Get the free Marion Township Real Property Record - gis co marion oh

Show details

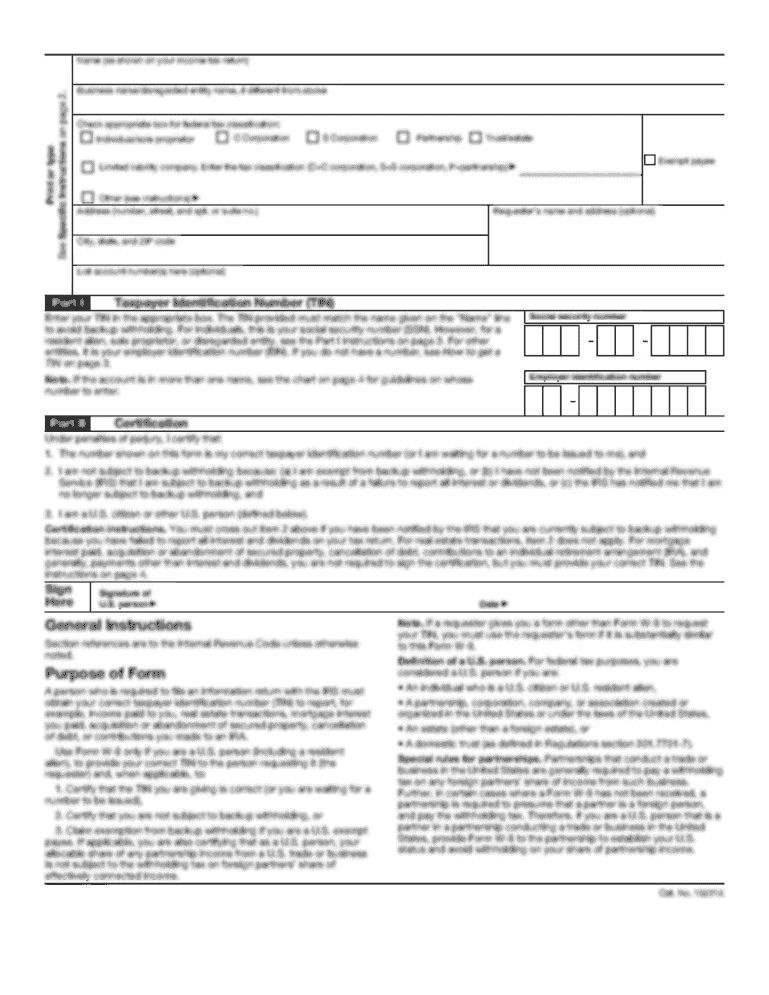

This document provides detailed property records for real estate in Marion County, Ohio, including property ownership, tax assessments, sale history, and property assessments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign marion township real property

Edit your marion township real property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your marion township real property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing marion township real property online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit marion township real property. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out marion township real property

How to fill out Marion Township Real Property Record

01

Obtain a copy of the Marion Township Real Property Record form from the local government office or website.

02

Begin by filling out the property owner’s name and contact information at the top of the form.

03

Enter the property address, including street number, street name, city, state, and zip code.

04

Indicate the property type (e.g., residential, commercial, agricultural) in the designated section.

05

Provide details about the parcel identification number, which can typically be found on your tax bill.

06

Describe the property's size, including lot dimensions and square footage.

07

List any improvements made to the property, such as renovations or new constructions.

08

Complete any additional sections relevant to your property, such as zoning information.

09

Review the entire form for accuracy and completeness before submission.

10

Submit the filled-out form to the Marion Township office along with any required documentation.

Who needs Marion Township Real Property Record?

01

Property owners looking to assess their property for taxes or selling.

02

Real estate agents needing accurate property details for listings.

03

Potential buyers wanting to understand property history and valuation.

04

Local government authorities for property assessment and tax purposes.

05

Researchers analyzing regional real estate data.

Fill

form

: Try Risk Free

People Also Ask about

How to find out who owns a property in Marion County, FL?

Property records are available at the property appraiser's office. Tax records & information are available at the tax collector's office.

What township is Marion, MI?

Marion Township is a civil township of Osceola County in the U.S. state of Michigan. The population was 1,565 at the 2020 census. The Village of Marion is located within the township.

How can I look up my property tax information in Marion County?

The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill. Information printed from this site should not be used in lieu of a tax bill. IF YOU USE THIS AS A TAXBILL, YOU MUST REMIT A $5.00 DUPLICATE BILL FEE, OR YOU WILL BE BILLED FOR THE FEE.

What happens if you miss the local property tax deadline?

If unpaid property taxes are left unaddressed, it could accumulate additional fees and penalties, and the County could ultimately auction the property to recover taxes owed. This process takes some time, but if you act quickly, you have a better chance of saving your home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Marion Township Real Property Record?

The Marion Township Real Property Record is an official document that provides detailed information about properties located within Marion Township, including ownership, assessed values, and property characteristics.

Who is required to file Marion Township Real Property Record?

Property owners and real estate professionals are typically required to file the Marion Township Real Property Record, especially when there are changes in property ownership or significant modifications made to the property.

How to fill out Marion Township Real Property Record?

To fill out the Marion Township Real Property Record, one must include property details such as the owner's name and address, property description, assessment information, and any relevant changes or updates, ensuring all information is accurate and complete.

What is the purpose of Marion Township Real Property Record?

The purpose of the Marion Township Real Property Record is to maintain an organized record of property ownership and details, facilitate property assessment for taxation, and provide transparency for real estate transactions within the township.

What information must be reported on Marion Township Real Property Record?

Information that must be reported on the Marion Township Real Property Record includes the property owner's name and contact information, property address, lot size, zoning classification, assessment value, and any improvements made to the property.

Fill out your marion township real property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Marion Township Real Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.