India Form VAT 105 2013-2025 free printable template

Show details

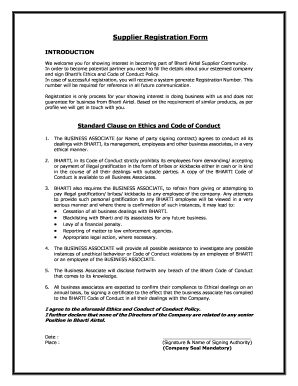

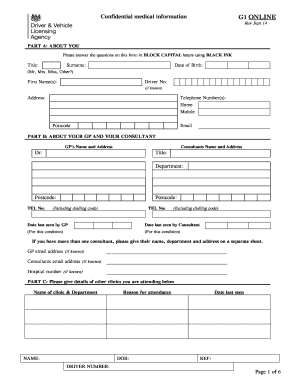

GOVERNMENT OF ANDHRA PRADESH COMMERCIAL TAXES DEPARTMENT. FORM VAT 105 VALUE ADDED TAX REGISTRATION CERTIFICATE See Rule 10 a I hereby certify that Whose place of business is situated at is registered with VAT Registration Number TIN with effect fromday of200 Pursuant to and in accordance with the APVAT Act 2005. The additional place of business/branch/godown is situated at Given under my hand aton theday of200. Your local Tax office is You are also registered under CST Act and the above VAT...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign vat certificate sample form

Edit your vat certificate download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat 105 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit value added tax registration certificate online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sample of vat certificate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample of vat certificate

How to fill out India Form VAT 105

01

Obtain the India Form VAT 105 from the official tax authority's website or office.

02

Fill in your personal details including name, address, and contact information at the top of the form.

03

Provide your business details such as the name of the business, GSTIN (if applicable), and the type of business.

04

Indicate the period for which you are reporting VAT.

05

Calculate your total sales, purchases, and any VAT paid or collected for the reporting period.

06

Enter the total VAT payable or refundable in the designated section.

07

Review the form for any errors or omissions before submission.

08

Submit the completed form along with any required supporting documents to the relevant tax office.

Who needs India Form VAT 105?

01

Businesses registered under the VAT system in India.

02

Individuals or organizations making taxable sales or services in India.

03

Entities seeking to claim VAT refunds or report VAT obligations.

Fill

form

: Try Risk Free

People Also Ask about

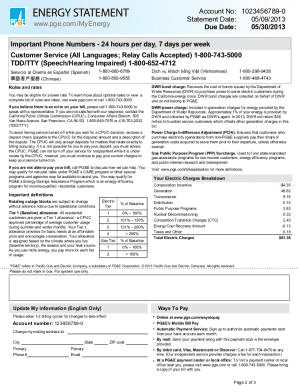

Can I find my VAT number online?

You can locate your VAT number on the VAT registration certificate issued by HMRC. Your VAT number will contain nine digits, with the first two digits indicating the country code ('GB' for UK businesses). You can locate your VAT number on the VAT registration certificate issued by HMRC.

How do I get proof of VAT registration?

Logon your eFiling profile; click SARS Registered details on the side menu; Select Notice of Registration; and. Select VAT.

Can I download my VAT certificate?

Whether you've misplaced your original certificate or just want to check that the details you have are correct, you can easily access your VAT certificate online and save or print a copy. You'll need the username and password you created when setting up your Government Gateway account.

Where can I download my VAT certificate?

How to View Your VAT Certificate Online First log into your government gateway account here: Government Gateway Login Scroll down and click 'View VAT account' Scroll down and click 'View VAT certificate'

How can I check my VAT certificate online UK?

How to View Your VAT Certificate Online First log into your government gateway account here: Government Gateway Login Scroll down and click 'View VAT account' Scroll down and click 'View VAT certificate'

What is a VAT Certificate USA?

VAT certificate in your home country: This document proves that your company is registered for a VAT number in its country of establishment. Normally, it must be original and recently issued by the local tax authorities, so we suggest requesting as many certificates as countries of registration.

How do I get my VAT?

Your unique VAT number is shown on the registration certificate which HMRC issue when your business becomes VAT registered. Once you receive your VAT registration certificate, you (or your agent) can create an online VAT account.

How do I download my VAT certificate in TN?

Registration Certificate can be downloaded from the portal under the option “Download documents”. After e-Mail ID is successfully verified a system generated Password will be sent to applicant's e-Mail ID.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

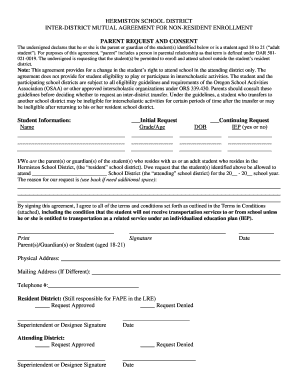

How can I send sample of vat certificate to be eSigned by others?

sample of vat certificate is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete sample of vat certificate online?

pdfFiller has made filling out and eSigning sample of vat certificate easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit sample of vat certificate straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing sample of vat certificate, you need to install and log in to the app.

What is India Form VAT 105?

India Form VAT 105 is a document used for filing Value Added Tax (VAT) returns by registered businesses in India. It is specifically designed to report sales, purchases, and other VAT-related information.

Who is required to file India Form VAT 105?

Registered businesses and dealers under the VAT regime in India are required to file India Form VAT 105, particularly those whose turnover exceeds the prescribed threshold limit.

How to fill out India Form VAT 105?

To fill out India Form VAT 105, businesses must provide details such as their GSTIN, sales and purchase figures, input tax credit claimed, any exemptions availed, and other relevant financial data for the reporting period.

What is the purpose of India Form VAT 105?

The purpose of India Form VAT 105 is to facilitate the reporting of VAT transactions to the government, ensure compliance with VAT laws, and enable accurate tax calculations and payments.

What information must be reported on India Form VAT 105?

India Form VAT 105 requires reporting information such as sales and purchase amounts, input tax credit, tax liability, exemptions, and total taxable turnover for the specified period.

Fill out your sample of vat certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Of Vat Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.