Get the free pdffiller

Show details

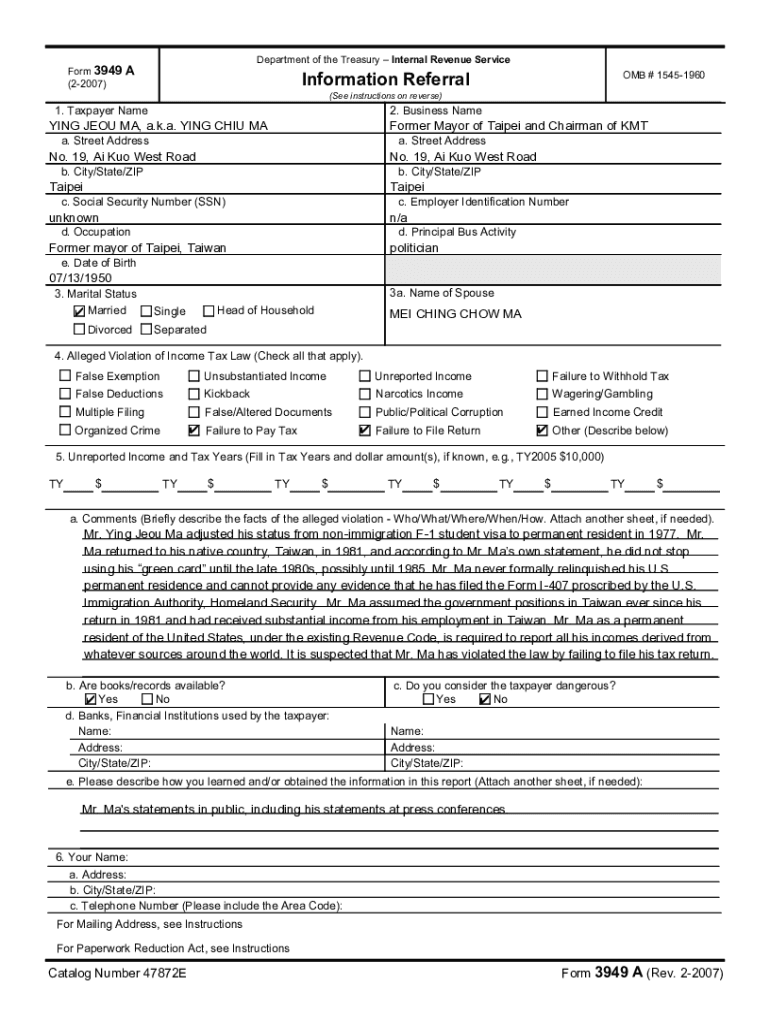

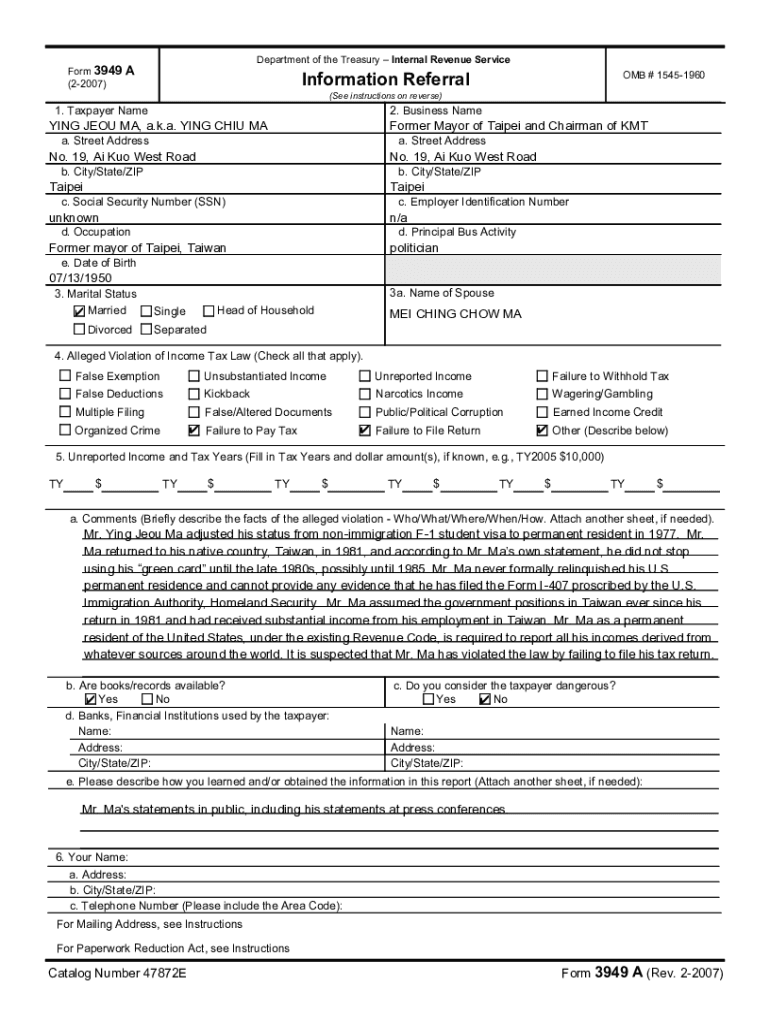

This form is used to report potential violations of the Internal Revenue laws, specifically regarding income tax. It gathers detailed information about the taxpayer, including violations, income,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pdffiller form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

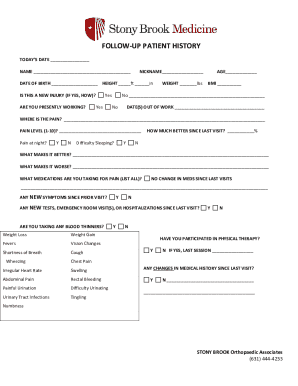

How to fill out Form 3949

01

Obtain a copy of Form 3949 from the IRS website or local IRS office.

02

Fill in your name, address, and contact information at the top of the form.

03

Provide information about the person or business you are reporting, including their name, address, and any known identification numbers.

04

Describe the alleged tax fraud or violation clearly and concisely in the space provided.

05

Include any supporting documents or evidence if available.

06

Sign and date the form at the bottom.

07

Mail the completed form to the address specified in the form instructions.

Who needs Form 3949?

01

Individuals who suspect tax fraud or misconduct involving individuals or businesses.

02

Taxpayers wishing to report unreported income or false claims for refunds.

03

Anyone aware of illegal tax schemes or tax evasion practices.

Fill

form

: Try Risk Free

People Also Ask about

Is the IRS form 3949-a anonymous?

While anyone can use the form, it's a valuable tool for whistleblowers who witness tax fraud or misconduct within a company or by an individual. They can use it to report the issue to the IRS without necessarily revealing their identity.

What is a 3949 form for child support?

The 3949-A Form is relevant in cases of suspected tax fraud or evasion affecting child support payments. For instance, if someone underreports income to reduce child support obligations, this form can alert the IRS.

How do I report someone to the IRS anonymously?

Report fraud, waste and abuse to Treasury Inspector General for Tax Administration (TIGTA), if you want to report, confidentially, misconduct, waste, fraud, or abuse by an IRS employee or a Tax Professional, you can call 800-366-4484 (800-877-8339 for TTY/TDD users). You can remain anonymous.

How to fill out form 3949-A?

