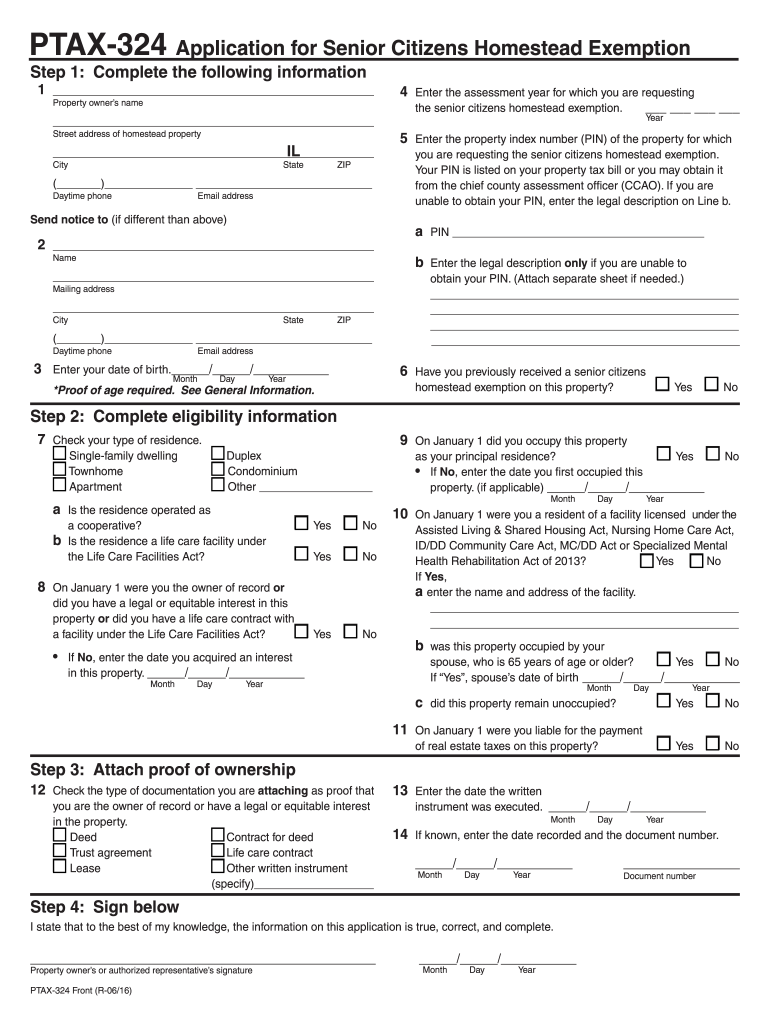

This document is an application for the Senior Citizens Homestead Exemption, which provides an annual reduction in the assessed property value for eligible senior citizens.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ptax-324 application for senior

Edit your ptax-324 application for senior form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ptax-324 application for senior form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ptax-324 application for senior online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ptax-324 application for senior. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ptax-324 application for senior

How to fill out PTAX-324 Application for Senior Citizens Homestead Exemption

01

Obtain the PTAX-324 form from your local assessor's office or download it from the official website.

02

Fill out the applicant's information, including name, address, and the property in question.

03

Provide proof of age; you must be 65 years old or older by the last day of the tax year.

04

Include proof of residency, showing that this is your primary residence.

05

List the total household income to ensure eligibility for the exemption.

06

Sign and date the application form.

07

Submit the completed PTAX-324 form to your local assessor's office by the designated deadline.

Who needs PTAX-324 Application for Senior Citizens Homestead Exemption?

01

Individuals aged 65 or older who own and occupy their primary residence and meet income requirements.

Fill

form

: Try Risk Free

People Also Ask about

At what age in Illinois do you stop paying property taxes?

If you are 65 or over, you will qualify for this exemption in your name and can apply online. Otherwise, your property will receive the exemption for the remainder of the year of your spouse's death. You will then have to apply when you turn 65.

How much is the Colorado senior property tax exemption?

Often referred to as the Senior Homestead Exemption, qualifying individuals receive a 50% discount on the first $200,000 of value of the home, if they have lived in the home for 10 years.

How to apply for senior homestead exemption in Illinois?

Filing a Senior Citizens General Homestead Exemption requires a completed application form and two additional documents. One of these documents is to establish proof of the applicant's age, the second to show proof of ownership of the real estate in question.

How do I claim homestead exemption in California?

Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office. Once the exemption has been granted, it remains effective until a change in eligibility occurs, such as selling or moving out of the home. Annual filing is not required.

How long do you have to pay property taxes in Illinois?

In most counties, property taxes are paid in two installments, usually June 1 and September 1. If the tax bills are mailed late (after May 1), the first installment is due 30 days after the date on your tax bill. County boards may adopt an accelerated billing method by resolution or ordinance.

Do senior citizens pay taxes in Illinois?

Illinois is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are not taxed. Wages are taxed at normal rates, and your marginal state tax rate is 0.0%.

At what age can you stop paying property tax?

Instead, property tax relief for seniors varies significantly depending on where you live. Most states and many local jurisdictions offer some form of property tax exemption, deferral, or credit program specifically designed for older residents, typically starting between the ages of 65 and 75.

Who doesn't have to pay property taxes in Illinois?

Properties of religious, charitable, and educational organizations, as well as units of federal, state and local governments, are eligible for exemption from property taxes to the extent provided by law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PTAX-324 Application for Senior Citizens Homestead Exemption?

PTAX-324 is an application form that allows qualifying senior citizens to apply for a homestead exemption, which reduces the property tax assessment on their primary residence.

Who is required to file PTAX-324 Application for Senior Citizens Homestead Exemption?

Senior citizens who own and occupy their home as their primary residence and meet specific income and age requirements are required to file the PTAX-324 application.

How to fill out PTAX-324 Application for Senior Citizens Homestead Exemption?

To fill out the PTAX-324, applicants must provide personal information, including their name, address, age, income, and any necessary documentation that proves eligibility for the exemption.

What is the purpose of PTAX-324 Application for Senior Citizens Homestead Exemption?

The purpose of the PTAX-324 application is to provide eligible senior citizens with property tax relief by exempting a portion of their home's value from taxation.

What information must be reported on PTAX-324 Application for Senior Citizens Homestead Exemption?

Applicants must report their personal identification details, property information, income details, and any previous exemptions claimed on the PTAX-324 application.

Fill out your ptax-324 application for senior online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ptax-324 Application For Senior is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.