Get the free form 46 income tax

Show details

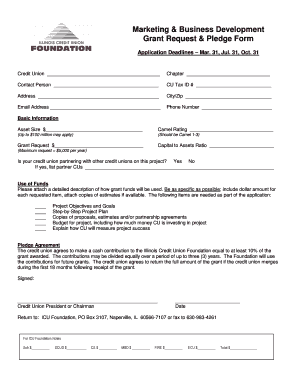

1 FORM NO. 46 See rule 113 Application for information under clause (b) of subsection (1) of section 138 of the Income tax Act, 1961 To The Chief Commissioner or Commissioner of Income tax, Sir, I

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form no 46

Edit your form 46 income tax pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 46 of income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form no 46 income tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 46 income tax download. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 46 income tax

How to fill out form 46 income tax:

01

Gather all necessary documents such as W-2 forms, 1099 forms, and any other income-related documents.

02

Review the form 46 income tax and familiarize yourself with all the sections and instructions.

03

Begin by providing your personal information, including your name, address, and social security number.

04

Fill in the necessary information about your income. This may include your wages, tips, self-employment income, and any other sources of income.

05

Calculate your deductions and credits accurately. This may include deductions for medical expenses, mortgage interest, education expenses, and any applicable credits.

06

Double-check all the information you have entered to ensure accuracy.

07

Sign and date the form.

08

Make a copy for your records and submit the form to the appropriate tax authority before the deadline.

Who needs form 46 income tax:

01

Individuals who have earned income from various sources, such as wages, self-employment, or investment income.

02

Taxpayers who meet the income tax filing requirements set by their country's tax authority.

03

Individuals who seek to comply with their tax obligations and report their income accurately.

Fill

form

: Try Risk Free

People Also Ask about

What are the terms of Rule 46A?

However, the Rule 46A of the Income-tax Rules, 1962, specifies that additional evidence means any evidence, whether oral or documentary, which is being produced before the CIT(A) for the first time and such evidences were not produced before the assessing officer during the course of assessment proceedings.

What is Rule 46A appeal?

The appellant must move an application under rule 46A seeking allowing the additional evidences to adjudicate upon. There is no provision in the law that without receiving any application for admission of additional evidences, CIT (A) can decide the appeal considering the additional evidences.

What is under section 45?

Section 45 of the Insurance Act 1938 states the conditions when an insurance policy shall not be held suspicious. A life insurance policy shall not be called in question on any grounds after it completes 3 years from– 1. The date of issuance of policy.

What is Section 45 4 capital gains?

The profits or gains arising from the transfer of a capital asset by way of distribution of capital assets on the dissolution of a firm or other association of persons or body of individuals (not being a company or a co-operative society) or otherwise, shall be chargeable to tax as the income of the firm, association

What is Tennessee Supreme Court Rule 46A?

Introduction. The Supreme Court adopted electronic filing (“e-filing”) in the appellate courts at a future date. This revised Rule 46, adopted effective July 1, 2022, continues to authorize parties to e-file documents voluntarily and governs specified procedures associated with those filings.

What are 46A rules?

In simple terms, Rule 46A was meant to protect indigent debtors who were in danger of losing their homes and give effect to Section 26 of the Constitution. The objective of judicial oversight is to determine whether Section 26 of the Constitution is implicated.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 46 income tax online?

Filling out and eSigning form 46 income tax is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make edits in form 46 income tax without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing form 46 income tax and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out form 46 income tax using my mobile device?

Use the pdfFiller mobile app to fill out and sign form 46 income tax on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is form 46 income tax?

Form 46 is a tax form used in certain jurisdictions for reporting income and other financial information to the tax authorities.

Who is required to file form 46 income tax?

Individuals and entities that meet specific income thresholds or who have certain types of income, as defined by the tax authorities, are required to file Form 46.

How to fill out form 46 income tax?

To fill out Form 46, gather all relevant income documents, follow the instructions provided by the tax authorities for the form, and accurately report all required information in the designated sections.

What is the purpose of form 46 income tax?

The purpose of Form 46 is to report income, calculate tax liability, and ensure compliance with tax laws, allowing tax authorities to assess each individual's or entity's tax obligations.

What information must be reported on form 46 income tax?

Form 46 typically requires information such as personal identification details, total income earned, deductions claimed, and any applicable credits that may affect the overall tax liability.

Fill out your form 46 income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 46 Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.