Use Form D-3949A to report alleged tax law violations. Complete if you are reporting an individual. Include their name, street address, city, state, ZIP Code, Social Security Number or Taxpayer Identification Number, date of birth, occupation, marital status, name of spouse (if married), and email address.

Do you get paid if you report someone for tax evasion?

The IRS Whistleblower Office pays monetary awards to eligible individuals whose information is used by the IRS. The award percentage depends on several factors, but generally falls between 15 and 30 percent of the proceeds collected and attributable to the whistleblower's information.

Will someone know if you reported them to the IRS?

Even then the IRS will only inform you if the case is still open or has been closed. And whether youMoreEven then the IRS will only inform you if the case is still open or has been closed. And whether you will receive a reward. The IRS will not disclose any details about the investigation. Or the

What happens when you file a 3949 form?

The primary purpose of this form is to report potential violations of the Internal Revenue laws. The information may be disclosed to the Department of Justice to enforce the tax laws. Providing the information is voluntary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 3949?

Form 3949 is a form used by individuals to report suspected tax fraud or tax evasion to the Internal Revenue Service (IRS).

Who is required to file Form 3949?

Anyone who suspects tax fraud or has information regarding tax evasion can file Form 3949. There is no specific requirement regarding who must file it.

How to fill out Form 3949?

To fill out Form 3949, provide detailed information about the individual or business suspected of tax fraud, including their name, address, and a description of the suspected activity. Submit the completed form to the IRS.

What is the purpose of Form 3949?

The purpose of Form 3949 is to inform the IRS about potential tax fraud or violations of tax law so that they can investigate and take appropriate action.

What information must be reported on Form 3949?

Form 3949 must include the name and address of the person or business suspected of fraud, the nature of the fraud, and any additional information that may assist the IRS in their investigation.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.