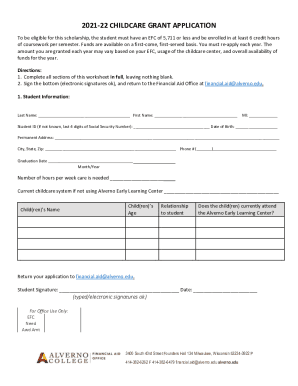

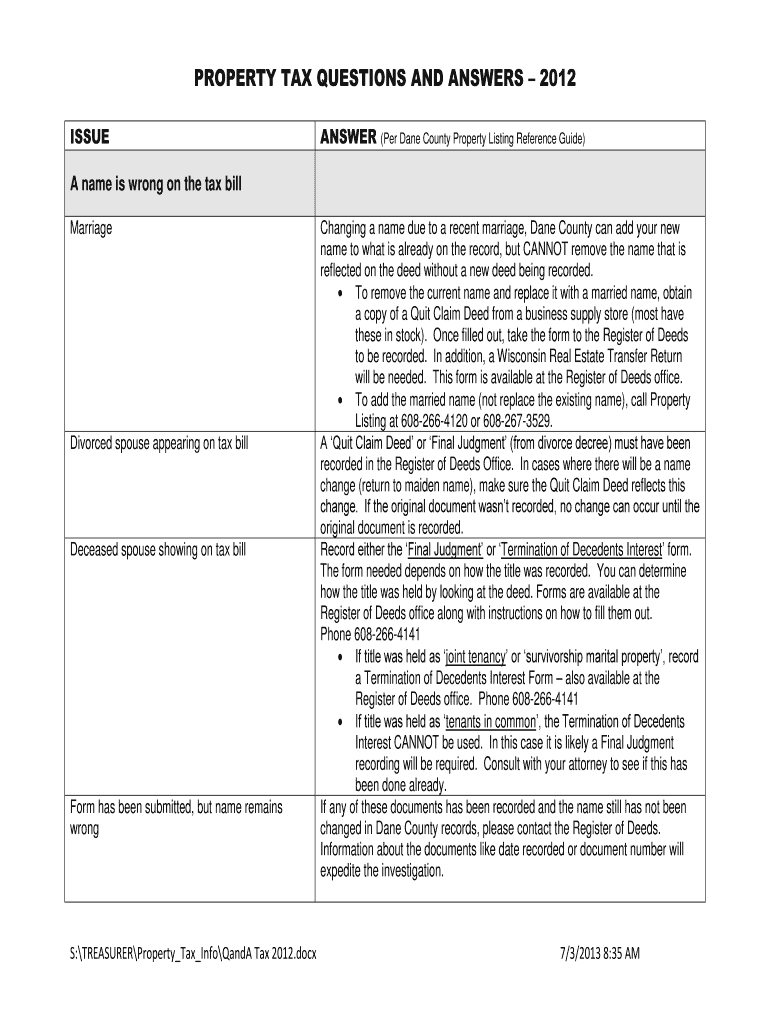

Get the free PROPERTY TAX QUESTIONS AND ANSWERS – 2012

Show details

This document provides answers to common questions related to property taxes in Dane County, including issues related to name changes on tax bills, property assessments, and combining property parcels.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax questions and

Edit your property tax questions and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax questions and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax questions and online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit property tax questions and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax questions and

How to fill out PROPERTY TAX QUESTIONS AND ANSWERS – 2012

01

Gather necessary documents, such as your property tax bill and any relevant forms.

02

Identify the specific questions included in the PROPERTY TAX QUESTIONS AND ANSWERS – 2012 document.

03

Review each question carefully and understand what information is being requested.

04

Fill out each section of the document point by point, ensuring accuracy and completeness.

05

Provide supporting documentation if required, such as receipts or proof of payment.

06

Double-check all entries for errors before submitting the completed form.

Who needs PROPERTY TAX QUESTIONS AND ANSWERS – 2012?

01

Property owners looking to understand their tax obligations.

02

Individuals appealing their property tax assessments.

03

Real estate professionals assisting clients with tax-related inquiries.

04

Anyone seeking clarity on property tax regulations specific to the year 2012.

Fill

form

: Try Risk Free

People Also Ask about

What is the success rate of property tax appeals?

The success rate for property tax appeals is surprisingly high. Studies indicate that 40% to 60% of property tax appeals result in a reduction of the assessed value.

What is the best first step in challenging a property tax assessment?

Step 1: Know your deadlines. Step 2: Check if you qualify for property tax breaks. Step 3: Set the record straight. Step 4: Compare with your neighbors. Step 5: Build your case. Step 6: Consider a professional appraisal.

Is it worth contesting property taxes?

Property valuations aren't set in stone, and if your assessment seems off, you have the right to push back. In fact, filing a property tax appeal could save you a significant amount of money.

How to win a property tax assessment appeal?

The easiest way to win an appeal is to find out the county has the wrong square footage for your property. An appeal triggers a review of your file. The discrepancy must be significant. Bring evidence bearing on the market value of your property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PROPERTY TAX QUESTIONS AND ANSWERS – 2012?

PROPERTY TAX QUESTIONS AND ANSWERS – 2012 is a document designed to provide guidance and clarify common inquiries related to property taxation for the year 2012.

Who is required to file PROPERTY TAX QUESTIONS AND ANSWERS – 2012?

Property owners or individuals with taxable property are typically required to file PROPERTY TAX QUESTIONS AND ANSWERS – 2012.

How to fill out PROPERTY TAX QUESTIONS AND ANSWERS – 2012?

To fill out PROPERTY TAX QUESTIONS AND ANSWERS – 2012, individuals should provide accurate and relevant information regarding their property, including ownership details and assessed values.

What is the purpose of PROPERTY TAX QUESTIONS AND ANSWERS – 2012?

The purpose of PROPERTY TAX QUESTIONS AND ANSWERS – 2012 is to ensure that property owners understand their tax obligations and the processes involved in property taxation.

What information must be reported on PROPERTY TAX QUESTIONS AND ANSWERS – 2012?

Information that must be reported includes property identification details, assessed values, ownership status, and any exemptions or deductions applicable.

Fill out your property tax questions and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Questions And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.