Get the free 2012 – XENIA CITY BUSINESS INCOME TAX RETURN

Show details

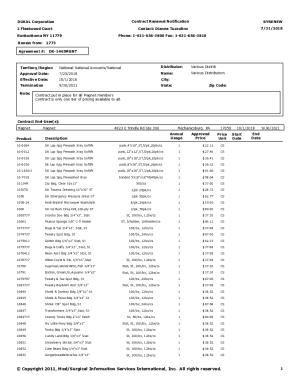

This document provides important information regarding the filing of business tax returns for the City of Xenia, including filing deadlines, estimated tax payments, and requirements for different

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 xenia city business

Edit your 2012 xenia city business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 xenia city business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012 xenia city business online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2012 xenia city business. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 xenia city business

How to fill out 2012 – XENIA CITY BUSINESS INCOME TAX RETURN

01

Gather all necessary financial documents for your business.

02

Obtain a copy of the 2012 Xenia City Business Income Tax Return form.

03

Fill in your business name, address, and other identifying information at the top of the form.

04

Report your gross receipts, sales, or other income on the designated lines.

05

Deduct any allowable business expenses according to the form instructions.

06

Calculate your taxable income by subtracting expenses from your gross income.

07

Apply the appropriate city tax rate to your taxable income to determine tax owed.

08

Complete any additional schedules if required by your business type.

09

Review your completed return for accuracy.

10

Submit your completed tax return to the Xenia City Tax Department by the due date.

Who needs 2012 – XENIA CITY BUSINESS INCOME TAX RETURN?

01

Businesses operating within the city of Xenia that generate income.

02

Self-employed individuals and sole proprietors living or doing business in Xenia.

03

LLCs, partnerships, and corporations that have taxable income sourced from Xenia.

Fill

form

: Try Risk Free

People Also Ask about

Is Xenia, Ohio a town or city?

Xenia township, Greene County, Ohio is a city, town, place equivalent, or township located in Greene County, Ohio. Xenia township, Greene County, Ohio has a land area of 43.9 square miles.

What is the income tax return in English?

Income Tax Return or ITR is a form used to show your gross taxable income for the given fiscal year. The form is used by taxpayers to formally declare their income, deductions claimed, exemptions and taxes paid. Therefore, it calculates your net income tax liability in a fiscal year.

What is the tax rate in Xenia, Ohio?

Xenia sales tax details The minimum combined 2025 sales tax rate for Xenia, Ohio is 6.75%. This is the total of state, county, and city sales tax rates. The Ohio sales tax rate is currently 5.75%.

Do Brits file tax returns?

In the United Kingdom, a tax return is a document that must be filed with HM Revenue & Customs declaring liability for taxation. Different bodies must file different returns with respect to various forms of taxation. The main returns currently in use are: SA100 for individuals paying income tax.

What cities in Ohio do not have an income tax?

With a population of approximately 46,000 people, the City of Beavercreek is one of three cities in the state of Ohio that does not have an income tax. The other two are Bellbrook, Ohio (population of 7,300) and Cortland, Ohio (population of 7,100).

Do I have to pay city taxes in Ohio?

Municipalities may impose an earned income tax on wages and net profits. The tax may be imposed on either residents only or both residents and nonresidents. Most municipalities have a 1 percent cap. Home rule municipalities (such as Philadelphia, Pittsburgh, and Scranton) are not subject to the cap.

What cities in Ohio have a city tax?

Most Ohio cities Villages have a municipal income tax with rates ranging from 0.5 to 3% for instanceMoreMost Ohio cities Villages have a municipal income tax with rates ranging from 0.5 to 3% for instance cities like Columbus and Cleveland have local tax rates of 2.5%. Number of municipalities.

Does Xenia, Ohio have a city income tax?

The City of Xenia utilizes the Regional Income Tax Agency (RITA) for collection of municipal income tax. For detailed information about the City's income tax please click here. The following are some highlights of the City's tax ordinance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012 – XENIA CITY BUSINESS INCOME TAX RETURN?

The 2012 – XENIA CITY BUSINESS INCOME TAX RETURN is a tax form used by businesses operating within Xenia City to report their income and calculate the amount of income tax owed to the city for the specified tax year.

Who is required to file 2012 – XENIA CITY BUSINESS INCOME TAX RETURN?

All businesses that generate income within Xenia City, including sole proprietorships, partnerships, and corporations, are required to file the 2012 – XENIA CITY BUSINESS INCOME TAX RETURN if their gross receipts exceed the minimum threshold set by the city.

How to fill out 2012 – XENIA CITY BUSINESS INCOME TAX RETURN?

To fill out the 2012 – XENIA CITY BUSINESS INCOME TAX RETURN, businesses must provide their federal tax identification number, report total income, calculate allowable deductions, and determine the taxable income before applying the city’s income tax rate.

What is the purpose of 2012 – XENIA CITY BUSINESS INCOME TAX RETURN?

The purpose of the 2012 – XENIA CITY BUSINESS INCOME TAX RETURN is to ensure that local businesses report their income accurately and pay the appropriate amount of income tax to Xenia City, contributing to local public services and infrastructure.

What information must be reported on 2012 – XENIA CITY BUSINESS INCOME TAX RETURN?

The information that must be reported on the 2012 – XENIA CITY BUSINESS INCOME TAX RETURN includes the business's name and address, federal tax identification number, total revenue, allowable deductions, taxable income, and the calculated tax owed, among other relevant financial details.

Fill out your 2012 xenia city business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Xenia City Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.