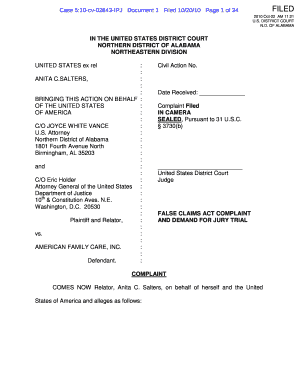

Get the free BUSINESS INCOME TAX REGISTRATION

Show details

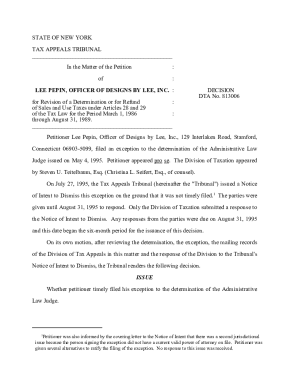

This document is a questionnaire for businesses operating in Kettering, Ohio, to register for income tax purposes. It requires information about the business structure, ownership, employees, and tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business income tax registration

Edit your business income tax registration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business income tax registration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business income tax registration online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business income tax registration. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business income tax registration

How to fill out BUSINESS INCOME TAX REGISTRATION

01

Gather all necessary business information, including your business name, address, and contact information.

02

Determine your business structure (e.g., sole proprietorship, partnership, corporation) and collect any required documentation.

03

Visit the official tax registration website or the appropriate government office in your region.

04

Complete the application form for business income tax registration, ensuring all fields are filled accurately.

05

Provide any supporting documents required, such as identification, tax identification numbers, or business licenses.

06

Review the completed application for any errors or omissions before submission.

07

Submit the application either online or in-person, depending on your local requirements.

08

Keep a copy of the submitted application and any acknowledgement or confirmation received for your records.

Who needs BUSINESS INCOME TAX REGISTRATION?

01

All businesses operating within a jurisdiction that generates income are required to register for business income tax.

02

New businesses that have just started operations and intend to earn revenue.

03

Established businesses that have not yet registered for business income tax.

04

Any freelance or self-employed individuals who earn income from their services.

05

Partnerships and corporations that must comply with local tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I register my business tax account in the UK?

You can set up a Business Tax Account on the gov.uk website. You must enter personal and business details, such as your Unique Taxpayer Reference (UTR) and Government Gateway ID. Once verified, you'll gain access to your online account to manage and pay all your business taxes.

Is there a difference between a tax ID number and EIN?

The primary difference between these tax identification numbers and Employer Identification numbers is that a TIN is used to identify people who can be taxed within the United States, while the EIN is used to identify companies. Therefore, the difference is in the way the EIN and tax ID numbers can be used.

How do I get a US TIN number outside the US?

The IRS accepts Form W-7, Application for an Individual Taxpayer Identification Number by mail accompanied by original documents or certified copy of the document from the issuing agency to establish the identity and foreign status of the ITIN applicant.

How much does a US tax ID cost?

It's free to apply for an EIN, and you should do it right after you register your business. Your business needs a federal tax ID number if it does any of the following: Pays employees.

How to file an income tax return for a business?

Step 1: Log in to the e-Filing portal using your user ID and password. Step 2: On your Dashboard, click e-File > Income Tax Returns > File Income Tax Return. Step 3: Select the Assessment Year as 2025-26 and Mode of Filing as online and click continue.

Can non-US citizens get a tax ID number?

The IRS is only interested in knowing where the business is operating. In order to obtain an EIN online, you will need a Social Security Number or U.S. address. However, an EIN for non-U.S. citizens can still be acquired by mailing or faxing the application to the IRS.

How do I get a US business tax ID?

Businesses apply for a federal EIN by preparing Internal Revenue Service (IRS) Form SS-4 and filing it with the IRS. BizFilings can assist with the obtainment of your company's EIN number from the IRS on your behalf. Simply complete our Federal Tax ID EIN online order form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BUSINESS INCOME TAX REGISTRATION?

Business income tax registration is the process through which a business formally registers with tax authorities to report its income and pay applicable taxes on that income.

Who is required to file BUSINESS INCOME TAX REGISTRATION?

Any individual or entity conducting business activities that generate income is typically required to file for business income tax registration, including sole proprietors, partnerships, corporations, and limited liability companies.

How to fill out BUSINESS INCOME TAX REGISTRATION?

To fill out a business income tax registration, you generally need to provide information such as the business name, structure, operational address, tax identification number, and estimated income, among other details, as specified by local tax authorities.

What is the purpose of BUSINESS INCOME TAX REGISTRATION?

The purpose of business income tax registration is to ensure that businesses comply with tax laws, accurately report their earnings, and pay taxes on income generated, thereby contributing to public revenues.

What information must be reported on BUSINESS INCOME TAX REGISTRATION?

The information that must be reported usually includes business name, type of business entity, location, ownership details, estimated income, and tax identification numbers, along with any other specifics required by the tax authority.

Fill out your business income tax registration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Income Tax Registration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.