Get the free ADMINISTRATION AD PROSEQUENDUM FACT SHEET-DECEDENT HAD NO WILL - co warren nj

Show details

Este formulario se utiliza para recopilar información sobre un difunto que no dejó testamento, incluyendo detalles sobre el difunto, sus familiares, activos y otros aspectos relevantes tras su fallecimiento.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign administration ad prosequendum fact

Edit your administration ad prosequendum fact form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your administration ad prosequendum fact form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing administration ad prosequendum fact online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit administration ad prosequendum fact. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out administration ad prosequendum fact

How to fill out ADMINISTRATION AD PROSEQUENDUM FACT SHEET-DECEDENT HAD NO WILL

01

Gather all necessary documents related to the decedent, including identification and any estate assets.

02

Obtain the correct form for the Administration Ad Prosequendum Fact Sheet.

03

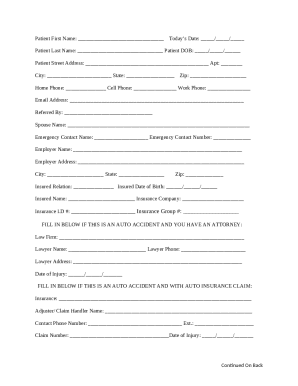

Fill in the decedent's name, date of birth, and date of death in the appropriate fields.

04

Provide information about the decedent's last known address.

05

List all surviving relatives, including their names and relationships to the decedent.

06

Detail the circumstances surrounding the decedent's death, if required.

07

If applicable, provide a description of the estate's assets and liabilities.

08

Review the completed form for accuracy before submission.

09

Submit the form to the appropriate court or agency as required by local laws.

Who needs ADMINISTRATION AD PROSEQUENDUM FACT SHEET-DECEDENT HAD NO WILL?

01

Individuals seeking to manage the estate of a decedent who did not leave a will.

02

Heirs or beneficiaries of the decedent’s estate.

03

Legal representatives or attorneys handling the probate process.

04

Courts and administrative agencies involved in the probate process.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to probate a will in NJ?

If the decedent has assets solely in his/her name at the time of death then the Will must be probated regardless of the value of the estate. You probate in order for the named executor in the Will to be given the authority to transfer the assets both real and personal to the estate.

How to become administrator of an estate without a will in NJ?

Administration of Estate (No Will) Check the death certificate to determine which county Surrogate's Court has jurisdiction. List all next of kin of proper decree of kinship with names, addresses and if minors the ages. Determine who has first right to make application for administration based on degree of kinship.

How much are estate administrator fees in NJ?

Size of Estate Influences Commission In New Jersey, an Executor is entitled to commissions based upon the size of the estate. The commissions are 5% of the first $200,000, 3.5% of the next $800,000 and 2% on the amount greater than $1 million.

Who is considered the next of kin in NJ?

A spouse and children are typically first in line, but how much each receives depends on whether children are from the current marriage or a previous one. If there is no surviving spouse or children, the estate passes to the decedent's parents, then to siblings, nieces, and nephews.

Who inherits in NJ if there is no will?

A spouse and children are typically first in line, but how much each receives depends on whether children are from the current marriage or a previous one. If there is no surviving spouse or children, the estate passes to the decedent's parents, then to siblings, nieces, and nephews.

What is the small estate administration in New Jersey?

A Small Estate Affidavit in lieu of administration may be an option when there is no will and the value of the estate does not reach a certain threshold. In New Jersey, the term “small estate” refers to estates that are valued at less than $50,000 for a surviving spouse or less than $20,000 for next of kin.

Who administers an estate if there is no will?

An administrator is someone who is responsible for dealing with an estate under certain circumstances, for example, if there is no will or the named executors aren't willing to act. An administrator has to apply for letters of administration before they can deal with an estate.

Who can be an administrator of an estate in New Jersey?

If there are no next of kin, any fit person or anyone who is owed a debt from the estate has the right to apply after 40 days have passed. The person who paid for the funeral expenses or the landlord who is owed back rent would have a right to apply for Administration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ADMINISTRATION AD PROSEQUENDUM FACT SHEET-DECEDENT HAD NO WILL?

The ADMINISTRATION AD PROSEQUENDUM FACT SHEET-DECEDENT HAD NO WILL is a legal document used to initiate the administration process for the estate of a decedent who did not leave a valid will. It provides necessary information about the decedent, their assets, and the appropriate administrators.

Who is required to file ADMINISTRATION AD PROSEQUENDUM FACT SHEET-DECEDENT HAD NO WILL?

The person seeking to be appointed as the administrator of the decedent's estate is required to file the ADMINISTRATION AD PROSEQUENDUM FACT SHEET-DECEDENT HAD NO WILL. Typically, this could be a family member or another interested party.

How to fill out ADMINISTRATION AD PROSEQUENDUM FACT SHEET-DECEDENT HAD NO WILL?

To fill out the ADMINISTRATION AD PROSEQUENDUM FACT SHEET, provide the required information including decedent's details such as full name, date of death, and residence. Include information about the assets, liabilities, and potential heirs, ensuring accuracy and completeness.

What is the purpose of ADMINISTRATION AD PROSEQUENDUM FACT SHEET-DECEDENT HAD NO WILL?

The purpose of the ADMINISTRATION AD PROSEQUENDUM FACT SHEET-DECEDENT HAD NO WILL is to document the decedent's assets and liabilities in order to facilitate the legal process of administering the estate, ensuring that the estate is distributed according to state law.

What information must be reported on ADMINISTRATION AD PROSEQUENDUM FACT SHEET-DECEDENT HAD NO WILL?

The information that must be reported on the ADMINISTRATION AD PROSEQUENDUM FACT SHEET includes the decedent's name, date of birth, date of death, residence address, details of the assets and liabilities of the estate, and information about potential heirs.

Fill out your administration ad prosequendum fact online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Administration Ad Prosequendum Fact is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.