Get the free Application for Credit Facilities - SHC - shc co

Show details

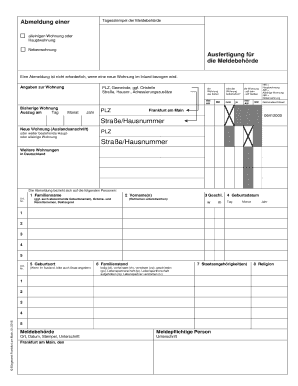

Web Form Application for Credit Facilities The information provided on this application form will be treated as Confidential and will be only used by our company for accounting purposes only Company

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for credit facilities

Edit your application for credit facilities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for credit facilities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for credit facilities online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for credit facilities. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for credit facilities

How to fill out an application for credit facilities:

01

Start by gathering all the necessary documents such as identification proof, income statements, bank statements, and any other relevant financial information.

02

Carefully read and understand the application form, ensuring that you provide accurate and complete information. This typically includes personal details, employment information, and financial history.

03

Double-check all the information you have entered to avoid any errors or mistakes that could affect the outcome of your application.

04

Attach any supporting documents required by the financial institution, such as proof of income or proof of address.

05

If you have any doubts or need clarification on any part of the application, reach out to the financial institution for assistance.

06

Once you have completed the application, review it one final time to ensure that everything is accurate and complete.

07

Submit the application either in person at the institution's office or through their online platform, following the specified instructions.

08

After submitting the application, wait for the financial institution to review and process it. This may take some time, so be patient and follow up if needed.

09

If your application is approved, carefully review the terms and conditions of the credit facility before accepting it.

10

Finally, if your application is denied, you may consider reaching out to the financial institution to understand the reasons behind the decision and explore possible alternatives.

Who needs an application for credit facilities?

01

Individuals who are looking to obtain credit for various purposes, such as purchasing a house, a car, or funding college education.

02

Small business owners who require financing to expand their operations, purchase inventory, or invest in equipment.

03

Companies seeking working capital to manage their cash flow, cover operational expenses, or invest in growth opportunities.

04

Startups and entrepreneurs who need funding to launch their business or develop a new product.

05

Individuals or businesses looking to consolidate their debts and manage their finances more effectively.

06

Those looking to establish or improve their credit history for future financial endeavors.

07

Anyone in need of a temporary or emergency financial solution to cover unexpected expenses or emergencies.

Remember, it is essential to consider your specific financial situation and requirements before applying for any credit facility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute application for credit facilities online?

pdfFiller has made it easy to fill out and sign application for credit facilities. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete application for credit facilities on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your application for credit facilities. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Can I edit application for credit facilities on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share application for credit facilities on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is application for credit facilities?

An application for credit facilities is a formal request submitted by an individual or business to a financial institution or lender to obtain credit or a loan.

Who is required to file application for credit facilities?

Any individual or business seeking financial assistance or credit from a lender is required to file an application for credit facilities.

How to fill out application for credit facilities?

To fill out an application for credit facilities, one must provide personal or business financial information, details about the requested credit amount, and any supporting documents required by the lender.

What is the purpose of application for credit facilities?

The purpose of an application for credit facilities is to formally request financial assistance or credit from a lender for personal or business needs.

What information must be reported on application for credit facilities?

The information required on an application for credit facilities may include personal or business financial details, credit history, requested loan amount, purpose of the loan, and any supporting documents.

Fill out your application for credit facilities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Credit Facilities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.